For self-employed borrowers and business owners, mortgage underwriting is rarely just about gross income. Lenders want to understand how efficiently a business operates, how much revenue is consumed by expenses, and what income remains available to support a mortgage. This is where a CPA Expense Ratio Letter for Mortgage Loans becomes essential.

Often referred to by lenders as a CPA Letter for Expense Ratio Mortgage, this document explains how business expenses relate to revenue and how lenders interpret that relationship when evaluating qualifying income. In many cases, it is reviewed alongside a CPA Letter for Use of Business Funds Mortgage, giving underwriters a complete picture of both income quality and cash usage.

What Is a CPA Expense Ratio Letter for Mortgage Loans?

A CPA Expense Ratio Letter for Mortgage Loans is a non-attest, explanatory letter prepared by a licensed CPA at the borrower’s request. Its purpose is to summarize:

- Business revenue

- Operating expenses

- The resulting expense ratio

- How that ratio compares to historical performance and industry norms

The letter does not audit financials, calculate qualifying income, or guarantee mortgage approval. Instead, it helps lenders interpret existing financial data already reported on tax returns and financial statements.

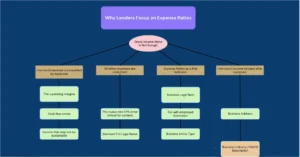

Why Lenders Focus on Expense Ratios

Gross Income Alone Is Not Enough

For business owners, high revenue does not automatically mean strong borrowing capacity. Lenders care about:

- How much revenue is consumed by expenses

- Whether expenses are consistent and predictable

- How much income remains after expenses

Expense Ratios as a Risk Indicator

An unusually high or volatile expense ratio may indicate:

- Thin operating margins

- Cash flow stress

- Income that may not be sustainable

This makes the CPA letter critical for context.

Borrower and Business Identification

Borrower Information

The letter typically identifies:

- Borrower Full Legal Name

This ensures the letter clearly ties to the mortgage applicant.

Business Identification

For self-employed borrowers, lenders expect clarity on:

- Business Legal Name

- Business Entity Type (LLC, S-Corp, Sole Proprietor, Partnership, etc.)

- Business Address

- Business Industry / NAICS Description

These details help lenders evaluate industry-specific expense behavior.

Ownership and Control Context

Ownership Percentage

The borrower’s ownership percentage is important because it determines:

- Control over expenses

- Access to profits

- Exposure to business risk

Lenders generally give more weight to income from businesses the borrower controls.

CPA Identification and Professional Credentials

CPA and Firm Details

A compliant letter includes:

- CPA Full Name

- CPA License Number

- State of CPA Licensure

- CPA Firm Name

- CPA Firm Address

- CPA Contact Phone Number

- CPA Email Address

Authorized Signature and Date

- Authorized CPA Signature

- Date of Letter

These elements establish credibility and allow lenders to verify licensure if needed.

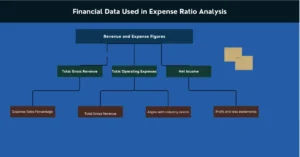

Financial Data Used in Expense Ratio Analysis

Revenue and Expense Figures

The letter typically summarizes:

- Total Gross Revenue

- Total Operating Expenses

- Net Income

These figures are taken directly from historical records, not recalculated for underwriting.

Expense Ratio Percentage

The expense ratio percentage is generally described as:

> Total Operating Expenses ÷ Total Gross Revenue

The CPA explains what the ratio represents without endorsing it as “acceptable” or “unacceptable.”

Industry Context and Benchmarking

Industry Standard Expense Ratio Reference

Lenders often want to know whether a business’s expense ratio:

- Aligns with industry norms

- Is higher or lower than typical for that sector

The letter may reference industry standards at a high level, without certifying benchmarks.

Why Industry Matters

Different industries naturally carry different expense structures. Context prevents misinterpretation.

Financial Records Reviewed

Documents Commonly Referenced

A CPA Letter for Expense Ratio Mortgage usually references review of:

- Tax returns

- Profit and loss statements

- Bank statements

Tax Years Covered

Most lenders require:

Two most recent tax years, though this may vary. The letter clearly states the tax years covered.

Purpose of the Letter and Intended Use

Purpose of Letter

The letter states it was prepared for:

- Mortgage underwriting

- Expense ratio evaluation

Lender and Loan Program Context

The letter may identify:

- Lender Name

- Loan Program Type (Expense Ratio, Non-QM, Bank Statement, etc.)

This limits reliance to a specific transaction.

How Lenders Use Expense Ratio Letters in Practice

Income Interpretation

Underwriters use the letter to:

- Understand expense consistency

- Evaluate margin sustainability

- Decide how much income is usable

Relationship to Other CPA Letters

A CPA Letter for Use of Business Funds Mortgage explains cash accessibility.

A CPA Letter for Expense Ratio Mortgage explains income efficiency.

Together, they give a balanced underwriting view.

What the Letter Does, and Does Not, Do

What It Does

- Explains expense behavior

- Provides industry and historical context

- Supports lender analysis

What It Does Not

- Audit financial statements

- Approve or deny the loan

- Guarantee income stability

Common CPA Disclaimers in Expense Ratio Letters

Most letters include language clarifying that:

- No audit or assurance was performed

- Information is based on records provided

- The letter is intended solely for mortgage review

These disclaimers are essential for compliance.

Best Practices for Borrowers

Maintain Consistency

Expense ratios should align with:

- Tax returns

- P&L statements

- Bank activity

Avoid Over-Engineering

Lenders value clarity more than aggressive justifications.

Best Practices for CPAs

Stay Descriptive, Not Judgmental

Explain ratios, do not defend or certify them.

Define Scope Clearly

Always specify records reviewed, years covered, and intended use.