CPA Comfort Letter

A licensed CPA will write a letter to verify business ownership, income, and financial facts for self-employed individuals, business owners, and partners with 100% approval guaranteed. It meets all requirements of mortgage lenders, landlords, and other financial institutions, ensuring accuracy and compliance with their standards.

We do not required tax return or bank statement

CPA Letter verifies:

Business Details

- Business is active and good standings

- Business Ownership Percentage

- Business Financials Information

Financial Details

- Business Expense ratio

- Certify Tax Returns and Financials

- Use of Business funds will not negative affect business operations

Self Employment

- Owner Self Employment Verification

- Certify Self-Employment Tenure (For 2 Years)

- Certify Self Employment Income

Pricing

Get CPA letter in $169

Service includes

- US Based Licensed CPA prepare your letter

- Certified by all state and federal authority

- 100% Guaranteed Approval or Get Money Back

- Unlimited Revisions untill approval

- Trusted by all lenders, banks and loan originators

Letter includes

- Income Verification Letter

- Self Employment Verification Letter

- Expense Factor/Ratio Letter

- CPA Letter Use of Business Funds

- Comfort/Mortgage Letter

- Any other CPA Letter (As Requested)

CPA Comfort Letter

A CPA Comfort Letter is an official document provided by a Certified Public Accountant (CPA) to verify an individual or business’s financial information. Often essential in mortgage applications and business transactions, this letter is a formal declaration that confirms the client’s financial standing, income stability, and business viability, giving assurance to third parties, such as lenders or mortgage companies. In essence, a CPA Comfort Letter provides the confidence lenders seek to proceed with loans and transactions.

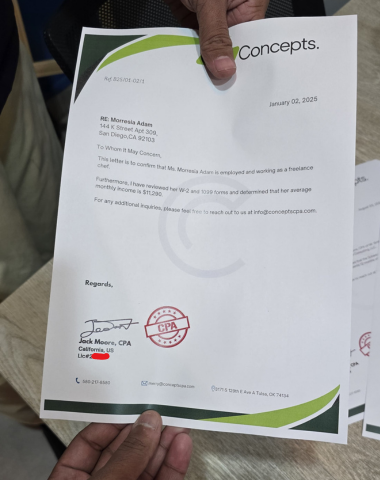

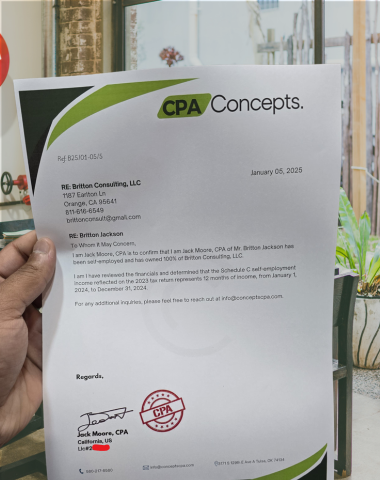

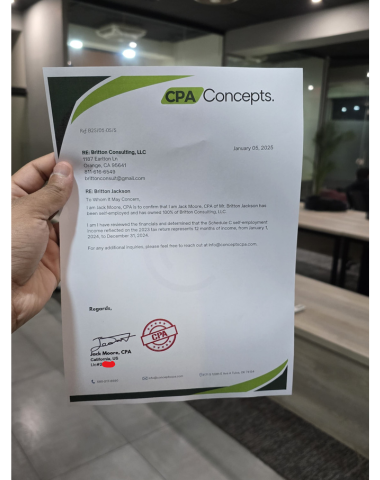

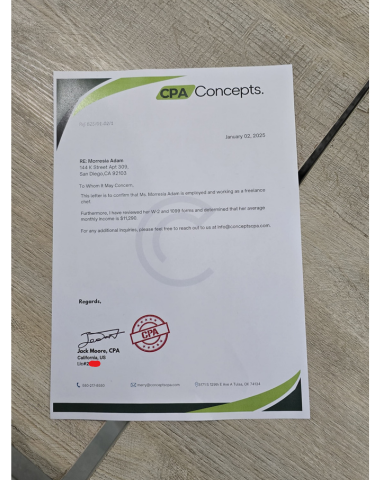

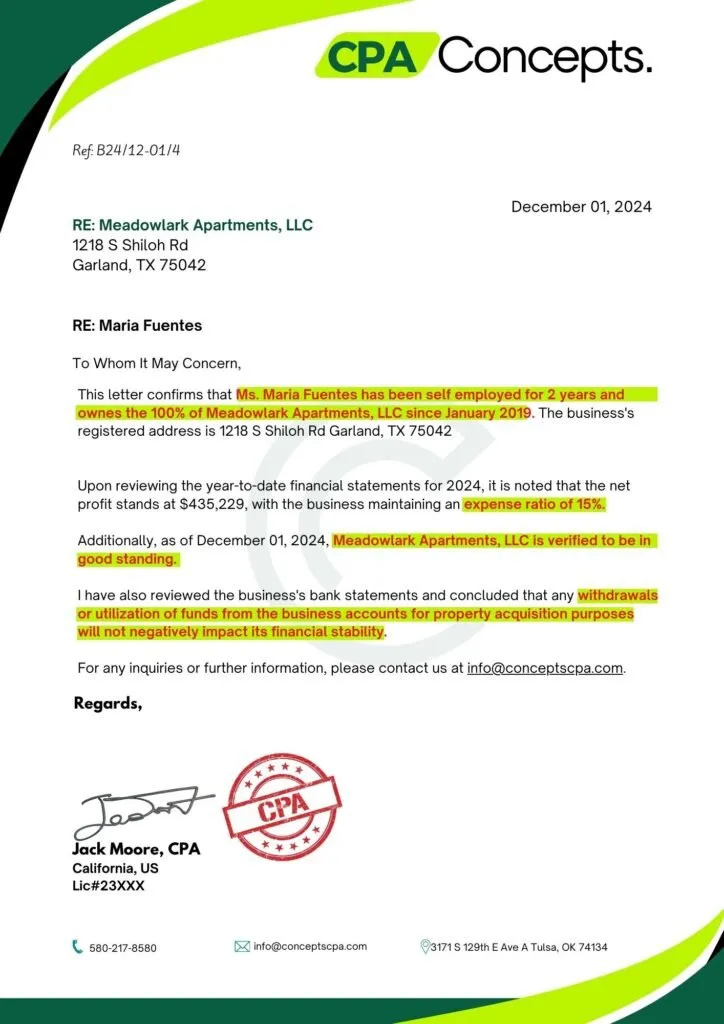

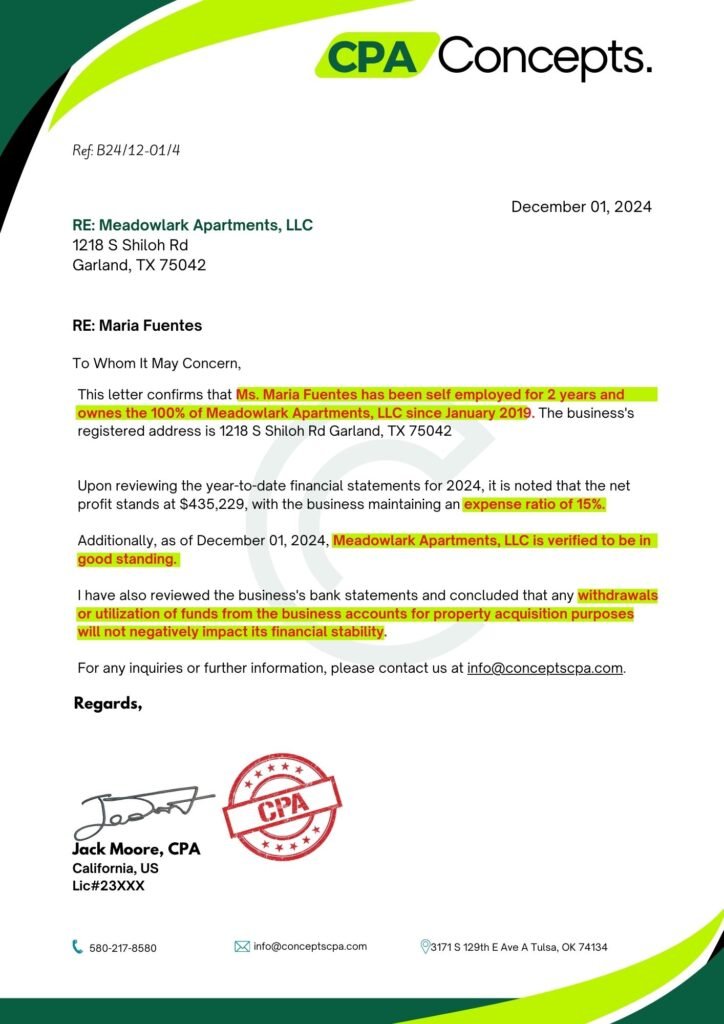

CPA Comfort Letter

This sample can serve as a guide to help self-employed individuals understand what to expect in a professionally drafted CPA letter. Customize the template as needed to match specific lender requirements or unique financial situations.

Ready to request your CPA letter? Contact us to begin the process today!

Understanding the Basics of CPA Comfort Letters

Definition and Purpose of a CPA Comfort Letter

A CPA Comfort Letter is typically requested by banks, lenders, or financial institutions to confirm financial information provided by their clients. This letter acts as a verification tool for income, tax filings, or financial statements, adding credibility to the client’s data.

Who Needs a CPA Comfort Letter?

This letter is most frequently required by:

- Individuals applying for mortgages or personal loans.

- Business owners looking to secure financing or validate their financial history.

- Self-employed individuals needing income verification.

How to Request a CPA Letter

To request a CPA letter, start by reaching out to a certified public accountant. Explain the purpose of the letter—whether it’s for a mortgage, loan application, or income verification—and share any specific requirements outlined by the lender or institution. Provide your CPA with a comprehensive overview of your financial situation to ensure accurate verification.

How to Obtain a CPA Comfort Letter

CPA Comfort Letters for Mortgages

Income Verification for Home Loans

Mortgage lenders often need a CPA Comfort Letter to verify the income of self-employed individuals. This letter assures lenders that the income sources and amounts stated are accurate, meeting the requirements for mortgage loans.

Comfort Letters for Business Transactions

Proof of Revenue and Stability

In business transactions, a CPA Comfort Letter helps confirm a business’s revenue and operational stability. It provides a financial snapshot that reassures stakeholders, investors, or potential partners about the business’s viability.

Comfort Letters for Loan Applications

Personal Loans and Financial Assurance

For personal loans, a CPA Comfort Letter may be required to show income consistency and financial reliability, serving as proof to lenders that the borrower’s financial health supports loan repayment.

Key Information Included in a CPA Comfort Letter

Verification of Income

The letter includes verified income statements, which are crucial in assessing loan eligibility.

Proof of Financial Stability

This section assures lenders of the client’s stable financial status, demonstrating a reliable foundation for loan repayment.

Business History and Ownership Details

If requested for a business, the CPA Comfort Letter includes details about the business’s ownership and operational history, adding another layer of credibility.

When Do You Need a CPA Comfort Letter?

Mortgage and Loan Applications

When applying for mortgages or loans, especially for self-employed individuals, a CPA Comfort Letter is often a requirement for income verification.

Business Transactions and Investments

In cases of business sales, mergers, or investments, a CPA Comfort Letter verifies financial details, establishing trust between parties.

How to Obtain a CPA Comfort Letter

Choosing the Right CPA

Importance of Expertise and Experience

When selecting a CPA, it’s essential to choose one with expertise in providing comfort letters. An experienced CPA ensures accuracy and compliance with financial and legal standards.

Information to Provide Your CPA

Income Documentation and Financial Statements

To prepare the comfort letter, a CPA will require detailed documentation of income, financial statements, and sometimes tax return verifications, depending on the lender’s requirements.

The Cost of a CPA Comfort Letter

Typical Fees for CPA Comfort Letters

The cost of a CPA Comfort Letter varies depending on the CPA’s experience, the complexity of the financial information, and the requirements of the verification process.

Factors That Influence Pricing

Factors affecting the price include:

- Urgency of the request.

- Level of detail required.

- Additional certifications or attestations beyond the letter.

Benefits of Using a CPA Comfort Letter

Builds Trust and Credibility

A CPA Comfort Letter builds trust with lenders or investors, as it is an independent verification by a licensed CPA.

Simplifies Loan Approval Processes

Many financial institutions require a CPA Comfort Letter to streamline the approval process, allowing for a quicker path to receiving funds.

Challenges and Limitations of CPA Comfort Letters

CPA Comfort Letters vs. Financial Statements

While a CPA Comfort Letter verifies certain financial details, it is not a full financial statement. Some financial institutions may still request additional documentation for more comprehensive insight.

Limits on Legal Accountability

A CPA Comfort Letter does not carry the same legal weight as an audit report, limiting the CPA’s liability and the document’s use.

Alternatives to a CPA Comfort Letter

Bank Statements

Bank statements serve as an alternative for those unable to obtain a CPA Comfort Letter but may not meet all lenders’ verification needs.

Personal Financial Statements

Personal financial statements provide a summary of an individual’s financial position and can sometimes serve as a substitute.

Final Thoughts on CPA Comfort Letters

A CPA Comfort Letter can be a powerful tool for those in need of verified income or financial stability to satisfy third-party requirements. From personal loans to business deals, the CPA Comfort Letter offers independent verification, establishing trust and facilitating financial transactions.

What is a CPA Comfort Letter?

A CPA Comfort Letter is a document issued by a CPA to verify a client’s financial information for third parties, such as lenders or mortgage companies.

What information is included in a CPA Comfort Letter?

It typically includes income verification, proof of financial stability, and, for businesses, operational history and ownership details.

Why do lenders require a CPA Comfort Letter?

Lenders require it to verify that a borrower’s income and financial information are accurate, especially in the case of self-employed individuals.

Can a CPA Comfort Letter be used for business transactions?

Yes, it can confirm financial stability and revenue, helping build trust in business deals.

How much does it cost to get a CPA Comfort Letter?

Costs vary depending on the CPA’s expertise, urgency, and complexity, ranging from moderate to higher fees for specialized verification.

Read More

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.