When applying for a home loan, self-employed individuals and contract workers often face more hurdles than traditional employees. One key document that lenders may request is a CPA letter, a formal verification prepared by an accountant. This letter serves as proof of income stability, making it an essential part of the loan approval process for people who don’t have traditional W-2 forms. Let’s explore why a CPA letter is so crucial and how it can help you secure that all-important home loan.

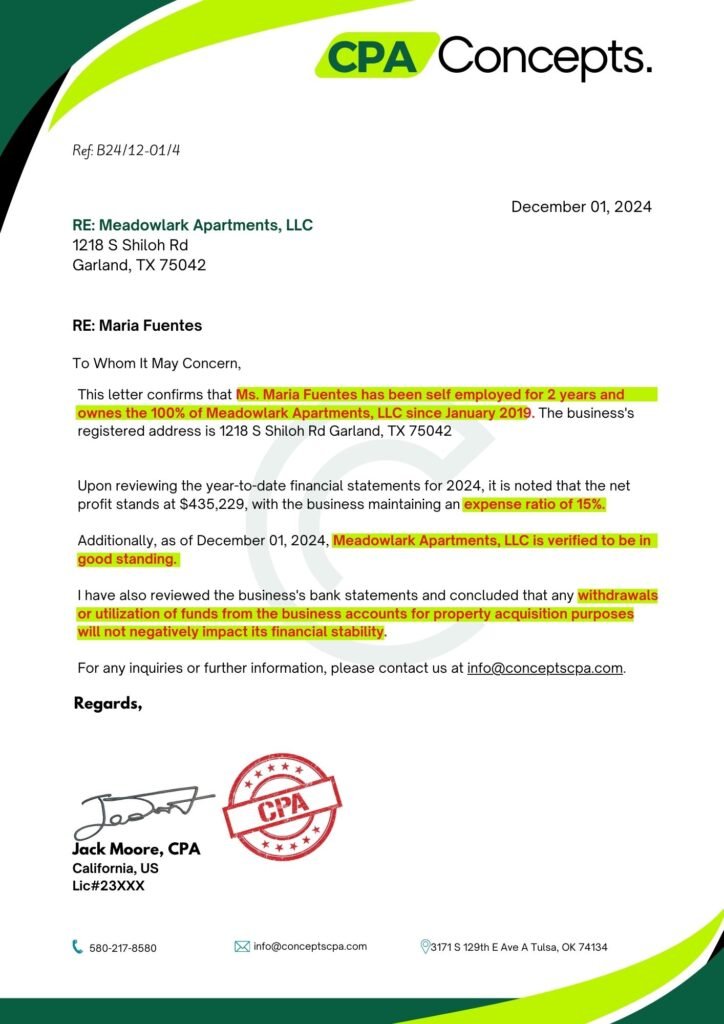

This sample can serve as a guide to help self-employed individuals understand what to expect in a professionally drafted CPA letter. Customize the template as needed to match specific lender requirements or unique financial situations.

Ready to request your CPA letter? Contact us to begin the process today!

A CPA letter for a home loan is a formal document prepared by a Certified Public Accountant (CPA) that verifies the income, financial health, and stability of an individual. This is especially important for those who are self-employed or contract workers, as they often don’t have W-2 forms or consistent paychecks to show proof of income. Instead, a CPA letter provides the necessary financial information that a lender can rely on when considering loan approval.

Lenders want to ensure that your income is reliable, but if you’re self-employed, proving this can be tricky. Unlike salaried employees, you don’t have straightforward paychecks or W-2s. This is where the CPA letter comes into play. Your CPA acts as a trusted third party, confirming that your finances are in good shape. Lenders are particularly cautious when it comes to approving loans for self-employed individuals. A CPA letter helps them understand your income trends over time, ensuring that your business is profitable and that you’re capable of making mortgage payments. Essentially, this letter bridges the trust gap, making it easier for banks to lend with confidence.

Your CPA letter should be clear, concise, and cover all the essentials. Typically, it includes:

By covering these areas, your CPA letter not only satisfies lender requirements but also speeds up the approval process.

There are various types of accountant’s letters that may come into play, depending on the lender’s specific request. The most common is the income verification letter, but other types include:

Where the CPA verifies that all taxes have been correctly filed. Additionally, third-party verification letters from a CPA can help validate other financial aspects, further bolstering the borrower’s case.

A lender may ask for specific financial disclosures in the CPA letter to confirm the applicant’s ability to repay the loan. Lender requests often include:

Responding to these requests accurately is critical, as missing or incorrect information can lead to delays or rejections.

CPA firms are bound by professional ethics and legal guidelines when it comes to disclosing client information. At our agency, we strictly follow CPA guidelines to determine what information can be shared with third parties, such as lenders. This ensures that we maintain the confidentiality and integrity of our client’s financial data.

Some important guidelines we follow include:

While a CPA letter can help you secure a home loan, there are risks if it’s not prepared correctly. Providing incomplete or incorrect financial information can lead to delays—or worse, a loan denial.

To avoid issues, make sure you:

By doing this, you reduce the chance of complications and ensure a smoother process.

Yes, you absolutely can! But let’s face it, getting a home loan when you’re self-employed or a contract worker can feel like navigating a maze. Traditional employees have it easy with their W-2s, but your situation is different. Lenders are naturally more cautious with non-traditional income streams, but that doesn’t mean you’re out of luck.

This is where the CPA letter becomes your secret weapon. It provides the reassurance lenders need, proving that your income is stable, even if it doesn’t come from a regular paycheck. The right documentation can make all the difference in getting that home loan approval.

Securing a home loan when you’re self-employed can be challenging, but it’s far from impossible. A well-prepared CPA letter can provide the proof lenders need to move forward with your application. It’s about making sure your financial story is told clearly and accurately—one that shows you’re more than capable of managing a mortgage.

If you’re feeling overwhelmed, we’re here to help. Our team can work with you to craft the perfect CPA letter that checks all the boxes for your lender. Contact us today, and let’s get you one step closer to owning your dream home!

Need help with your CPA letter for a home loan? Contact us today to get a professionally crafted CPA letter that meets lender requirements and gets you one step closer to securing your dream home.

A CPA letter should include details about your income, financial statements, business ownership, and tax information.

It usually takes a few days to a week, depending on your CPA’s availability and the complexity of your finances.

Yes, a CPA letter can explain fluctuations in income, helping lenders understand your financial situation better.

While not always mandatory, many lenders require a CPA letter to verify income for self-employed individuals.

No, a CPA letter is a supplement, not a replacement for tax returns or other financial documentation.