Mortgage underwriting often moves fast, but when income, assets, or fund movements don’t fit neatly into standard checklists, lenders may ask for additional professional context. One document that frequently comes up in these situations is a CPA Comfort Letter for Mortgage.

While commonly requested, comfort letters are also widely misunderstood. This article explains what a CPA comfort letter is, what it can legitimately provide, where its limits lie, and how it differs from more specific documents like a CPA Letter for Mortgage Use of Funds.

What Is a CPA Comfort Letter for Mortgage Applications?

A CPA Comfort Letter for Mortgage is a non-attest, limited-assurance communication issued by a Certified Public Accountant at a client’s request. Its purpose is to provide restricted, negative-assurance–style comfort to a lender or reviewer based on information supplied by the client.

Importantly, it is not:

- An audit

- A verification of income or assets

- A certification of mortgage eligibility

It is a narrowly scoped letter designed to address reasonableness and consistency, not correctness.

Why Lenders Request Comfort Letters

Gaps in Standard Documentation

Lenders may request a comfort letter when:

- Income documentation is complex or non-traditional

- Funds require contextual explanation

- Timing or structure raises underwriting questions

Clarifying Without Certifying

A comfort letter allows lenders to receive professional perspective without placing verification responsibility on the CPA.

Identifying the Request and Purpose

Letter Requesting Party

The letter clearly identifies the requesting party, typically:

- A mortgage lender

- A loan processor

- An underwriter or compliance team

Mortgage Review Purpose

The purpose is stated precisely, for example:

- Mortgage underwriting review

- File completeness support

Transaction Classification

The letter may reference whether the transaction is a purchase, refinance, or cash-out, purely for context.

File, Property, and Client Identification

File and Property References

To ensure proper reliance, the letter may include:

- File Identification Code

- Property Reference Descriptor (address or internal reference)

Client Identification

Common identifiers include:

- Client Legal Designation

- Additional Client Identifier (if applicable)

- Financial Role or Capacity (borrower, owner, guarantor)

Relationship to Transaction

The letter clarifies the client’s role in the mortgage transaction.

Nature and Level of Comfort Provided

Nature of Comfort Provided

Comfort is typically framed as:

- “Nothing came to our attention that would indicate…”

- “Based on the information provided, we are not aware of…”

This is negative assurance, not confirmation.

Information Basis Statement

The letter explicitly states that conclusions are based on:

- Client-provided information

- Records made available

Level of Professional Reliance

Reliance is limited to the scope described, no broader inference is permitted.

Explicit Exclusions and Risk Controls

Explicit Exclusions Statement

A compliant comfort letter clearly excludes:

- Verification of balances

- Authentication of documents

- Independent corroboration

No Verification / No Audit Clarification

This language is essential to avoid unintended assurance.

Accountant Identification and Authority

Signing Accountant Details

The letter includes:

- Signing Accountant Name

- Professional Standing Indicator (CPA)

- Licensing Body Name

- Authorization Reference Number

Duration of Client Engagement

Some lenders request disclosure of how long the CPA has worked with the client.

Financial Period and Data Referenced

Referenced Financial Period

The letter defines the exact period considered.

Data Source Description

Typical references include:

- Tax filings

- Internal accounting summaries

- Bank statements (reviewed, not verified)

Reasonableness and Change Awareness

Reasonableness Commentary

The CPA may comment on whether information appears reasonable in context, without validation.

Material Change Awareness Statement

The letter may state whether the CPA is aware of any material changes during the period reviewed, based solely on information provided.

Accounting Firm Identification

Organization and Contact Details

A lender-acceptable letter includes:

- Accounting Organization Name

- Practice Headquarters Address

- Administrative Contact Number

- Official Correspondence Email

Intended Use and Restrictions

Intended Recipient Statement

The letter names the specific lender or reviewing party.

Use Restriction Clause

Use is restricted to the stated mortgage transaction only.

Execution and Effectiveness

Letter Effective Date

The letter clearly states its effective date.

Accountant Endorsement Signature

An original or authorized signature finalizes the document.

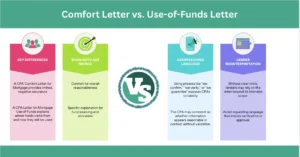

Comfort Letter vs. Use-of-Funds Letter

Key Differences

- A CPA Comfort Letter for Mortgage provides limited, negative assurance

- A CPA Letter for Mortgage Use of Funds explains where funds came from and how they will be used

When Both Are Needed

In complex files, lenders may request both:

- Comfort for overall reasonableness

- Specific explanation for fund sourcing and allocation

Risks of Improper Comfort Letters

Overreaching Language

Using phrases like “we confirm,” “we verify,” or “we guarantee” exposes CPAs to liability.

Lender Misinterpretation

Without clear limits, lenders may rely on the letter beyond its intended scope.

Best Practices for Borrowers

Understand What the Letter Can Say

Avoid requesting language that implies verification or approval.

Pair With Proper Documentation

Comfort letters supplement, never replace, required mortgage documents.

Best Practices for CPAs

Define Scope Relentlessly**

State purpose, period, reliance, and exclusions clearly.

Use Standard Comfort Language

Consistency protects both the CPA and the borrower.