CPA Letters For Apartment

A licensed CPA will write a letter to verify business ownership, income, and financial facts for self-employed individuals, business owners, and partners with 100% approval guaranteed. It meets all requirements of mortgage lenders, landlords, and other financial institutions, ensuring accuracy and compliance with their standards.

We do not required tax return or bank statement

CPA Letter verifies:

Business Details

- Business is active and good standings

- Business Ownership Percentage

- Business Financials Information

Financial Details

- Business Expense ratio

- Certify Tax Returns and Financials

- Use of Business funds will not negative affect business operations

Self Employment

- Owner Self Employment Verification

- Certify Self-Employment Tenure (For 2 Years)

- Certify Self Employment Income

Pricing

Get CPA letter in $169

Service includes

- US Based Licensed CPA prepare your letter

- Certified by all state and federal authority

- 100% Guaranteed Approval or Get Money Back

- Unlimited Revisions untill approval

- Trusted by all lenders, banks and loan originators

Letter includes

- Income Verification Letter

- Self Employment Verification Letter

- Expense Factor/Ratio Letter

- CPA Letter Use of Business Funds

- Comfort/Mortgage Letter

- Any other CPA Letter (As Requested)

CPA letter for Apartment

CPA letters serve as essential tools for verifying income and financial stability when applying for a mortgage or renting an apartment. This guide breaks down what a CPA letter entails, what documents are required, and the key elements included, while answering common questions about this documentation.

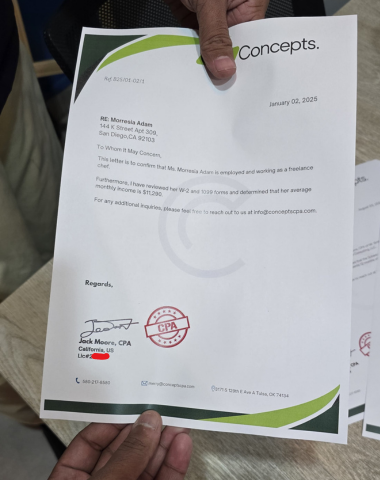

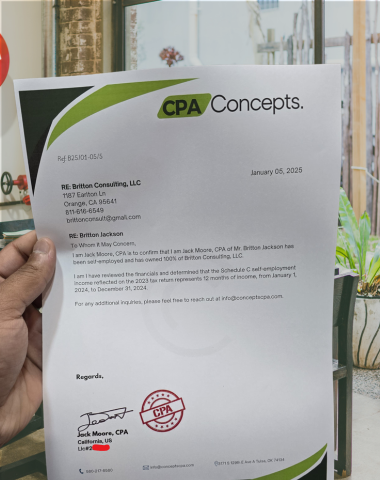

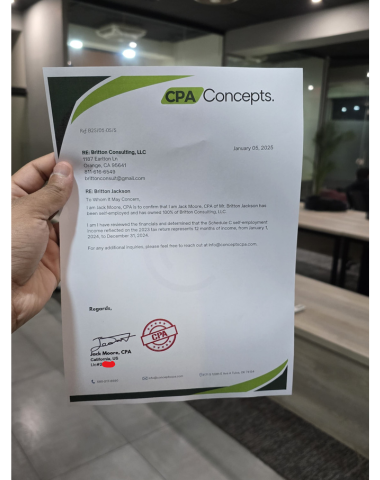

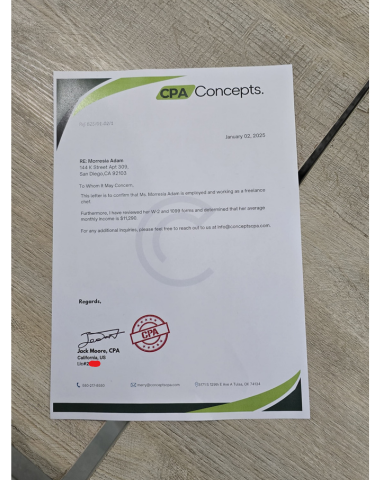

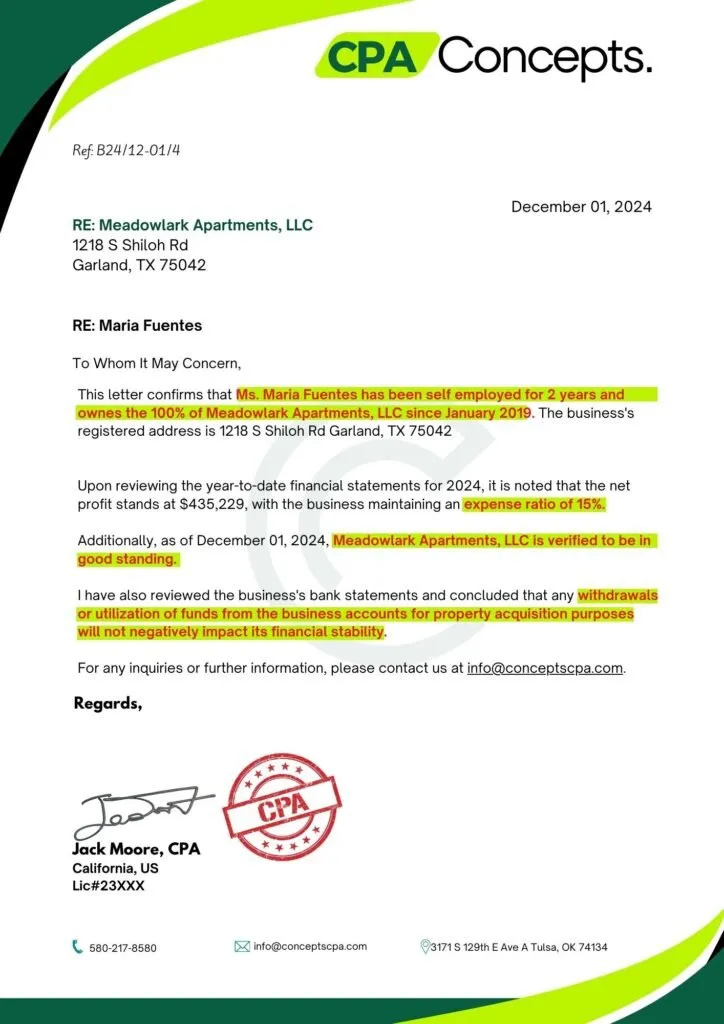

Sample CPA letter for Apartment

This sample can serve as a guide to help self-employed individuals understand what to expect in a professionally drafted CPA letter. Customize the template as needed to match specific lender requirements or unique financial situations.

Ready to request your CPA letter? Contact us to begin the process today!

Get a CPA Letter for Mortgage or Apartment Rental

A CPA letter, also called an income verification or comfort letter, confirms a tenant’s or borrower’s financial position. It’s particularly useful for self-employed individuals or those with non-traditional income sources, as it offers reliable income verification when standard documentation like pay stubs isn’t available.

How Can a CPA Verify an Applicant’s Income for an Income Verification Letter?

To prepare a CPA letter, the CPA reviews financial documents like tax returns, bank statements, and other income records. The letter verifies the applicant’s reported income, confirming their ability to make consistent mortgage or rent payments.

What Items Do You Need to Provide to a CPA to Prepare an Income Verification Letter?

A standard CPA letter includes:

- Tax Returns: Typically the last two years.

- Bank Statements: Recent statements to show consistent income flow.

- Income Records: Profit and loss statements for self-employed individuals.

- Identification: Proof of identity, sometimes required for notarization.

Providing these documents helps the CPA validate income accurately.

What Information is Included in a CPA Letter?

A standard CPA letter includes:

- Applicant’s Name and Business Information: Confirms employment or business operations.

- Verified Income and Employment Status: States monthly or yearly income and type of employment.

- CPA’s Contact Information and License Number: Validates the credibility of the letter.

CPA letters for apartment rentals or mortgage applications follow this format to ensure transparency and reliability

What Information Cannot Be Included in a CPA Letter?

Due to confidentiality and ethical standards, certain details may be omitted:

- Non-verified Income Sources: Only verified income is listed.

- Personal Spending Patterns: Expenses unrelated to income verification are excluded.

- Non-Financial Information: Personal background details or opinions are omitted.

Why You Need a CPA Letter for Mortgage

Mortgage lenders require CPA letters to confirm income stability, which affects loan terms and eligibility. For self-employed individuals, a CPA letter demonstrates income consistency and financial reliability, helping them qualify for better loan rates and conditions

Why You Need a CPA Letter for Rental Property

Landlords use CPA letters to screen tenants, particularly those with unconventional income. A CPA-verified income letter assures landlords that tenants have the financial means to afford rent, reducing risk and often resulting in smoother rental approval processes

Why Choose ConceptsCPA

Choosing an experienced firm like ConceptsCPA ensures your CPA letter is:

- Accurate: Verified with attention to detail.

- Recognized: Accepted by lenders and landlords alike.

- Timely: Available on schedule to meet application deadlines.

Final Thoughts

A CPA letter plays a vital role in establishing financial credibility for mortgage and rental applications. By understanding what is included and why it’s needed, applicants can approach lenders or landlords with confidence. Selecting a reputable CPA ensures the letter’s accuracy, meeting all verification standards.

Can I Write My Own CPA Letter?

While you can draft a basic income or employment letter, a CPA letter holds added credibility because it’s prepared by a licensed professional. CPA letters are trusted by lenders and landlords because they’re based on verified financial records. Writing your own may not carry the same weight and could lead to additional requests for verification.

How Do I Get a Letter from a CPA?

To obtain a CPA letter, contact a certified public accountant and provide necessary financial documentation, such as recent tax returns, bank statements, and identification. The CPA will review these documents to prepare a letter verifying your income and financial standing, tailored to your needs, whether for a mortgage, rental application, or loan.

Can a CPA Write a Comfort Letter?

Yes, a CPA can provide a comfort letter, often used for income verification or business assessments. Comfort letters provide an independent review of financial information, which helps assure lenders, landlords, or other third parties of your financial reliability.

What is a CPA Notarized Letter?

A CPA notarized letter is a CPA-verified document that has been notarized to confirm its authenticity. This letter is often requested for high-stakes financial matters like mortgages or leases, providing a legally binding, third-party verification of your income and financial stability.

Read More

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.