CPA Expense Ratio Letter

Do you need to verify your business’s expense-to-revenue ratio for audits, loan applications, or tax filings, Our CPA can provide it.

$295

- Licensed CPA letter for Expense Ratio

- Certified by a tax authority

- Approved by all over US Lenders

- Unlimited Revisions untill approval

- 2 Hours Express Delivery

- 99% lender approval rate as of Today

- Verification to lenders, Tenant, Bank Officers

- Used for any legal, loan, Financial purposes with 100% Acceptance Rate

CPA Expense Ratio Letter

$295

- Licensed CPA letter for Expense Ratio

- Certified by a tax authority

- Approved by all over US Lenders

- Unlimited Revisions untill approval

- 2 Hours Express Delivery

- 99% lender approval rate as of Today

- Verification to lenders, Tenant, Bank Officers

- Used for any legal, loan, Financial purposes with 100% Acceptance Rate

CPA Expense Ratio Letter

A licensed CPA will write a letter to verify business ownership, income, and financial facts for self-employed individuals, business owners, and partners with 100% approval guaranteed. It meets all requirements of mortgage lenders, landlords, and other financial institutions, ensuring accuracy and compliance with their standards.

We do not required tax return or bank statement

CPA Letter verifies:

Business Details

- Business is active and good standings

- Business Ownership Percentage

- Business Financials Information

Financial Details

- Business Expense ratio

- Certify Tax Returns and Financials

- Use of Business funds will not negative affect business operations

Self Employment

- Owner Self Employment Verification

- Certify Self-Employment Tenure (For 2 Years)

- Certify Self Employment Income

Pricing

Get CPA letter in $199

Service includes

- US Based Licensed CPA prepare your letter

- Certified by all state and federal authority

- 100% Guaranteed Approval or Get Money Back

- Unlimited Revisions untill approval

- Trusted by all lenders, banks and loan originators

Letter includes

- Income Verification Letter

- Self Employment Verification Letter

- Expense Factor/Ratio Letter

- CPA Letter Use of Business Funds

- Comfort/Mortgage Letter

- Any other CPA Letter (As Requested)

CPA Expense Ratio Letter

A CPA Expense Ratio Letter is a document prepared by a Certified Public Accountant (CPA) that details the expense ratio—a measure of how much of one’s income is directed toward necessary and discretionary expenses. This letter is often requested by lenders or investors to confirm a business or individual’s financial stability. With a CPA expense ratio letter template, you can get a standardized approach to presenting your proof of income and managing a CPA loan application.

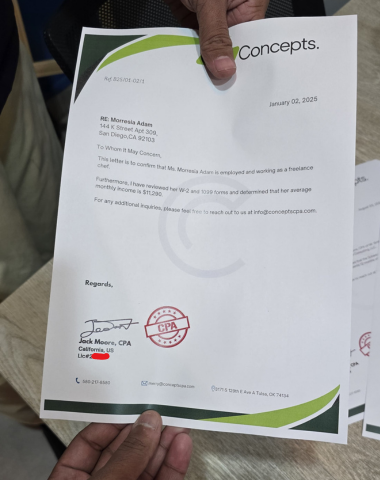

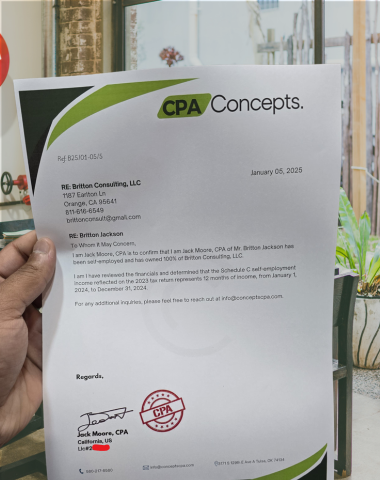

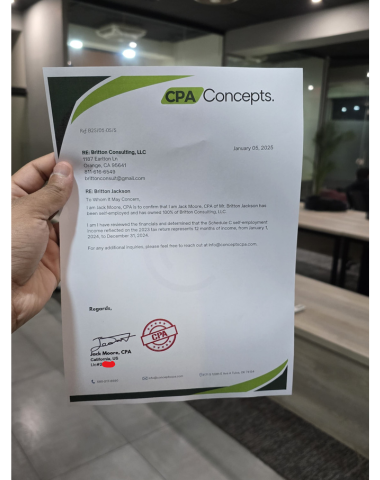

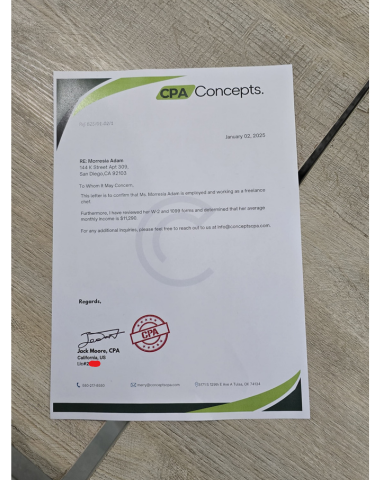

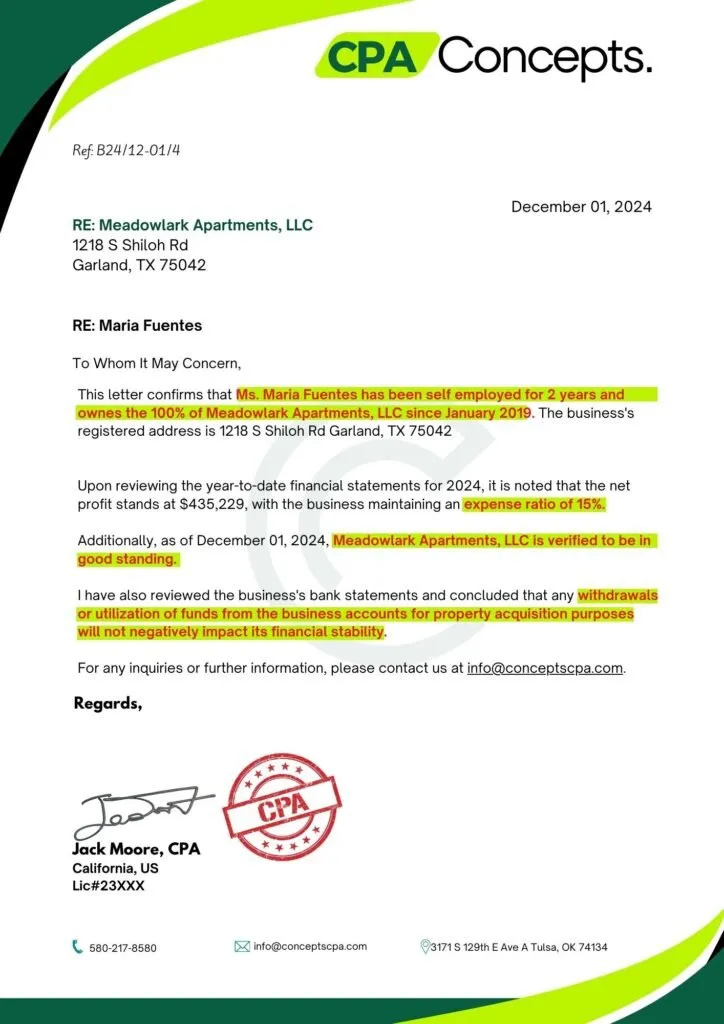

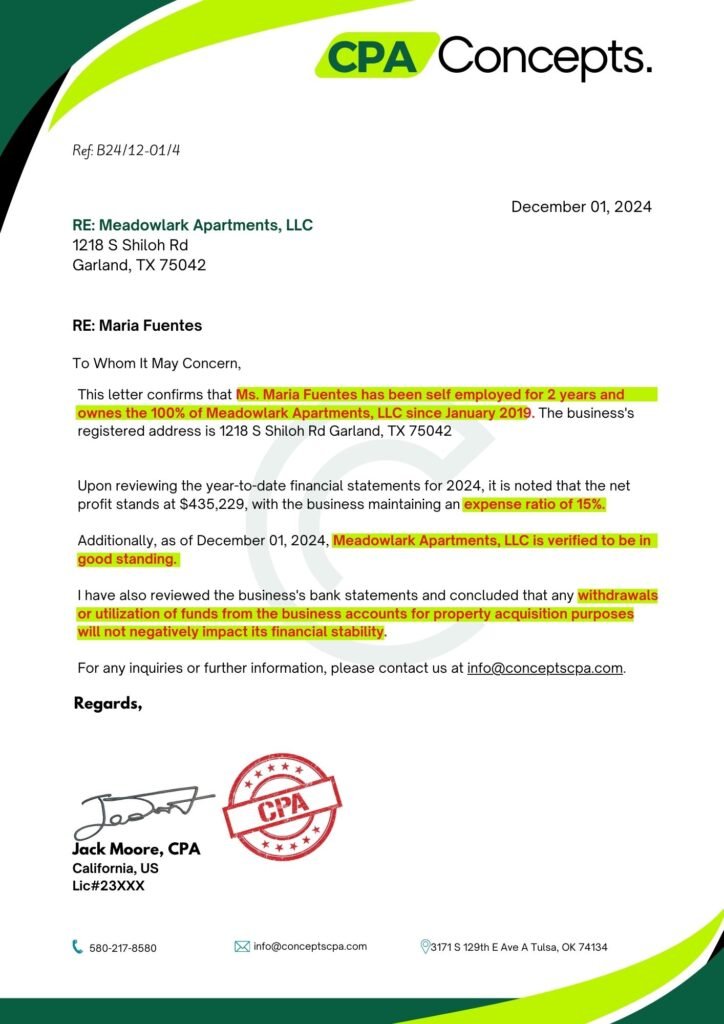

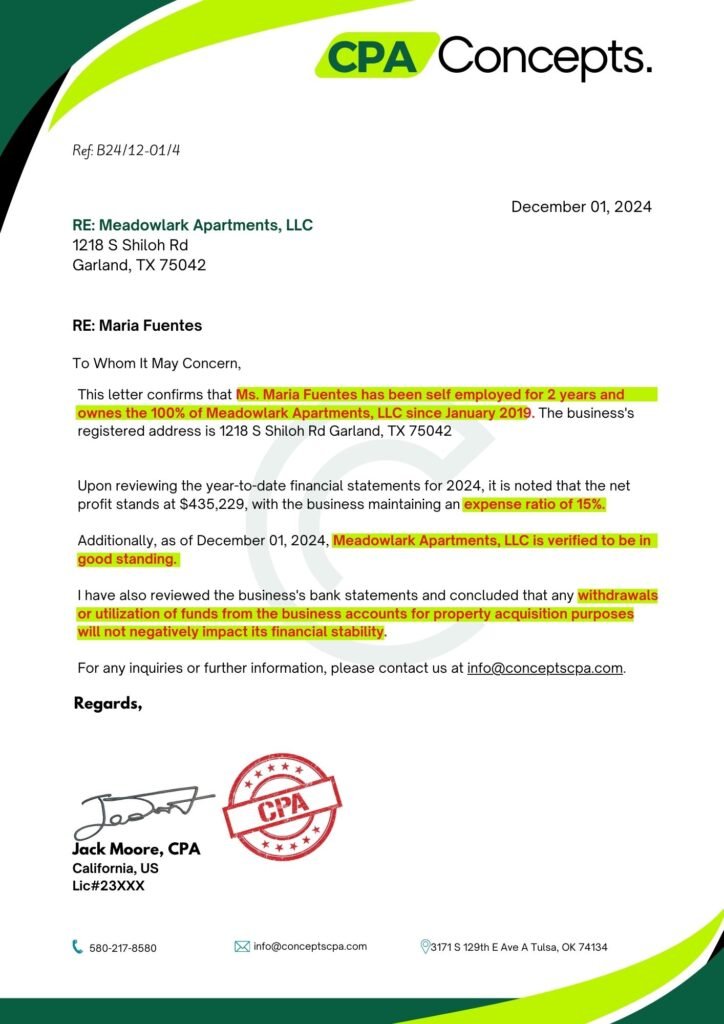

Sample CPA Expense Ratio Letter

This sample can serve as a guide to help self-employed individuals understand what to expect in a professionally drafted CPA letter. Customize the template as needed to match specific lender requirements or unique financial situations.

Ready to request your CPA letter? Contact us to begin the process today!

Why Do You Need a CPA Expense Ratio Letter?

Having a CPA letter for mortgage or an expense ratio letter is crucial when you need to demonstrate financial responsibility. It highlights expense management relative to income, improving your credibility with lenders. Whether you need a cpa letter of explanation for gaps in employment or a method of verification letter for self-employment, this document can help meet lender requirements.

Key Situations for Needing a CPA Expense Ratio Letter

- Business Loans: When applying for a cpa letter mortgage loan, banks require a breakdown of income and expenses to assess repayment ability.

- Investor Relations: Investors appreciate a well-prepared comfort letter from a CPA as it reassures them that the business is financially sound.

- Personal Financial Planning: Knowing your expense ratio helps with budgeting and overall financial planning.

How Does an Expense Ratio Work?

The expense ratio measures financial efficiency, calculated by dividing total expenses by income. Conceptscpa professionals use this ratio to advise on cost-cutting strategies. A high expense ratio indicates financial strain, while a low one suggests better financial health.

Understanding Expense Ratio Calculations

Expense ratios are calculated by summing all monthly or yearly expenses and dividing by total income. This percentage shows the proportion of income absorbed by expenses, which lenders use as a tax verification letter of one’s financial situation

Fixed Costs vs. Variable Costs

- Fixed Costs: These are consistent expenses like rent and salaries, essential to any letter of expenses.

- Variable Costs: Fluctuating expenses, such as marketing and production, are included in the ratio to show potential changes in expense analysis.

Expense Ratios for Individuals vs. Businesses

For individuals, expense ratios focus on living expenses versus income. For businesses, the focus extends to operational and reinvestment costs. CPAs prepare tailored accountant letters based on each unique financial picture.

Key Components of a CPA Expense Ratio Letter

- Detailed Financial Breakdown: Lists income sources and expenses, forming the basis of a sample CPA letter for self-employed.

- Clear Explanation of Ratios: Provides context and explanation, ensuring clarity in your cpa letter of explanation.

- Supporting Documentation: This includes statements or self-employed proof of income letters to substantiate analysis.

Steps to Obtain a CPA Expense Ratio Letter

- Choosing the Right CPA: Selecting a knowledgeable CPA who understands third-party verification requirements is key. Look for reviews and consider specialization, especially for unique needs like internal revenue service employment verification.

- Providing Necessary Financial Information: Transparency is critical to accurate representation. Include data for employment verification letters for self-employed individuals if applicable.

- Reviewing the Draft with Your CPA: Collaborate on the draft to correct errors and understand the letter explaining gaps in employment for mortgage samples if required.

Common Uses of a CPA Expense Ratio Letter

- Applying for Business Loans: Lenders evaluate the expense ratio to understand repayment capacity for CPA letters mortgage loans.

- Personal Financial Planning: Insight into your expense ratio can guide budgeting and saving decisions, crucial for long-term financial growth.

Benefits of a CPA Expense Ratio Letter

- Accurate Expense Analysis: A tax letters section provides detailed income vs. expense analysis.

- Enhanced Credibility with Lenders: Having a CPA-reviewed document improves trust, particularly for loan confirmation letters.

How Much Does a CPA Expense Ratio Letter Cost?

Typical Cost Range

The cost for a CPA expense ratio letter typically ranges between $250 and $490, although prices vary depending on financial complexity and CPA expertise.

Factors Influencing the Price

Complexity, urgency, and the CPA’s experience level all impact the fee, especially when verifying sole proprietorship letters.

Conclusion

Is a CPA Expense Ratio Letter Right for You?

A CPA Expense Ratio Letter is an invaluable tool for anyone needing a clear view of their expense management. It’s beneficial for both personal and business use, as it offers insights into financial habits that can support growth, planning, and loan applications. With a professional CPA, you can ensure your expense ratio is accurately represented—an advantage when credibility with lenders and investors is essential.

How long does it take to get a CPA expense ratio letter?

Usually, it takes 1-2 weeks, depending on CPA availability and financial complexity.

Can I prepare an expense ratio letter myself?

While possible, a CPA’s signature adds credibility that many lenders require.

What happens if the ratio is too high?

A high ratio may cause lenders to question repayment ability, impacting loan approvals.

Do all lenders accept CPA expense ratio letters?

Most do, but it’s wise to confirm with your lender.

Is a CPA expense ratio letter the same as a profit and loss statement?

No, a P&L statement details income and expenses, while a CPA expense ratio letter analyzes income-to-expense ratios specifically.