CPA Letter for Self-Employed Mortgage Applicants

Lender-Accepted

A licensed CPA will write a letter to verify business ownership, income, and financial facts for self-employed individuals, business owners, and partners with 100% approval guaranteed. It meets all requirements of mortgage lenders, landlords, and other financial institutions, ensuring accuracy and compliance with their standards.

We do not required tax return or bank statement

CPA Letter verifies:

Business Details

- Business is active and good standings

- Business Ownership Percentage

- Business Financials Information

Financial Details

- Business Expense ratio

- Certify Tax Returns and Financials

- Use of Business funds will not negative affect business operations

Self Employment

- Owner Self Employment Verification

- Certify Self-Employment Tenure (For 2 Years)

- Certify Self Employment Income

Pricing

Get CPA letter in $199

Service includes

- US Based Licensed CPA prepare your letter

- Certified by all state and federal authority

- 100% Guaranteed Approval or Get Money Back

- Unlimited Revisions untill approval

- Trusted by all lenders, banks and loan originators

Letter includes

- Income Verification Letter

- Self Employment Verification Letter

- Expense Factor/Ratio Letter

- CPA Letter Use of Business Funds

- Comfort/Mortgage Letter

- Any other CPA Letter (As Requested)

CPA Letter for Self Employed

If you’re self-employed, securing a loan or verifying your income for tax purposes can be a unique challenge. Lenders and institutions often require official documentation confirming your financial standing and income stability, which is where a CPA letter comes in. A CPA (Certified Public Accountant) letter for self-employed individuals provides a third-party verification of income, making it an essential document for loan applications, mortgage approvals, and tax records.

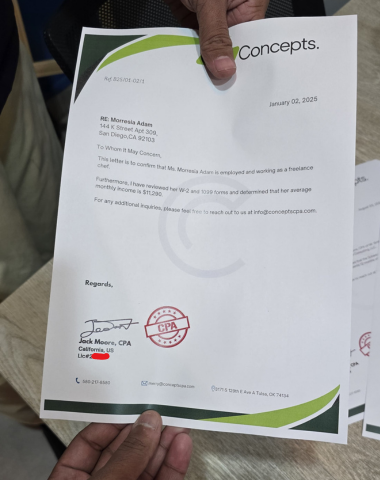

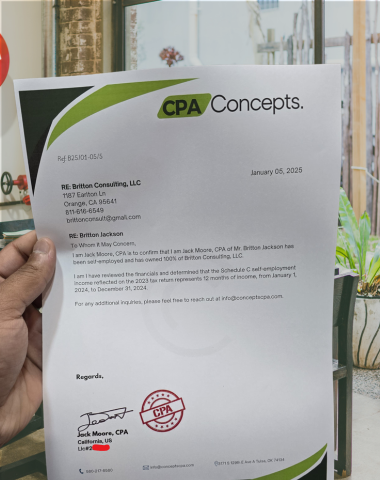

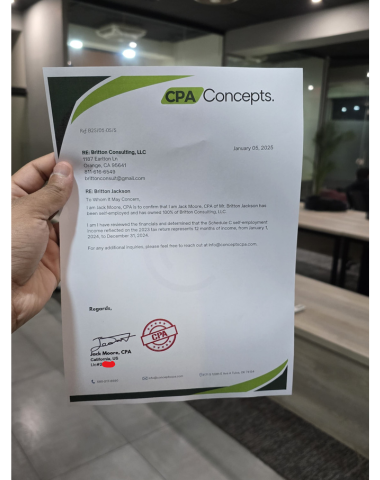

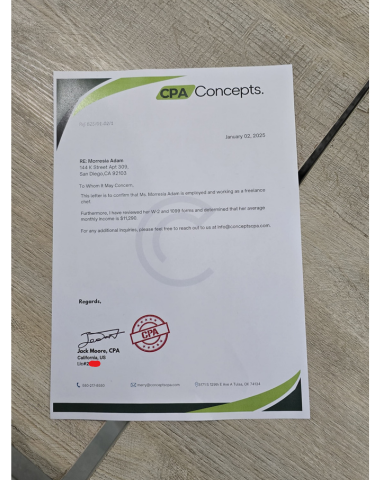

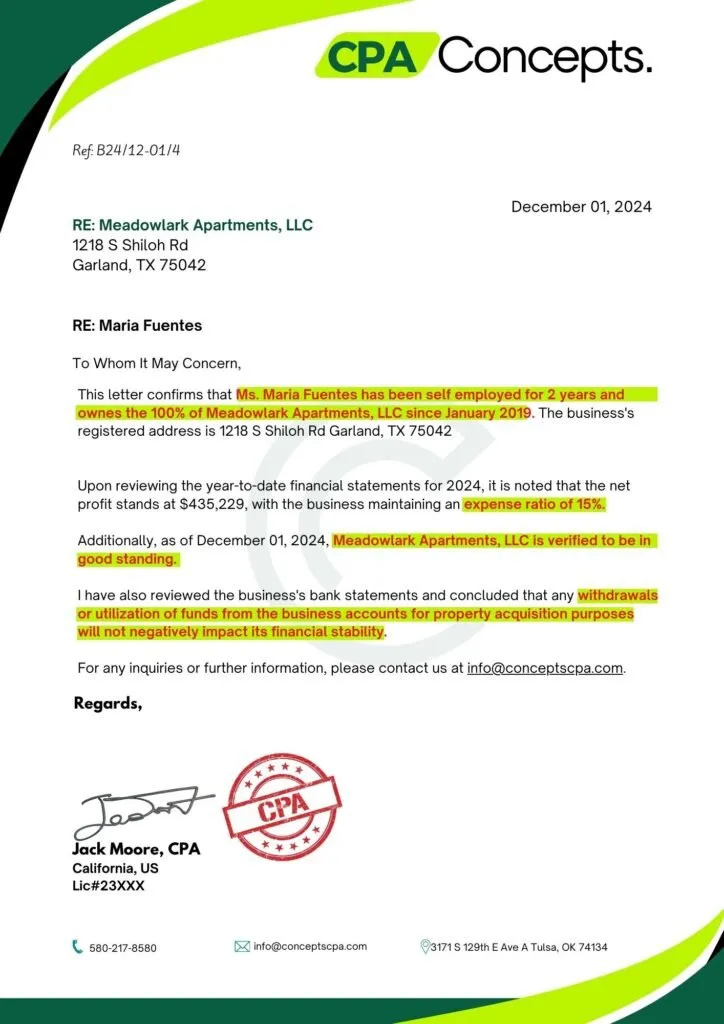

Sample CPA Letter for Self-Employed Income Verification

This sample can serve as a guide to help self-employed individuals understand what to expect in a professionally drafted CPA letter. Customize the template as needed to match specific lender requirements or unique financial situations.

Ready to request your CPA letter? Contact us to begin the process today!

What is a CPA Letter for Self-Employed?

Understanding the CPA Letter and Its Purpose

A CPA letter for self-employed individuals serves as an official statement confirming your income, financial stability, and self-employment status. These letters are typically prepared by a certified accountant to provide reliable verification that lenders and financial institutions can trust. Whether you’re applying for a mortgage, securing a loan, or verifying income for tax purposes, a CPA letter adds legitimacy and meets the documentation requirements often set by lenders and other third parties.

Common Requests from Lenders and Institutions

Financial institutions, mortgage companies, and even the IRS may request a CPA letter to confirm self-employment income. These letters help lenders understand your financial position, assess risk, and ensure that your income can cover the financial obligations you’re applying for. Common requests from lenders for CPA letters include

- Income Confirmation: Verifying the stability and amount of income.

- Address Verification: Ensuring your residential address is accurate.

- Financial Stability: Confirming ongoing self-employment status and financial health.

Why You Need a CPA Letter and Potential Risks of Not Providing One

Why You Need a CPA Letter for Loans and Financial Verifications

When you’re self-employed, proving your income can be more complex than simply providing a pay stub. A CPA letter is an effective way to formally verify your income, which is especially important when applying for mortgages or loans. Without a CPA letter, lenders may find it difficult to assess your financial stability, potentially leading to delays or even denials in the loan approval process.

Risks of Not Providing Proper Income Verification

If proper income verification isn’t provided, your application might face additional scrutiny or delays. A CPA letter minimizes the risk of loan rejections by offering verified financial information and providing proof that your self-employment income is stable and reliable.

How to Request a CPA Letter for Self-Employed Verification

Options for Responding to a CPA Letter Request

If you receive a request from a lender or financial institution for a CPA letter, here are the steps to take:

- Gather Necessary Documentation: Collect tax records, financial statements, and any other documents that support your income claims.

- Consult Your CPA: Share the specific requirements from the lender with your CPA to ensure the letter addresses their needs.

- Request Customization if Needed: Confirm that the CPA letter includes essential details like income level, duration of self-employment, and contact information.

How to Request a CPA Letter

To request a CPA letter, start by reaching out to a certified public accountant. Explain the purpose of the letter—whether it’s for a mortgage, loan application, or income verification—and share any specific requirements outlined by the lender or institution. Provide your CPA with a comprehensive overview of your financial situation to ensure accurate verification.

CPA Letter Format and Key Elements

CPA Letter Format for Self-Employment Verification

A well-structured CPA letter should include several key components to meet verification standards:

- CPA’s Information: Header with the CPA’s name, certification, and contact details. and any other documents that support your income claims.

- Client’s Information: Include the client’s full name, self-employment status, and business name (if applicable).

- Income Verification: Specify income details, such as the amount and consistency over time.

- Duration of Self-Employment: Include how long the client has been self-employed.

- CPA’s Contact for Verification: This provides additional credibility and allows institutions to verify the details if needed.

Additional Resources and Related Services

Looking for more support as a self-employed individual? Check out our services for:

- Tax Preparation for Self-Employed Individuals

- IRS Audit Assistance and Tax Documentation

- Third-Party Verification Services for Self-Employed Income

How do I write a proof of income letter for self-employed?

While you can draft a basic income letter, it’s generally recommended to have a CPA verify and sign it for authenticity. Include key sections like income details, self-employment verification, and contact information for a credible document.

Why would I get a letter from a CPA?

CPA letters provide third-party verification for your income and financial status, which can be essential for loan applications, mortgage approvals, or tax documentation. Financial institutions and lenders trust CPA letters as they are issued by certified professionals.

Can I write myself an employment letter for self-employed?

Although you can technically write a letter, most lenders will require a third-party verification for authenticity. A CPA-signed letter adds legitimacy and meets lender requirements, making it more credible than a self-issued letter.

How much does a CPA letter cost for a mortgage?

The cost of a CPA letter can vary depending on the complexity and location but typically ranges from $100 to $500. Contact a CPA for an estimate based on your needs and any additional verification requirements.

What details should be included in a CPA letter for self-employment?

A CPA letter should include the CPA’s credentials, client’s information, income details, duration of self-employment, and the CPA’s contact information for verification purposes. This structure ensures credibility and fulfills most lender requirements.

Read More

Lenders require verified proof of income and business activity.

Tax returns alone are often not enough.

A CPA Letter for self employed addresses this gap.

It provides third-party income verification prepared by a Certified Public Accountant and aligned with lender documentation standards used across Chicago.

According to mortgage industry data, over 30% of self-employed loan applications require additional income verification beyond tax filings.

CPA income verification letters are commonly used to meet this requirement.

Lender-Accepted CPA Letter for Self-Employed Individuals

This CPA letter is prepared for formal review by mortgage lenders, landlords, and financial institutions.

It focuses on income confirmation, self-employment status, and financial consistency.

The letter is based on client-provided financial records and reviewed under professional standards.

The content is structured to support mortgage, home loan, rental, and bank verification needs without overstating financial claims.

Proof of Self-Employment

This section confirms that the individual operates as a self-employed individual.

It references the business name, type of activity, and self-employment status.

Verification is based on tax returns, business records, and supporting financial documentation.

Lenders use this confirmation to validate ongoing business activity and employment stability.

Income Verification

Income verification focuses on reported gross income and net profit.

Figures are derived from reviewed tax returns, Schedule C, income statements, and bank statements.

The letter states the income period covered and the nature of the review performed.

Industry studies show that lenders rely on income consistency over time rather than a single tax year when evaluating self-employed borrowers.

Mortgage & Rental Use

This CPA letter is commonly requested for:

- Mortgage and home loan applications

- Refinancing and mortgage loans

- Apartment and rental agreements

- Bank and third-party income verification

The language is tailored to support lender and landlord review processes without serving as a guarantee or financial forecast.

CPA-Signed Letterhead

The letter is issued on official CPA letterhead.

It includes the CPA’s signature, license identification, and contact details.

Standard disclaimer language is included to define the scope of verification and professional responsibility.

This format supports credibility and aligns with verification processes used by mortgage lenders and financial institutions.

CTA:

Get CPA Letter for Self-Employed in Chicago

CPA Letter for Self-Employed — Scope of Service

This service is designed to meet formal income and self-employment verification needs.

It supports mortgage lenders, landlords, and financial institutions that require third-party confirmation prepared by a licensed Certified Public Accountant.

The scope is limited to verification based on client-provided records.

It does not represent an audit, forecast, or guarantee of future income.

This approach aligns with professional standards and lender expectations.

CPA Income Verification Letter for Self-Employed

This letter verifies income reported by a self-employed individual.

It is based on reviewed tax returns, income statements, and bank statements.

The CPA identifies the income period covered and the type of records reviewed.

Mortgage lenders often request this letter when income varies year to year.

It helps confirm consistency and financial stability for loan evaluation.

CPA Letter for Verification of Self-Employment

This section confirms the individual’s self-employment status.

It references the business name, ownership structure, and nature of operations.

Verification relies on tax filings, business records, and financial documentation.

Lenders use this confirmation to validate that the applicant is actively self-employed.

Proof of Income Letter for Self-Employed CPA

This letter serves as formal income proof.

It summarizes gross income and net profit derived from reviewed records.

The wording is structured to support income verification without overstating conclusions.

It is commonly used for mortgage, rental, and bank verification purposes.

CPA Letter Confirming Business Income

This letter focuses on business-generated income rather than wages.

It references revenue and expenses as reported in financial records.

The CPA confirms that the figures are consistent with the documents reviewed.

This format is often requested for small business owners and sole proprietors.

CPA Earnings Letter for Self-Employed Individuals

This letter provides an earnings overview for a defined period.

It supports applications requiring income confirmation for financing or housing.

The scope is clearly defined to reflect verification, not certification.

Financial institutions rely on this letter to supplement tax returns during review.

What This CPA Letter Covers

This CPA letter is structured to address common verification points requested by mortgage lenders, landlords, and financial institutions.

Each section is clearly defined to support income and self-employment verification without expanding beyond professional responsibility standards.

The coverage is based on reviewed documentation and prepared by a licensed Certified Public Accountant.

Business Name and Self-Employment Status

This section identifies the business name associated with the self-employed individual.

It confirms the individual’s self-employment status and business structure.

References are made to tax filings and business records used for verification.

Lenders rely on this confirmation to validate ongoing self-employment and operational activity.

Gross Income and Net Profit Overview

This part outlines reported gross income and net profit figures.

Amounts are derived from reviewed tax returns, income statements, and financial records.

Mortgage lenders typically evaluate both gross income and net profit to assess repayment capacity.

Income Period Covered

The letter specifies the exact income period reviewed.

This may include one or multiple tax years, depending on the application requirement.

Clear date ranges help lenders assess income consistency over time.

Defined income periods reduce follow-up requests during the verification process.

Verification Based on Client-Provided Records

All verification is based on records provided by the client.

These may include tax returns, bank statements, profit and loss statements, and other financial documents.

This approach aligns with standard CPA income verification practices.

CPA Independence & Disclaimer Language

The letter includes standard independence and limitation language.

It clarifies that the CPA is not providing an audit, review, or financial guarantee.

The disclaimer defines the scope of responsibility and intended use of the letter.

Mortgage lenders and financial institutions expect this language as part of professional compliance.

Built for Mortgage, Rental, and Financial Verification

Self-employed individuals are often asked to provide additional documentation.

Lenders and third parties require income verification that goes beyond tax returns.

A CPA letter helps meet these verification needs in a standardized format.

Industry lending data shows that self-employed applicants are up to 40% more likely to be asked for supplemental income documentation compared to salaried borrowers.

CPA verification letters are commonly used to address this requirement.

Each letter is prepared by a licensed Certified Public Accountant and aligned with third-party review expectations.

CPA Letter for Self-Employed Mortgage Application

Mortgage lenders often request a CPA letter to confirm income and self-employment status.

The letter supports loan underwriting by summarizing reported income and business activity.

It references reviewed tax returns and financial records.

This document helps lenders assess income stability for mortgage approval.

CPA Letter for Home Loan and Refinancing

Home loan and refinancing applications frequently require updated income verification.

A CPA letter helps confirm current earnings when income fluctuates.

It is commonly used alongside tax returns and bank statements.

Refinancing reviews often focus on income consistency over multiple periods.

CPA Letter for Apartment Rental Verification

Landlords and property managers may request proof of income from self-employed tenants.

This CPA letter confirms business income and employment status.

It supports rental agreement decisions without disclosing unnecessary financial detail.

Rental verification letters help reduce delays in application approval.

CPA Letter for Bank and Financial Institutions

Banks and financial institutions use CPA letters for income confirmation.

The letter supports account verification, lending decisions, and compliance reviews.

It is structured for third-party verification processes.

Financial institutions rely on standardized CPA documentation for consistency.

CPA Letter for Visa and Third-Party Verification

Some visa and third-party applications require formal income confirmation.

A CPA letter provides documented proof based on reviewed financial records.

The scope is clearly defined for verification purposes only.

Third-party reviewers often require CPA-signed documentation for credibility.

Why Self-Employed Applicants Are Asked for a CPA Letter

Self-employed income is reviewed differently than salaried income.

Mortgage lenders and financial institutions apply additional verification steps.

A CPA letter helps address documentation gaps that commonly appear in self-employment cases.

Industry lending data indicates that self-employed borrowers are reviewed under stricter income validation rules due to income variability and documentation complexity.

Income Fluctuation in Self-Employment

Self-employed income often changes from year to year.

Revenue depends on contracts, clients, and market conditions.

This makes income harder to assess using pay stubs or monthly statements.

Lenders use CPA income verification letters to better understand income patterns over a defined period.

Lender Risk and Verification Process

Mortgage lenders assess repayment risk before loan approval.

A CPA letter provides structured verification based on reviewed financial records.

This reduces follow-up requests and supports a clearer verification process.

Mortgage Lenders and Documentation Standards

Mortgage lenders follow documentation standards set by financial institutions and loan programs.

Self-employed applicants are commonly required to submit tax returns, bank statements, and third-party verification.

A CPA letter supports these requirements by summarizing key financial information.

Clear documentation helps lenders evaluate income stability and compliance.

Role of Certified Public Accountants in Verification

A Certified Public Accountant plays a defined role in income verification.

The CPA reviews client-provided records and prepares a verification letter within professional standards.

The letter does not guarantee income or future earnings.

Lenders rely on CPA involvement for independent and standardized verification.

Our CPA-Led Verification Approach

Income verification for self-employed individuals requires a structured review.

This process follows professional standards and focuses on accuracy and clarity.

Each step is completed by a licensed Certified Public Accountant using client-provided documentation.

The approach is designed to support mortgage lenders, landlords, and financial institutions without expanding beyond verification scope.

Review of Tax Returns and IRS Form 1040

Tax returns provide the primary source of income data.

The CPA reviews IRS Form 1040 to confirm reported income.

Filing status and reported totals are checked for consistency.

This review helps establish income history for verification purposes.

Schedule C Profit or Loss Review

Schedule C outlines business income and expenses.

The CPA reviews Schedule C to identify net profit.

Expense categories are reviewed to understand business operations.

Mortgage lenders often rely on Schedule C figures when evaluating self-employed income.

Bank Statements and Financial Records Analysis

Bank statements support income verification.

The CPA reviews business and personal bank statements to confirm cash flow patterns.

Financial records are compared with reported income figures.

This step helps identify consistency between tax filings and banking activity.

Business Income Statement and Expense Ratio Review

Business income statements summarize revenue and expenses.

The CPA reviews profit and loss statements to assess expense ratios.

This provides context for net income calculation.

Expense ratio review helps lenders understand business sustainability without forecasting future performance.

How the CPA Letter Process Works

The CPA letter process follows a defined sequence.

Each step focuses on verification, not estimation.

The goal is to produce a lender-ready document that aligns with third-party review standards.

All steps are handled by a licensed Certified Public Accountant using client-provided records.

Step 1: Document Collection

The process begins with document collection.

Clients provide tax returns, bank statements, and business records.

Common documents include IRS Form 1040, Schedule C, and income statements.

Accurate documentation reduces delays during lender or landlord review.

Step 2: Income and Financial Statement Review

The CPA reviews reported income and financial statements.

Gross income, net profit, and expense ratios are evaluated.

Figures are checked for consistency across records.

This review establishes the basis for income verification.

Step 3: CPA Letter Drafting

The CPA prepares the verification letter based on reviewed documents.

The letter outlines self-employment status, income figures, and the income period covered.

Language is structured for mortgage lenders and financial institutions.

No projections or guarantees are included.

Step 4: CPA Signature, License, and Letterhead

The final letter is issued on official CPA letterhead.

It includes the CPA’s signature, license identification, and contact details.

Standard disclaimer language defines the scope and intended use.

This final format supports acceptance by lenders, landlords, and third parties.

CPA Letter Services for Different Self-Employed Profiles

Self-employment structures vary.

Income reporting and documentation also vary.

This CPA letter service is adjusted based on how income is earned and reported.

Each letter is prepared by a licensed Certified Public Accountant and based on the records relevant to the specific self-employed profile.

CPA Letter for Independent Contractors

Independent contractors often receive income from multiple clients.

Income is commonly reported through contracts and invoices.

The CPA letter verifies self-employment status and income based on tax returns and supporting records.

This letter is frequently requested for mortgage and rental applications.

CPA Letter for Freelancers

Freelancers may experience variable income throughout the year.

The CPA letter summarizes reported earnings over a defined period.

Verification is based on tax filings, bank statements, and income records.

Lenders use this letter to understand income consistency for freelancers.

CPA Letter for Sole Proprietors

Sole proprietors report business income on Schedule C.

The CPA letter confirms ownership, business activity, and reported income.

It references gross income and net profit figures from reviewed records.

This format is commonly used for loan and bank verification.

CPA Letter for 1099 Contractors

1099 contractors receive non-employee compensation.

Income is reviewed using tax returns and 1099 documentation.

The CPA letter confirms self-employment income without classifying wages.

This letter supports mortgage and financial verification needs.

CPA Letter for Small Business Owners

Small business owners often have multiple income and expense categories.

The CPA letter focuses on business-generated income and expense ratios.

Verification is based on financial statements and tax records.

Lenders rely on this letter to assess business income stability.

CPA Letter for LLC Owners

LLC owners may report income as pass-through earnings.

The CPA letter confirms ownership and income distribution based on tax filings.

It references relevant financial records without providing forecasts.

This letter supports lending, rental, and third-party verification requirements.

What Makes Our CPA Letter Different

Not all CPA letters meet lender review standards.

This CPA letter is structured to support verification needs without overstatement.

Each letter is prepared by a licensed Certified Public Accountant and follows established verification practices.

CPA-Reviewed Financial Data

All financial information included in the letter is reviewed by a CPA.

Data is taken from tax returns, income statements, and financial records provided by the client.

Figures are checked for consistency across documents.

This review supports accurate income verification for third-party use.

Aligned With Mortgage Lender Expectations

Mortgage lenders apply specific documentation standards.

This CPA letter is formatted to align with common lender review criteria.

It includes required income details, defined periods, and verification language.

Alignment reduces follow-up requests during underwriting.

Clear Income Verification Language

The letter uses direct and precise wording.

It clearly states what has been reviewed and what is being verified.

No assumptions, projections, or guarantees are included.

Clear language helps lenders and landlords understand the scope of verification.

Professional Standards and Compliance Focus

The letter follows professional responsibility standards.

It includes independence and limitation disclaimers.

The scope is limited to verification based on client-provided records.

Compliance-focused formatting supports acceptance by financial institutions and third parties.

CPA Letter Formatting and Professional Standards

Formatting and professional presentation play a key role in third-party acceptance.

Mortgage lenders and financial institutions expect CPA letters to follow defined standards.

This letter is structured to meet those expectations without unnecessary detail.

All formatting and language are prepared by a licensed Certified Public Accountant and aligned with verification use cases.

CPA Letterhead and Contact Details

The CPA letter is issued on official letterhead.

It includes the firm name, address, and contact information.

This allows lenders and third parties to identify the source of verification.

Official letterhead supports document credibility during review.

Signature and CPA License Identification

Each letter includes the CPA’s signature.

License identification is clearly stated.

This confirms professional authorization and accountability.

Lenders often require visible license details for compliance checks.

Purpose-Specific Language

The letter uses language specific to its intended purpose.

Mortgage, rental, and bank verification letters are worded differently.

Only relevant income and self-employment details are included.

Purpose-specific wording helps prevent misinterpretation.

Limitation and Responsibility Clauses

Standard limitation clauses are included.

They define the scope of verification and CPA responsibility.

The letter clarifies that it is not an audit, review, or guarantee.

These clauses are expected by financial institutions and support professional compliance.

CPA Letter Formatting and Professional Standards

CPA letters are reviewed by third parties who follow strict documentation criteria.

Formatting and wording affect whether a letter is accepted or questioned.

This service follows commonly recognized professional standards used by lenders and financial institutions.

Each letter is prepared by a licensed Certified Public Accountant with a defined verification scope.

CPA Letterhead and Contact Details

The letter is issued on official CPA letterhead.

It displays the accounting firm name and contact information.

This allows lenders, landlords, and banks to identify the issuing party.

Recognizable letterhead supports third-party verification processes.

Signature and CPA License Identification

Every CPA letter includes a signed authorization.

The CPA license identification is clearly stated.

This confirms professional standing and regulatory compliance.

License details are often required during lender background checks.

Purpose-Specific Language

The wording is tailored to the intended use of the letter.

Mortgage, rental, and bank verification letters use different language.

Only relevant income and self-employment details are included.

Purpose-specific language helps prevent misinterpretation during review.

Limitation and Responsibility Clauses

The letter includes standard limitation clauses.

These clauses define what was reviewed and what was not.

They clarify that the letter is not an audit, certification, or financial guarantee.

Such clauses are expected by financial institutions and support compliance with professional responsibility standards.

Area-Specific CPA Letter Solutions in Chicago IL

Documentation requirements can vary by location.

Mortgage lenders, landlords, and financial institutions in Chicago often apply local review standards.

This CPA letter service is structured to align with those regional expectations.

Each letter is prepared by a licensed Certified Public Accountant and based on verification practices commonly used in Illinois.

Chicago Mortgage Lender Documentation Needs

Mortgage lenders in Chicago frequently request additional income verification for self-employed applicants.

This includes confirmation of income stability and business activity.

A CPA letter helps summarize reviewed financial data in a format lenders recognize.

Clear documentation supports smoother underwriting and fewer follow-up requests.

Local Rental Agreement Verification

Chicago landlords often require proof of income from self-employed tenants.

A CPA letter provides third-party confirmation of income and self-employment status.

The letter supports rental application review without disclosing unnecessary financial detail.

This approach helps landlords assess financial reliability.

Illinois-Based Financial Institution Requirements

Banks and financial institutions in Illinois follow internal verification processes.

CPA letters are commonly used to support loan applications, account verification, and compliance reviews.

The letter is structured to meet these verification needs.

Consistency with local banking practices improves acceptance.

CPA Letter for Self-Employed in Chicago Illinois

This service is tailored for self-employed individuals operating in Chicago Illinois.

It reflects local lender expectations and documentation standards.

Verification is based on reviewed tax returns and financial records.

The result is a CPA letter designed for regional mortgage, rental, and financial verification use.

Smart Income Documentation for Self-Employed Applicants

A structured CPA letter helps present income clearly, ensuring lenders receive the verification they need. These issues usually relate to documentation, consistency, and expectations.

Understanding these common problems helps reduce delays in mortgage, rental, and financial applications.

Clear and Structured Income Presentation

Income from various sources and fluctuating revenue can be accurately documented through professional CPA guidance, helping lenders understand your full financial picture with confidence.

A CPA letter helps explain income patterns using reviewed financial records.

Missing Income Verification Letter

Many lenders require third-party income confirmation.

Applicants sometimes submit tax returns without a CPA verification letter.

Providing a CPA letter early helps support income verification requirements.

Complete & Lender-Ready Documentation Support

Well-prepared and clearly organized financial documentation helps streamline the review process. Providing complete financial statements and consistent figures strengthens your application and supports confident lender evaluation.

A CPA letter summarizes key financial data in a structured format.

Misunderstanding CPA Verification Scope

Some applicants expect a CPA letter to guarantee income or approval.

CPA verification is limited to reviewing provided records.

The letter does not certify future earnings or financial outcomes.

Understanding the scope helps set realistic expectations during application review.

Understanding CPA Income Verification

CPA income verification helps third parties review self-employed income in a structured way.

It supports mortgage lenders, landlords, and financial institutions that require documented confirmation beyond tax filings.

The process is handled by a licensed Certified Public Accountant and follows defined professional limits.

Difference Between CPA Letter and Tax Returns

Tax returns report income to the Internal Revenue Service.

They reflect historical filing data.

A CPA letter summarizes income information from those returns and related records.

Lenders often request both.

Tax returns provide detail.

CPA letters provide verification context.

CPA Attestation vs Certification

CPA income verification is not a certification.

It does not guarantee accuracy beyond reviewed records.

Attestation refers to confirming information based on provided documentation.

This distinction is important for lender compliance and professional responsibility.

Third-Party Verification Expectations

Third parties expect clarity and defined scope.

They look for income period coverage, verification basis, and CPA identification.

They do not expect forecasts or financial guarantees.

Meeting these expectations helps reduce follow-up requests.

Role of Financial Statements in Verification

Financial statements support income verification.

They provide detail on revenue, expenses, and net profit.

CPAs review these statements alongside tax returns and bank records.

This combined review helps present a clearer financial picture for verification purposes.

Documents Commonly Used for CPA Verification

CPA income verification relies on specific financial documents.

These records help confirm self-employment status and reported income.

All verification is based on client-provided documentation and reviewed by a licensed Certified Public Accountant.

Providing complete records helps reduce review time and follow-up requests.

Tax Returns

Tax returns are the primary source of income information.

They show reported income filed with the Internal Revenue Service.

CPAs commonly review IRS Form 1040 and related schedules.

Lenders use tax returns to evaluate income history and consistency.

Profit & Loss Statement

Profit and loss statements summarize business income and expenses.

They provide insight into net profit over a specific period.

CPAs review these statements to understand business performance.

This document supports income verification when tax returns are reviewed.

Bank Statements

Bank statements show cash flow activity.

They help confirm that reported income aligns with deposits.

Both business and personal statements may be reviewed.

Lenders often compare bank activity with reported income figures.

Business Records and Financial Statements

Additional business records support verification.

These may include income statements, expense records, and financial summaries.

They help clarify how income is generated and reported.

Reviewing these records supports accurate and consistent CPA verification.

Sample CPA Letter for Self-Employed (Overview Only)

A sample CPA letter helps applicants understand structure and expectations.

It shows how income and self-employment information is presented to third parties.

This overview focuses on format and content, not wording templates.

Each letter is prepared by a licensed Certified Public Accountant and limited to verification based on reviewed records.

Required Elements in a CPA Income Letter

A standard CPA income letter includes defined components.

These typically cover the business name, self-employment status, and income period.

It also states the type of records reviewed and includes CPA identification.

Clear structure helps third parties quickly locate required information.

What Lenders Look For

Lenders focus on consistency and clarity.

They review income figures, time period covered, and verification basis.

They also check for proper CPA letterhead, signature, and license details.

Letters that stay within verification scope are more likely to be accepted.

What Makes a Strong and Lender-Ready CPA Letter

A high-quality CPA letter presents verified information, clearly outlines income timelines, and includes all required professional disclosures to support smooth lender review.

Avoiding these mistakes helps prevent delays and additional documentation requests.

Client Reviews for CPA Letter Services in Chicago

Client feedback reflects how CPA letters are used in real application scenarios.

Most reviews focus on documentation clarity, acceptance by third parties, and reduced processing time.

These experiences come from self-employed individuals operating in Chicago.

Mortgage Application Approval Experiences

Mortgage applicants often mention smoother underwriting reviews.

Clients note fewer follow-up requests from mortgage lenders.

Clear income verification helps support loan application decisions.

Many reviews reference acceptance of the CPA letter alongside tax returns.

Rental Verification Feedback

Rental applicants highlight faster approval timelines.

Landlords accept CPA letters as income proof for self-employed tenants.

Clients report reduced need to submit additional financial documents.

This feedback reflects common rental verification practices in Chicago.

Small Business Owner Experiences

Small business owners reference clearer income presentation.

Reviews often mention alignment with lender documentation standards.

Clients note that structured CPA letters help summarize business income.

These experiences reflect common verification needs for self-employed business owners.

Frequently Asked Questions About CPA Letters

Below are common questions asked by self-employed individuals during mortgage, rental, and financial applications.

Answers are based on standard lender and verification practices.

Is a CPA Letter Required for a Mortgage?

Not all mortgages require a CPA letter.

Many lenders request one when the applicant is self-employed.

It is often used alongside tax returns and bank statements.

Requirements vary by lender and loan program.

How Long Does the Verification Process Take?

Processing time depends on document completeness.

Most verifications are completed after reviewing tax returns and financial records.

Providing complete documentation helps reduce turnaround time.

Can a CPA Letter Replace Tax Returns?

A CPA letter does not replace tax returns.

Tax returns remain the primary income documentation.

The CPA letter supports and summarizes information from those returns.

Lenders typically require both documents.

What Records Are Required?

Required records usually include tax returns and income statements.

Bank statements and business records may also be requested.

The exact list depends on the application purpose.

Providing accurate records supports faster verification.

Is the Letter Accepted by All Lenders?

Acceptance depends on lender policies.

Most lenders accept CPA letters when prepared within verification scope.

Proper formatting and professional standards improve acceptance.

Applicants should confirm requirements with their lender.

Get a CPA Letter for Self-Employed in Chicago IL

Self-employed individuals often need income verification within a limited timeframe.

This service is structured to support mortgage, rental, and financial verification needs in Chicago.

Each CPA letter is prepared by a licensed Certified Public Accountant and based on reviewed financial records.

Same-Day CPA Letter Availability

Some applications require urgent documentation.

Same-day CPA letter availability is offered when records are complete and review-ready.

This option supports time-sensitive mortgage and rental applications.

Same-day processing depends on document accuracy and completeness.

CPA Letter for Self-Employed Online

The CPA letter process can be completed online.

Documents are securely submitted for review.

Communication and delivery are handled digitally.

This option supports self-employed individuals who prefer remote processing.

Fast CPA Letter Processing

Fast processing focuses on efficient document review.

Income verification is completed without unnecessary steps.

The letter is prepared once verification criteria are met.

Efficient processing helps reduce application delays.

Affordable CPA Letter Options

Pricing is structured based on verification scope.

Costs reflect document review time and complexity.

There are no bundled or unrelated services included.

Transparent pricing helps self-employed individuals plan verification needs.

Ready to Request Your CPA Letter?

If you are self-employed and preparing for a mortgage, rental, or financial application, proper income verification matters.

A CPA letter helps present your income and self-employment status in a format lenders and third parties expect.

This service is available for self-employed individuals operating in Chicago and surrounding areas.

Start Your CPA Verification Process

The process begins with submitting your financial records.

These typically include tax returns, income statements, and bank statements.

Clear documentation helps move the verification forward without delays.

Starting early helps avoid last-minute application issues.

Speak With a Certified Public Accountant

Income verification is handled by a licensed Certified Public Accountant.

The CPA reviews your records and explains what can be verified.

This helps set clear expectations before the letter is prepared.

Direct CPA involvement supports accuracy and compliance.

Request CPA Letter for Self-Employed Today

Once documents are reviewed, the CPA letter is prepared for its intended use.

It is structured for mortgage, rental, or financial verification.

The final letter includes required professional details and disclaimers.

This helps support third-party review with clear and verified information.

Final CTA:

Request CPA Letter for Self-Employed in Chicago IL