When it comes to securing loans, rental agreements, or other financial transactions, having verified proof of income is essential. For many self-employed individuals, freelancers, and business owners, the best way to confirm income is through a CPA income verification letter. This document provides reliable, third-party verification of earnings, allowing you to move forward with confidence in various financial applications.

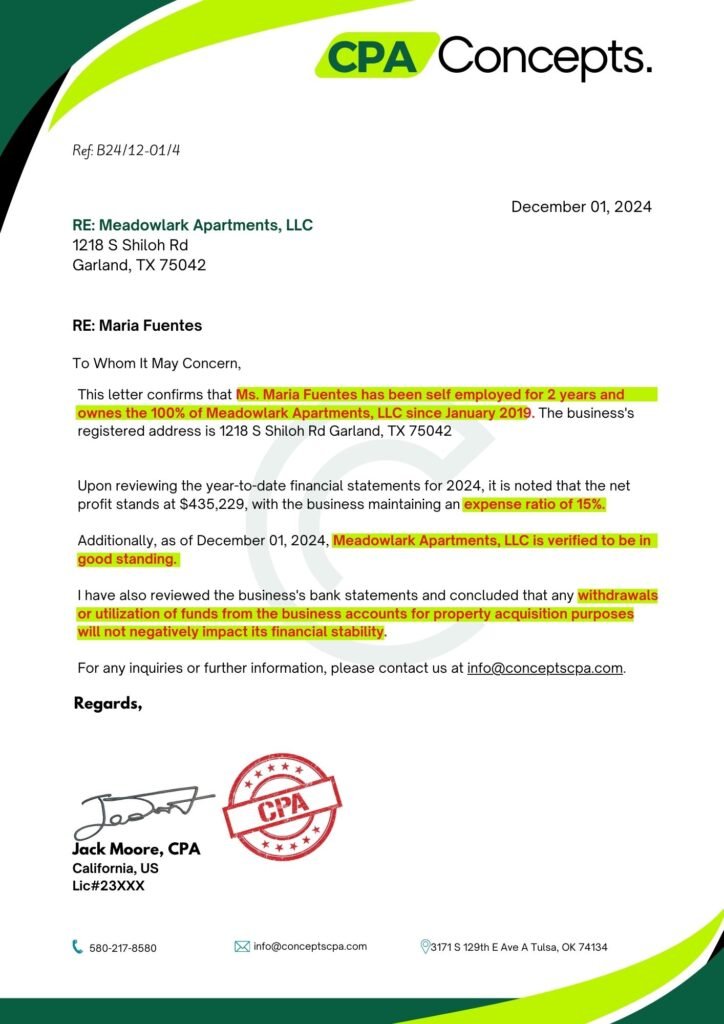

A CPA income verification letter follows a structured format to ensure clarity and completeness. Here’s an example outline.

A CPA income verification letter is a document prepared by a Certified Public Accountant (CPA) that certifies an individual’s income. It’s especially valuable for self-employed individuals who might lack the traditional pay stubs or employment contracts that salaried employees provide. A CPA’s involvement ensures that the income reported is accurate and credible.

Securing a CPA letter is crucial because it provides lenders, landlords, and business partners with trustworthy evidence of your financial status. For individuals without regular pay slips or payroll records, a CPA income verification letter becomes a vital document in proving their financial health and income stability.

Income verification letters are typically required in situations where reliable proof of income is essential, such as:

Many self-employed individuals may not have standard documents to confirm their income. A CPA income verification letter provides a verified account of earnings, making it easier for freelancers, gig workers, and small business owners to prove their income when needed.

For those working as independent contractors or receiving income through 1099 forms, a CPA letter is often required. The letter allows contractors to show evidence of their income in a clear and credible format for tax purposes or financial applications.

To create a reliable income verification letter, CPAs use several methods to confirm an applicant’s income:

CPAs examine tax filings from recent years to calculate annual income accurately.

Monthly bank statements give a clear view of deposits, reflecting income consistency.

CPAs review expense documentation, including receipts and invoices, to ensure net income is reported accurately.

A CPA income verification letter should contain the following essential elements to ensure it meets lender and financial institution standards:

A CPA letter of income verification is typically needed in the following scenarios:

A CPA income verification letter follows a structured format to ensure clarity and completeness. Here’s an example outline:

In addition to the income verification letter, CPAs can issue various types of financial verification letters depending on the needs of the client, such as:

If your CPA lacks familiarity with your specific industry, they might overlook unique aspects of your income. For instance, freelancers or creative professionals often have irregular income patterns. Hiring a CPA who understands these nuances can help ensure accurate income verification that truly reflects your earnings.

The cost of a CPA income verification letter typically ranges from $150 to $500, depending on factors like complexity, geographic location, and CPA experience. CPAs may charge higher fees if additional services, like detailed financial reviews, are needed.

Securing a CPA income verification letter can be a game-changer for anyone looking to establish financial credibility in personal or business transactions. For self-employed individuals, freelancers, and contractors, this letter provides a trusted, third-party verification of earnings, making it easier to obtain mortgages, rental agreements, or business partnerships. Working with a knowledgeable CPA familiar with your industry can make all the difference in creating an accurate and impactful income verification letter.

If you’re considering applying for a loan, renting an apartment, or entering a financial partnership, an income verification letter from a CPA is a reliable way to affirm your income stability and open doors to new opportunities. Reach out to a qualified CPA today to help you demonstrate financial credibility and move forward with confidence.

On average, it takes about 3-5 business days to prepare, depending on the CPA’s schedule and the complexity of the request.

Yes, CPAs can verify self-employed income by reviewing documents like tax returns, bank statements, and expense reports.

Yes, many lenders require verified income documentation, especially for self-employed individuals applying for a mortgage.

Most CPAs will request tax returns, bank statements, and records of expenses to complete an income verification letter.

CPAs can calculate average monthly income based on a longer period, providing a clear picture of earnings for fluctuating incomes.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.