A CPA letter is an official document prepared by a Certified Public Accountant (CPA) that verifies a person’s financial information, often needed in the form of a CPA income verification letter or proof of self-employment letter. In the context of self-employment, a CPA letter confirms the legitimacy of an individual’s business and verifies their income level. These letters serve as a third-party verification crucial for self-employed individuals who need to provide a formal proof of income to banks, landlords, or potential business partners.

This sample can serve as a guide to help self-employed individuals understand what to expect in a professionally drafted CPA letter. Customize the template as needed to match specific lender requirements or unique financial situations.

Ready to request your CPA letter? Contact us to begin the process today!

Self-employed individuals face unique challenges in proving income consistency due to fluctuating earnings and the lack of traditional pay stubs. A CPA letter serves as a proof of self-employment letter, filling the gap with an external verification of income, which is especially important for financial stability assessments in loans, mortgages, or rental applications. CPA letters provide the assurance and professionalism that financial institutions rely on for verifying income stability.

CPA letters for self-employed individuals are often required by lenders who need clear verification of an applicant’s income. Traditional employment provides W-2s and pay stubs, but employment verification letters for the self-employed prove financial standing in place of these standard documents.

Entrepreneurs seeking partnerships or funding often need sample employment verification letters for self-employed individuals. These letters establish the financial health of a business, increasing trustworthiness with potential partners or investors.

Freelancers may need CPA letters to confirm their income when signing new contracts. Verification of funds letters can give clients confidence in the freelancer’s financial reliability, helping secure projects and maintain credibility in professional relationships.

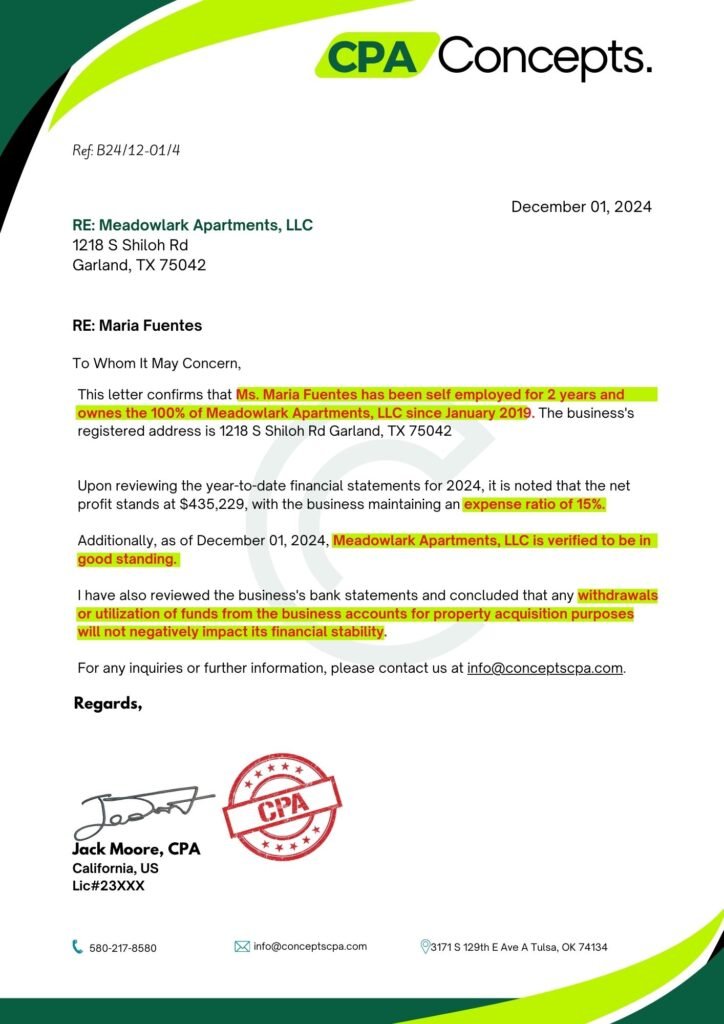

A well-prepared CPA letter should include the CPA’s contact details and credentials. Such third-party verification provides a professional point of contact, reassuring the recipient of the CPA’s credibility.

The letter should describe the self-employed person’s business or professional role, including the CPA letter verifying income and any relevant work details. This information is especially helpful for niche businesses that require clear verification.

Income verification is at the core of these letters, often in the form of an accountant letter confirming income. Typically, CPAs include income summaries for the past year, showing proof of income and financial stability over time.

A CPA letter includes a statement from the CPA that they’ve reviewed the individual’s financial records. This CPA letter of explanation does not guarantee income but confirms that the CPA has assessed supporting documents, like tax returns or bank statements.

Be clear about your purpose for needing the letter. Mention specific details the lender letter may require and agree on a timeline so your CPA can produce the necessary document promptly.

To help your CPA draft a comprehensive letter, provide recent tax returns, financial statements, and relevant documents. The more details you supply, the easier it is for your CPA to create an instant proof of funds letter or an accurate verification of funds letter template.

A CPA letter self-employed individuals can use to verify their income increases credibility in loan applications, where proof of income letters for the self-employed reassure lenders of financial reliability.

CPA letters, such as a CPA comfort letter, reflect a self-employed individual’s professionalism. When clients or partners see a CPA’s involvement, it demonstrates transparency and dedication to accurate financial representation.

Mortgage lenders require CPA letters to confirm a borrower’s income, often asking for documents such as a CPA expense ratio letter or employment verification letter self-employed applicants provide.

Partnerships or investments might require a confirmation of income letter from an accountant. This documentation reassures potential partners about the individual’s financial stability and reliability in business.

Landlords may request CPA letters to verify income stability for self-employed renters. An accountant letter confirming income can offer landlords the proof they need to approve the lease application.

Costs can range from $100 to $500 depending on the complexity of the letter and the CPA’s rates. Discuss pricing upfront with your CPA to avoid surprises.

A CPA letter for self-employment verification is invaluable for self-employed individuals who need to prove their income. It offers credibility in critical applications, from loans to rental agreements. Understanding the components and scenarios for these letters can help self-employed individuals secure opportunities with confidence. Whether for a bank confirmation letter, a verification of funds letter, or simply a CPA letter self-employed individuals can rely on, this document is essential for a stable financial profile.

Provide recent tax returns, financial statements, and business documents to help your CPA accurately draft a proof of self-employment letter.

Typically, CPA letters are prepared within a week, although urgent requests may come with extra fees.

While a CPA letter assists in income verification, it does not guarantee loan approval; additional requirements may apply.

Most banks and lenders accept CPA letters, particularly when they meet specific requirements, like those in a sample employment verification letter self-employed individuals provide.

No, a CPA letter summarizes income without the detailed breakdown of a tax return, often used as a complement to tax documentation.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.