Conventional mortgage underwriting follows a different rulebook than government-insured loans. When income is complex, variable, or business-derived, lenders may request a CPA letter to help interpret documentation under agency standards. A CPA Letter for Conventional Mortgages is designed to support underwriting aligned with Fannie Mae and Freddie Mac, while staying firmly within non-attest boundaries.

This guide explains what lenders expect, how underwriters use these letters, and how a well-drafted CPA letter for a mortgage fits into agency-compliant decision-making.

What Is a CPA Letter for Conventional Mortgages?

A CPA Letter for Conventional Mortgages is a non-attest, explanatory letter prepared by a licensed CPA at the borrower’s request. Its role is to clarify income characteristics, history, predictability, and context, when underwriting requires professional explanation beyond standard documents.

It does not:

- Verify or audit income

- Determine qualifying income

- Guarantee approval

Final determinations remain with the lender and its agency guidelines.

Why Conventional Lenders Request CPA Letters

Agency-Driven Documentation Expectations

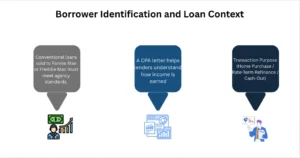

Conventional loans sold to Fannie Mae or Freddie Mac must meet agency standards. When income is non-W-2, layered, or variable, underwriters seek context, not certification.

Risk Management Without Assurance

A CPA letter helps lenders understand how income is earned and how stable it has been, without shifting responsibility away from underwriting.

Borrower Identification and Loan Context

Applicant Details

A compliant letter identifies:

- Primary Applicant Full Name

- Co-Applicant Identifier (if applicable)

Names must match the loan file exactly.

Transaction and Property Details

The letter may reference:

- Loan Category (Conventional)

- Transaction Purpose (Home Purchase / Rate-Term Refinance / Cash-Out)

- Property Usage Designation (Primary residence, second home, or investment)

Employment and Income Classification

Current Occupation and Income Type

Underwriters expect clarity on:

- Current Occupation Title

- Income Classification Type (W-2, self-employed, partnership income, etc.)

Duration and Predictability

The letter often describes:

- Duration of Current Income Source

- Income Predictability Statement (descriptive, not predictive)

Underwriting Standard References

Agency Alignment

The letter may cite the Underwriting Standard Reference (Fannie Mae or Freddie Mac) to anchor context, without interpreting or enforcing guidelines.

Loan File Identification

Where provided by the lender, a Loan File Reference Number may be included to tie the letter to the specific transaction.

CPA Identification and Professional Standing

Accounting Professional Credentials

A lender-acceptable letter includes:

- Accounting Professional Name

- Professional Designation Status (CPA)

- License Issuing Authority

- Credential Identification Number

Firm Identification

- Accounting Office Name

- Practice Mailing Address

- Office Contact Number

These details allow licensure verification and establish credibility.

Relationship and Scope of Review

Years of Professional Engagement

Some lenders ask how long the CPA has worked with the borrower to gauge familiarity with records.

Scope of Financial Review

The letter clearly states the scope, typically a review of client-provided records—without audit or testing.

Income Figures and Periods Covered

Financial Statement Period

The letter identifies the Financial Statement Period reviewed.

Earnings Presented

Common references include:

- Annual Earnings Amount

- Year-to-Date Earnings Summary

Figures are described as reported, not recalculated.

Income Stability, Trends, and Variability

Historical Income Trend Indicator

Underwriters look for whether income appears stable, increasing, or decreasing based on history.

Variability Explanation

If income fluctuates, the letter may provide context (seasonality, compensation structure) without forecasting.

Income Sustainability Opinion (Descriptive)

Any discussion of sustainability is informational and grounded in historical patterns, not guarantees.

How Underwriters Use the CPA Letter

Contextual Support

The CPA letter complements:

- Tax returns

- Pay statements or K-1s

- Bank statements

It helps underwriters interpret, not replace, those documents.

Agency Compliance

By keeping language descriptive and scoped, the letter supports agency compliance while avoiding prohibited assurances.

What the Letter Does, and Does Not, Do

What It Does

- Clarifies income history and structure

- Provides professional context

- Supports agency-aligned underwriting

What It Does Not

- Verify income accuracy

- Set qualifying income

- Guarantee approval

Common Disclaimers (Best Practice)

Most letters include statements that:

- No audit or assurance was performed

- Information relies on records provided

- The letter is prepared solely for the identified loan

These protect all parties and align with EEAT expectations.

Best Practices for Borrowers

Consistency Is Key

Ensure the CPA letter aligns with tax filings and the loan application.

Avoid Overreach

Requests for guarantees or predictions can delay underwriting.

Best Practices for CPAs

Define Scope Early

State the purpose, period, and limitations clearly.

Use Neutral Language

Explain facts and trends without judgment or assurance.