For business owners, proving income is rarely as simple as showing a paycheck. Revenue flows through entities, expenses reduce taxable income, and compensation structures vary widely depending on ownership and tax treatment. This complexity is exactly why a CPA Letter for Business Owners has become a critical document for lenders, landlords, investors, and other decision-makers.

Unlike basic confirmations, a CPA letter explains how income is earned, why expenses exist, and whether the business owner’s financial position is stable. It also clarifies why, in many cases, a CPA letter carries more weight than an employer-issued document, an important distinction in the CPA Letter vs Employment Letter discussion.

Why Business Owners Need CPA Letters

Business owners often face skepticism during financial reviews because their income does not follow a predictable payroll pattern. Underwriters and reviewers want to understand:

- How ownership affects compensation

- Whether income is recurring or discretionary

- How expenses impact net income without harming cash flow

A CPA letter exists to translate business finances into clear, professional language that third parties can rely on responsibly.

What Is a CPA Letter for Business Owners?

A CPA Letter for Business Owners is a written explanation prepared by a licensed CPA that outlines income sources, expense structure, and financial stability based on reviewed records. It is issued for a specific purpose and includes a letter issue date to define its relevance.

The letter does not certify outcomes or guarantee future performance. Instead, it provides clarity grounded in accounting and tax documentation.

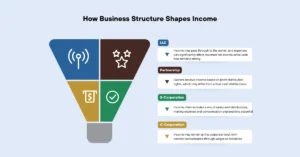

How Business Structure Shapes Income

Why Entity Type Matters

The way a business is structured determines how income is reported and perceived.

LLC

Income may pass through to the owner, and expenses can significantly affect reported net income while cash flow remains strong.

Partnership

Owners receive income based on profit distribution rights, which may differ from actual cash distributions.

S-Corporation

Income often includes a mix of salary and distributions, making expense and compensation explanations essential.

C-Corporation

Income may remain at the corporate level, with owners compensated through wages or dividends rather than direct pass-through income.

A CPA letter explains these distinctions so reviewers do not misinterpret tax filings.

Ownership, Authority, and Control

Management Authority and Economic Rights

Beyond income figures, decision-makers often need to understand:

- Management authority within the business

- The owner’s capital contribution amount

- Whether ownership interests are restricted

These details help establish how much control and financial stake the business owner truly holds.

Agreements and Restrictions

A CPA letter may reference, at a high level:

- Buy-sell agreement existence

- Any non-transferability clause affecting ownership interests

These factors influence liquidity and long-term stability, even if they do not affect current income.

Explaining Business Income Clearly

Revenue Classification and Industry Context

CPAs often contextualize income by referencing the business’s NAICS code, which helps reviewers understand:

- Industry norms

- Typical expense levels

- Expected income variability

This prevents unfair comparisons to unrelated industries.

Guaranteed Payments and Owner Compensation

In some structures, owners receive guaranteed payments rather than traditional wages. These payments are explained carefully to show how they fit into overall income without overstating certainty.

Expenses and Financial Reality

Why Expenses Reduce Income on Paper

Business expenses often lower taxable income but do not necessarily weaken financial stability. A CPA explains:

- Which expenses are ordinary and necessary

- Whether they are recurring or strategic

- How they affect reported income versus real cash flow

This context is essential for accurate evaluation.

Authorization and Use of Tax Records

IRS Form 8821 and Limited Review

To ensure consistency, a CPA may rely on authorized tax records through IRS Form 8821, which allows review of filed information without granting representation authority.

The CPA letter clearly states the scope of review and reliance on provided records.

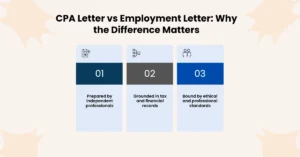

CPA Letter vs Employment Letter: Why the Difference Matters

Why Employment Letters Fall Short for Business Owners

Employment letters assume a fixed employer-employee relationship. They are typically based on payroll data and do not explain:

- Ownership income

- Business expenses

- Profit distributions

In contrast, a CPA letter addresses the full financial picture.

Why CPA Letters Carry More Credibility

In the CPA Letter vs Employment Letter comparison, CPA letters are often trusted more for business owners because they are:

- Prepared by independent professionals

- Grounded in tax and financial records

- Bound by ethical and professional standards

Professional Limits and Disclaimers

A proper CPA letter always includes clear boundaries:

- No audit or assurance was performed

- Income is not guaranteed

- Decisions remain with the recipient

These disclosures are required to maintain trust and compliance.

EEAT Perspective: Why CPA Letters Work

From an EEAT standpoint, CPA letters demonstrate:

- Experience interpreting complex business income

- Expertise in entity-level accounting and tax treatment

- Authoritativeness through licensed CPA involvement

- Trustworthiness via transparency and defined scope

This is why they remain a preferred tool in high-stakes financial reviews.

Common Situations Where CPA Letters Are Required

Typical Use Cases

- Mortgage and loan underwriting

- Apartment or commercial lease approvals

- Investor or partnership reviews

- Situations involving variable or non-payroll income

In these cases, explanation matters more than raw numbers.