Applying for an FHA mortgage often feels simple in the early stages, until the file reaches underwriting and additional documentation is requested. One requirement that frequently catches borrowers off guard, particularly those who are self-employed or have variable income, is a CPA Letter for Mortgage FHA Loan. Although the Federal Housing Administration does not mandate a CPA letter in every situation, lenders commonly request one to address underwriting questions around income consistency, business expenses, and overall financial stability. In some cases, this includes a CPA Letter for Expense Ratio Mortgage to help explain how deductions and operating costs affect reported income.

This article breaks down why lenders ask for CPA letters in FHA mortgage scenarios, what FHA documentation standards typically expect, and how a properly prepared letter can support the underwriting process. When written carefully and kept within compliance boundaries, a CPA Letter for Expense Ratio Mortgage can clarify financial details, reduce follow-up conditions, and help move the loan toward approval more efficiently, without creating unnecessary risk for the borrower or the lender.

What Is an FHA Loan?

An FHA loan is a government-backed mortgage designed to make homeownership more accessible. These loans are commonly used for:

- First-time homebuyers

- Borrowers with limited down payments

- Self-employed individuals or variable income earners

Because FHA loans carry lower risk for borrowers, lenders must strictly follow underwriting documentation requirements to offset that risk.

What Is a CPA Letter for Mortgage FHA Loan?

A CPA Letter for Mortgage FHA Loan is a signed statement prepared by a licensed accountant that confirms factual financial information already supported by existing documentation. It does not guarantee income or predict future earnings.

Lenders use these letters to confirm:

- Income source details

- Business expense structure

- Employment classification

- Length and consistency of income

When Lenders Request a CPA Letter for FHA Loans

Common Scenarios

Lenders typically request CPA letters when the Applicant:

- Is self-employed

- Owns 25% or more of a business

- Has fluctuating income

- Claims significant business deductions

- Uses adjusted income for qualification

Description of Income and Employment Status

Income Source Description

The letter explains how income is earned, such as:

- Salary or wages

- Self-employment income

- Business income or professional services

Employment Classification

Underwriters need clarity on whether the borrower is:

- Employee

- Self-Employed

Employer or Trade Name

If applicable, the employer name or trade name (DBA) is included to support continuity analysis.

FHA Loan Purpose and CPA Letters

CPA letters are commonly tied to:

- FHA Loan Purpose (Purchase / Refinance)

- Income justification for affordability

- Clarification of reduced taxable income

Key FHA Documentation Elements in a CPA Letter

Income Source Description

The letter may confirm the nature of income, such as:

- Business income

- Contract income

- Professional services income

This section should match tax returns exactly and avoid estimates.

Occupancy and Property Use Declarations

Owner-Occupancy Confirmation

FHA loans require owner occupancy. The CPA letter may acknowledge that the loan is intended for owner-occupied use, based on borrower representations.

Primary Residence Declaration

This reinforces FHA eligibility but does not replace lender verification.

Employment Classification (Employee / Self-Employed)

Clearly stating whether the borrower is an employee or self-employed helps underwriters apply the correct FHA income calculation method.

Employer or Business Confirmation

If applicable, the letter may identify the Employer or business entity and confirm the applicant’s role without commenting on future prospects.

Length of Income History

FHA underwriting often looks for a two-year income history. A CPA letter may confirm:

- How long the applicant has earned income from the same source

- Whether the income has been consistent

Continuity of Income Statement

This is one of the most sensitive areas. The CPA may confirm historical continuity but must avoid language suggesting income is “guaranteed” or “expected to continue.”

CPA Letter for Expense Ratio Mortgage (FHA Context)

Why Expense Ratios Matter

Self-employed borrowers often reduce taxable income through deductions. This can raise red flags for lenders.

A CPA Letter for Expense Ratio Mortgage may be requested to:

- Explain unusually high deductions

- Confirm expense consistency

- Clarify whether expenses are ordinary and necessary

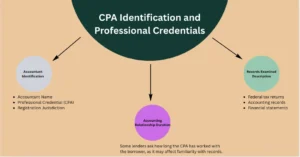

CPA Credentials and Professional Verification

Accounting Relationship Duration

Some lenders ask how long the CPA has worked with the borrower, as it may affect familiarity with records.

CPA Identification Information

This section identifies the accountant preparing the letter, including name, license status, firm affiliation, and contact details, allowing lenders to verify the professional’s credentials and legitimacy.

Records and Reporting Periods Reviewed

This section outlines the specific financial records reviewed by the accountant, such as tax returns or financial statements, and clarifies the time period covered to support the factual statements in the letter.

What FHA Underwriters Look For in a CPA Letter

Underwriting Documentation Requirement Checklist

- Matches tax returns exactly

- Contains factual statements only

- Is printed on official letterhead

- Signed and dated by the accountant

- Avoids forward-looking language

Why CPA Letters Matter for FHA Loan Approval

A well-prepared CPA letter:

- Reduces underwriting friction

- Clarifies income complexity

- Prevents unnecessary conditions

- Builds lender confidence

While it does not replace required FHA documentation, it often serves as the missing piece that helps underwriters move forward.