When banks evaluate a borrower for financing, they look beyond surface-level income figures. They want clarity, consistency, and confidence that the borrower can repay the loan under real-world conditions. For self-employed individuals, business owners, and applicants with variable earnings, a CPA Letter for Mortgage & Loan Approval often becomes a critical part of the underwriting process.

While similar in structure to a CPA Letter for Apartment Approval, mortgage and loan letters are reviewed with far greater scrutiny. Banks rely on them to understand income trends, documentation integrity, and financial sustainability before releasing funds.

Why Banks Request a CPA Letter

From a lender’s perspective, risk management is everything. A lender or financial institution needs to verify that the borrower’s income is legitimate, recurring, and sufficient for the loan being requested.

A CPA letter helps banks:

- Interpret complex income structures

- Validate income stability over time

- Reduce uncertainty during underwriting

Unlike informal explanations, CPA letters carry professional accountability and standardized disclosures.

What Is a CPA Letter for Mortgage & Loan Approval?

A CPA Letter for Mortgage & Loan Approval is a written statement prepared by a licensed CPA that summarizes income and financial capacity based on reviewed records. It is usually addressed to a specific loan officer and may reference the loan officer name, loan purpose, and loan program type.

The letter is informational, not promotional, and includes professional limitations to avoid overstating assurance.

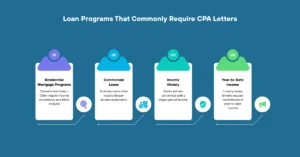

Loan Programs That Commonly Require CPA Letters

Different loan programs apply different underwriting standards, but CPA letters are most common when income is not easily verified.

Residential Mortgage Programs

- Conventional loans – Often require income consistency and trend analysis

- Federal Housing Administration (FHA) – Focuses on documented income history

- U.S. Department of Veterans Affairs (VA) – Requires reliable income for long-term affordability

- U.S. Department of Agriculture (USDA) – Emphasizes stable income for rural housing loans

Business and Commercial Loans

- Business loans often require deeper income explanation

- CPA letters help clarify owner compensation and cash flow

Each program applies different thresholds, but all rely on credible documentation.

What Banks Actually Review in a CPA Letter

Income History and Trends

Banks are less concerned with a single year of income and more focused on the income trend. A CPA explains whether income is:

- Increasing

- Stable

- Variable but predictable

This analysis is essential when income fluctuates year to year.

Year-to-Date Income and Current Capacity

In many cases, lenders request confirmation of year-to-date income to ensure current earnings align with prior tax filings. A CPA may reference interim records to support continuity without certifying future performance.

Occupancy Status and Loan Purpose

Banks also evaluate:

- Occupancy status (primary residence, secondary home, investment property)

- Stated loan purpose (purchase, refinance, expansion)

These factors affect risk assessment and underwriting standards.

The Role of IRS Documentation

Verification Through Tax Records

Tax filings remain the most authoritative income source. Banks commonly request verification using:

- IRS Form 4506-C

- IRS tax return transcripts

These documents confirm that income figures align with records filed with the Internal Revenue Service.

Authorization and Professional Limits

In limited cases, a CPA may be authorized through IRS Form 2848 to review records, but the CPA letter itself remains informational and non-assuring.

How Mortgage CPA Letters Differ from Apartment CPA Letters

CPA Letter for Mortgage & Loan Approval vs CPA Letter for Apartment Approval

While both letters explain income, mortgage letters require:

- Deeper income trend analysis

- More conservative language

- Stricter alignment with tax records

Apartment approval letters focus on rent affordability. Mortgage letters focus on long-term repayment risk.

What a CPA Letter Does Not Do

To meet professional and ethical standards, a CPA letter clearly states that:

- No audit or assurance engagement was performed

- Income is not guaranteed

- Approval decisions remain solely with the lender

These disclaimers are not weaknesses, they are requirements that protect all parties.

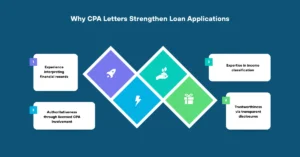

Why CPA Letters Strengthen Loan Applications

From an EEAT perspective, CPA letters succeed because they combine:

- Experience interpreting financial records

- Expertise in income classification

- Authoritativeness through licensed CPA involvement

- Trustworthiness via transparent disclosures

Banks value clarity over optimism, and CPA letters deliver that balance.

Common Situations Where CPA Letters Are Essential

Typical Use Cases

- Self-employed mortgage applicants

- Business owners with variable income

- Borrowers applying for FHA, VA, or USDA programs

- Business loan applicants without traditional payroll

In these cases, a CPA letter often determines whether underwriting moves forward.