When applying for a home loan, income is the foundation of every underwriting decision. For self-employed borrowers, business owners, contractors, and even some W-2 earners with complex compensation, lenders often request a CPA Letter for Mortgage Income Verification to better understand how income is earned, calculated, and sustained.

This article explains exactly what mortgage underwriters look for, how a CPA letter for mortgage income verification is structured, what it can and cannot say, and how it fits into lender compliance and underwriting standards.

What Is a CPA Letter for Mortgage Income Verification?

A CPA Letter for Mortgage Income Verification is a non-attest, explanatory letter prepared by a licensed Certified Public Accountant at the borrower’s request. Its purpose is to summarize income information already reported in tax returns, financial statements, or accounting records so that mortgage underwriters can interpret the borrower’s income accurately.

The letter does not:

- Certify income accuracy

- Guarantee loan approval

- Replace lender underwriting or verification

Instead, it provides professional context around historical income.

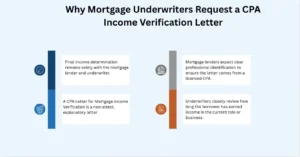

Why Mortgage Underwriters Request a CPA Income Verification Letter

Complexity of Income Sources

Underwriters often request a CPA letter when income is:

- Self-employed or business-derived

- Variable or commission-based

- Reported across multiple tax forms

Risk and Continuity Assessment

The letter helps lenders assess:

- Whether income is consistent

- Whether it appears sustainable

- How it should be interpreted alongside tax documents

CPA Firm Identification Requirements

Mortgage lenders expect clear professional identification to ensure the letter comes from a licensed CPA.

CPA Firm Details

A compliant letter typically includes:

- CPA Firm Legal Name

- CPA Firm Letterhead

- Firm Address

- Firm Phone Number

- Firm Email

CPA Credentials

The letter must clearly state:

- CPA Name

- CPA Title

- CPA License Number

- State of Licensure

- CPA Signature

- Date of Letter

These details establish professional credibility and traceability.

Borrower Identification Information

Borrower Details

Underwriters usually require:

- Borrower Full Legal Name

- Borrower Address (sometimes required)

Sensitive Information Handling

- Social Security Number is usually not included, unless a lender specifically requests it

- CPAs typically avoid including SSNs to reduce liability and privacy risk

Employment and Income Classification

Type of Employment

The letter identifies how income is earned, such as:

- Self-Employed

- W-2 Employee

- 1099 Contractor

- Business Owner

Length of Employment or Self-Employment

Underwriters closely review how long the borrower has earned income in the current role or business.

Business Information (If Applicable)

For self-employed borrowers or owners, the letter may include:

Business Identification

- Business Legal Name

- Business Address

- Ownership Percentage

Role of Ownership

Ownership percentage helps lenders understand:

- Control over income

- Exposure to business risk

Income Periods and Tax Years Reviewed

Tax Year Coverage

Mortgage lenders almost always want clarity on:

- Tax Year(s) Reviewed (usually the most recent 2 years)

Income Figures Explained

The letter may reference:

- Gross Annual Income

- Net Annual Income

- Average Income (multi-year, if applicable)

The CPA does not calculate qualifying income but explains what the historical numbers represent.

Income Trend and Stability Analysis

Income Trend Description

Underwriters pay close attention to whether income is:

- Stable

- Increasing

- Decreasing

Consistency and Continuation

The letter may address:

- Consistency of Income

- Ongoing or Expected Continuation of Income, based on historical patterns

This is descriptive, not predictive.

Source of Income Clarification

Income Sources Identified

The CPA letter often explains whether income comes from:

- Business operations

- Salary or wages

- Distributions or draws

- Contract or consulting activity

This helps lenders classify income correctly under mortgage guidelines.

Documents Reviewed by the CPA

Tax Returns Reviewed

The letter commonly references review of:

- Form 1040

- Schedule C

- K-1

- Form 1120-S

- Form 1065

Financial Records Reviewed

Additional references may include:

- Financial statements

- Internal accounting records

Important Limitation

The CPA states that these documents were reviewed, not audited or verified.

What a CPA Letter for Mortgage Income Verification Does Not Do

No Assurance or Certification

The letter does not:

- Audit income

- Confirm exact qualifying income

- Provide lender approval

No Underwriting Decision

Final income determination remains solely with the mortgage lender and underwriter.

Common CPA Disclaimers in Mortgage Income Letters

Most compliant letters include statements such as:

- No audit or assurance was performed

- Information is based on records provided

- Letter is issued solely for mortgage income verification purposes

These disclaimers protect both the CPA and the borrower.

How Underwriters Use the Letter in Practice

Underwriters typically combine:

- Tax returns

- Bank statements

- Pay stubs or business records

- CPA letter for mortgage income verification

The CPA letter acts as contextual support, not primary evidence.

Best Practices for Borrowers

Before Requesting the Letter

- Confirm exactly what the lender wants

- Avoid requesting language that implies assurance

During the Process

- Provide complete tax returns

- Be consistent with other loan documents

Best Practices for CPAs

Maintain Professional Boundaries

- Use explanatory, not confirmatory language

- Clearly define scope and reliance

Align With Mortgage Standards

- Keep content factual

- Avoid promises about income continuation or approval