A licensed CPA will write a letter to verify business ownership, income, and financial facts for self-employed individuals, business owners, and partners with 100% approval guaranteed. It meets all requirements of mortgage lenders, landlords, and other financial institutions, ensuring accuracy and compliance with their standards.

When applying for a mortgage loan, especially if you are self-employed, a CPA letter for a mortgage lender can be a vital tool in proving your financial stability. A CPA letter — also known as an accountant letter confirming income — provides lenders with an accurate, CPA-verified summary of your income and business health, helping facilitate the approval process.

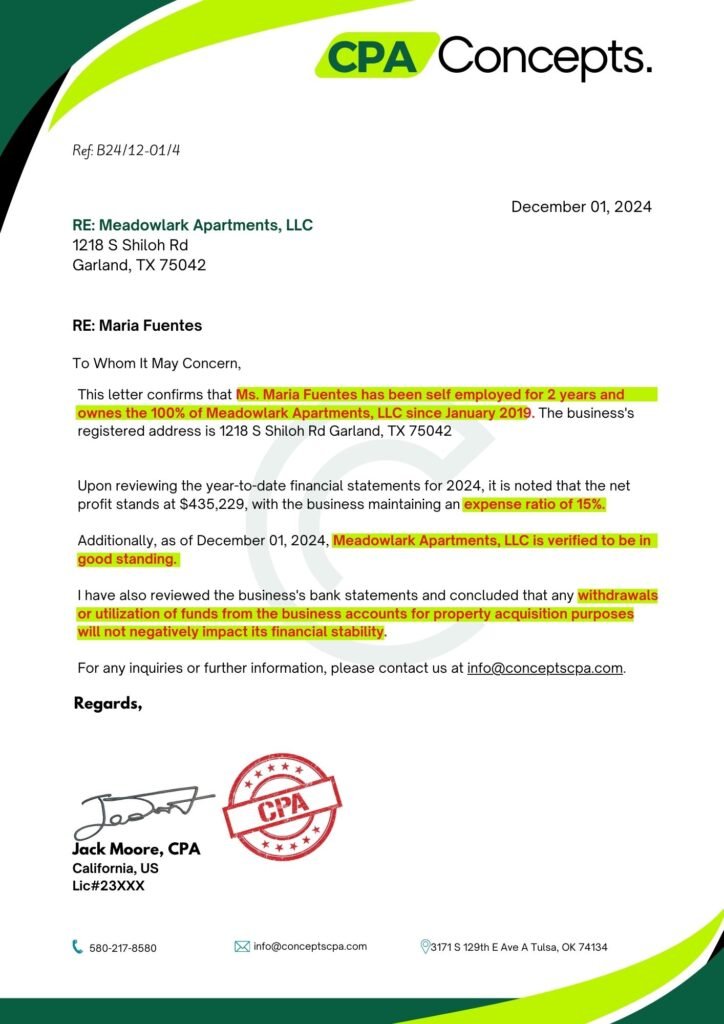

This sample can serve as a guide to help self-employed individuals understand what to expect in a professionally drafted CPA letter. Customize the template as needed to match specific lender requirements or unique financial situations.

Ready to request your CPA letter? Contact us to begin the process today!

A CPA letter of explanation is a specialized document created to verify an applicant’s income sources, stability, and financial background. Lenders typically require these letters from Certified Public Accountants (CPA) because of their trusted authority in assessing financial credibility. Whether for a mortgage, rental application, or loan application letter, this document builds lender confidence by offering a detailed look at your finances.

A complete CPA letter includes:

Each of these points ensures lenders receive a transparent and verified financial overview.

A CPA comfort letter or lending letter has multiple advantages for borrowers, particularly those with unique income sources. This letter offers income verification documents for apartments or mortgage applications, often easing the burden of excessive documentation requests. Additionally, a CPA verify signature enhances trust, simplifying approval from lenders and landlord accountants alike.

If you’re wondering how to write a CPA letter for a mortgage lender, keep these essentials in mind:

A CPA’s detailed insight, backed by licenses and certifications, reassures lenders, significantly improving the success of a loan application letter.

The cost of a CPA letter can vary depending on the CPA’s experience and the complexity of the document. On average, a letter from a CPA for mortgage purposes may range from $150 to $500. Choosing a reliable CPA is essential; ConceptsCPA and other reputable firms offer these services at competitive rates.

Not limited to mortgages, a rental verification letter from a CPA can prove income reliability for rental properties. This income verification document for apartments is often required by landlords to ensure you can afford rent, particularly if you’re self-employed or lack traditional pay stubs.

A well-prepared CPA letter for a mortgage lender can be the key to a successful mortgage or rental application. At [Your CPA Firm Name], we specialize in crafting CPA letters that align with lender requirements, whether it’s for mortgage, rental verification letters, or lender letters. Contact us today to get started on your path to homeownership.

While some tax preparers may hold CPA credentials, not all are licensed CPAs. Ensure you hire a CPA by me or another certified expert for maximum credibility.

A CPA typically reviews financial statements and other documents, issuing a comfort letter audit to verify financial health.

Lenders seek CPA letters to validate the applicant’s income stability and financial reliability, especially when traditional verification methods are unavailable.

A CPA Letter for Mortgage is often requested when lenders need third-party confirmation of a borrower’s financial information. In Chicago IL, mortgage lenders frequently require this letter for self-employed individuals, business owners, and borrowers with non-traditional income.

According to recent mortgage industry data, over 30% of U.S. mortgage applications involve self-employed or variable-income borrowers, where income verification becomes a key approval condition. A properly prepared CPA Letter helps lenders review income, tax filing status, and business existence without delaying the mortgage approval process.

Our letters are prepared by a Certified Public Accountant, based on reviewed tax returns and financial records. The scope stays clear. The language stays factual. The letter aligns with lender expectations in Illinois.

Mortgage lenders in Chicago require CPA Letters that are accurate, limited in scope, and compliant with professional standards. We prepare CPA Letters that support mortgage underwriting by addressing income verification and borrower financial status without overstating conclusions.

Each CPA Letter is issued on firm letterhead and structured to meet common mortgage lender documentation requirements.

Service Features

If you are applying for a home loan, refinance, or mortgage approval in Chicago IL, request a CPA Letter prepared for lender review. Our accounting firm supports borrowers, mortgage lenders, and third parties with timely and compliant CPA Letter services.

A CPA Letter for Mortgage is a supporting document used during the mortgage approval process. It helps mortgage lenders understand specific financial details when standard documentation is not sufficient. The scope of the letter is limited and clearly defined. It does not replace underwriting or financial audits.

Industry data shows that nearly 1 in 4 mortgage applications require additional income or business verification due to self-employment, multiple income sources, or recent financial changes. In such cases, lenders often request a CPA Letter to support their review.

The sections below explain what this letter typically covers.

Mortgage lenders may request confirmation of income when pay stubs or Form W-2 are not applicable. A CPA Letter summarizes historical income based on filed tax returns and related financial records.

The letter references reported income figures. This helps lenders assess income consistency during mortgage loan evaluation.

A CPA Letter may confirm the borrower’s financial position as reflected in available records. This includes reviewing tax filings and selected financial statements.

The purpose is to support the lender’s understanding of the borrower’s financial situation at a point in time. The letter avoids opinions on creditworthiness or lending decisions.

For self-employed individuals and business owners, lenders often require confirmation of business existence and ownership. A CPA Letter may state the length of business operation and the borrower’s role, based on accounting records.

This is common for LLCs, sole proprietors, and small business owners applying for a home loan or refinance in Chicago IL.

Mortgage lenders frequently ask whether tax returns have been filed. A CPA Letter may confirm that returns were prepared and filed based on information provided by the client.

The review is limited to tax compliance status. It does not certify the absence of audits or future tax liabilities.

Each mortgage lender may have specific wording and documentation expectations. A CPA Letter is prepared to align with common lender requirements while following professional standards.

The letter is issued by a Certified Public Accountant and presented on firm letterhead. Its scope remains factual, precise, and suitable for mortgage underwriting review.

Mortgage lenders look for CPA Letters that are accurate, limited in scope, and aligned with professional standards. In Chicago IL, lenders value clearly written third-party letters that use accurate language and well-supported statements, as they help keep the mortgage approval process efficient and on track.

Industry guidance from lending institutions shows that documentation clarity and compliance reduce underwriting delays by over 20%. Our CPA Letters are prepared with this expectation in mind. Each letter focuses on verifiable facts drawn from tax and accounting records.

Every CPA Letter is reviewed and signed by a Certified Public Accountant. The review is based on filed tax returns, financial statements, and business records provided by the client.

This ensures the letter reflects actual financial data without extending beyond what can be supported.

Mortgage lenders expect CPA Letters to follow a familiar structure. We format each letter specifically for mortgage loan and refinance applications.

The language is direct. Sections are clearly defined. This allows lenders to locate income verification and business details quickly during underwriting.

Mortgage lenders in Chicago IL often follow state-level and institutional documentation practices. Our CPA Letters are prepared with awareness of local lending expectations and common request patterns.

This helps avoid revisions caused by misaligned wording or missing information.

CPA Letters must stay within professional and ethical boundaries. Our letters avoid opinions on loan approval, creditworthiness, or future income.

The scope is clearly stated. Only verified information is included. This approach supports lender confidence and reduces compliance concerns.

When permitted, we support clarification requests from mortgage lenders or authorized third parties. This helps resolve documentation questions without unnecessary delays.

Clear communication improves the mortgage application process while keeping responsibilities properly defined.

A CPA Letter for Mortgage follows a defined process. Each step focuses on accuracy, documentation clarity, and lender usability. This structure helps reduce follow-up requests during mortgage underwriting.

Mortgage processing studies indicate that document rework accounts for nearly 25% of mortgage delays. A structured CPA Letter process helps limit those issues by addressing lender needs early.

The process begins with a review of the mortgage loan application purpose. This includes purchase, refinance, or other home loan scenarios.

We identify why the mortgage lender is requesting a CPA Letter. This step defines the scope before any documentation is reviewed.

Next, relevant tax returns and financial statements are assessed. The review is limited to filed returns and supporting accounting records provided by the client.

This step supports income verification and financial consistency without extending into audit-level procedures.

For self-employed individuals and business owners, income sources and business funds are reviewed based on historical records.

The CPA Letter reflects reported income and business activity.

Once the review is complete, the CPA Letter is prepared and signed by a Certified Public Accountant.

The letter is issued on official accounting firm letterhead. The scope, limitations, and purpose are clearly stated.

The completed CPA Letter is delivered for use in mortgage underwriting. It is formatted for direct submission to mortgage lenders and authorized third parties.

This final step supports timely lender review and helps keep the mortgage approval process on track.

Mortgage lenders may request different types of CPA Letters depending on the borrower’s income structure and loan requirements. Each letter serves a specific purpose within the mortgage application and underwriting process.

Industry lending data indicates that self-employed and variable-income borrowers account for more than 35% of conditional mortgage approvals, where additional CPA documentation is required. Selecting the correct CPA Letter type helps lenders complete income review without expanding the scope beyond standard verification.

A CPA Income Verification Letter is used when lenders need confirmation of income reported on tax returns. This applies when traditional employment documents are not available or do not fully reflect income patterns.

The letter summarizes historical income based on filed tax returns and related financial records. It supports lender review by presenting income figures clearly and consistently. The CPA does not guarantee future income or loan repayment.

This letter is commonly requested for mortgage loans, refinancing, and home loan applications in Chicago IL.

Self-employed individuals often face additional documentation requirements during mortgage underwriting. A CPA Letter for self-employed mortgage applicants confirms business existence, ownership status, and income history based on accounting records.

The letter may reference the length of business operation and the type of business entity. It is prepared by a Certified Public Accountant and follows ethical and professional limitations.

This type of CPA Letter is frequently used by business owners, freelancers, and independent professionals applying for a mortgage or refinance.

Mortgage lenders may request confirmation of business ownership when a borrower is a business owner or self-employed individual. A CPA Letter verifying business ownership states the borrower’s relationship to the business based on accounting and tax records.

The letter may reference the business entity type and ownership period. It focuses only on information supported by filed records and does not assign business value or evaluate financial performance beyond documented data.

During refinancing, lenders often re-evaluate income and financial consistency. A CPA Letter for mortgage refinance supports this review by summarizing income history and tax filing status.

The letter is based on previously filed tax returns and available financial statements. It helps lenders confirm continuity without restating prior loan terms or offering opinions on approval.

Some mortgage approvals are issued with conditions requiring additional documentation. A CPA Letter for mortgage approval conditions addresses specific lender requests, such as income clarification or business verification.

The scope is limited to the condition outlined by the mortgage lender. This helps prevent unnecessary revisions during underwriting.

Mortgage applications involve multiple supporting documents. A CPA Letter for mortgage documentation provides written confirmation that complements tax returns and financial statements.

This letter helps lenders interpret financial records more efficiently during loan processing.

All mortgage-related CPA Letters are signed by a Certified Public Accountant and issued on official letterhead.

The signature confirms professional responsibility for the contents while maintaining defined limitations. This supports lender confidence and proper third-party documentation use.

Client feedback helps mortgage lenders and borrowers understand how CPA Letter services perform in real lending situations. Reviews often reflect documentation clarity, response time, and how well the CPA Letter aligns with lender requirements.

Market research shows that over 70% of borrowers rely on service reviews when selecting professional services related to mortgage documentation. Consistent feedback highlights the importance of accuracy and communication during the mortgage approval process.

Borrowers in Chicago IL frequently mention timely delivery and clear wording as key factors in their experience. Many reviews reference reduced follow-up requests from mortgage lenders after submitting the CPA Letter.

Clients also note that properly scoped letters help avoid confusion during underwriting, especially for self-employed individuals and business owners.

Reviews for Concepts CPA often focus on professional handling of CPA Letters for mortgage lenders. Business owners and individual borrowers reference structured documentation, consistent communication, and adherence to lender-requested formats.

This feedback reflects a focus on practical mortgage support rather than generalized accounting services.

Mortgage lenders and borrowers in Chicago IL look for CPA Letters that are accurate, compliant, and easy to review. Trust is built when documentation aligns with lender expectations and avoids unsupported statements.

Industry lending reports indicate that clear third-party documentation improves underwriting efficiency by up to 18%. Our CPA Letter services focus on clarity, defined scope, and professional responsibility.

Mortgage lenders often follow internal documentation standards. Our CPA Letters are prepared with awareness of common lender wording, structure, and limitations.

This experience helps reduce clarification requests during mortgage underwriting and supports smoother loan processing.

Income figures included in a CPA Letter are based on filed tax returns and related financial records. The letter reflects historical data only.

This approach supports lender review without projecting future income or influencing lending decisions.

CPA comfort letters must follow professional and ethical guidelines. Our letters clearly define what is reviewed and what is excluded.

Each letter is prepared and signed by a Certified Public Accountant, ensuring accountability while maintaining proper limitations.

We support mortgage lenders, brokers, and authorized third parties with CPA Letters designed for business-to-business use.

Clear communication and defined responsibility help align all parties involved in the mortgage approval process.

Mortgage lending in Chicago IL presents documentation challenges that differ from other regions. Self-employment trends, varied business structures, and lender-specific requirements often lead to additional verification requests.

Housing finance data shows that clear income verification plays an important role in Illinois mortgage applications, helping reduce documentation-related delays that can occur during the review process.

A properly scoped CPA Letter helps address these issues without expanding lender risk.

Illinois has a high percentage of self-employed individuals and small business owners. Mortgage lenders often request CPA Letters when income does not follow a fixed payroll structure.

A CPA Letter summarizes historical income based on filed tax returns. It helps lenders understand income patterns while maintaining defined professional limits.

Many borrowers in Chicago operate through LLCs or as sole proprietors. These structures can complicate mortgage documentation when business and personal income overlap.

A CPA Letter may confirm business existence and ownership structure based on accounting records. It does not evaluate business performance or future stability.

Mortgage lenders in Chicago IL may request specific language or confirmations in CPA Letters. These expectations often differ between banks, credit unions, and mortgage brokers.

Preparing the letter with local lender practices in mind helps reduce revision requests during underwriting.

Tight closing timelines are common in competitive Chicago housing markets. Delays can be minimized when third-party documentation is prepared early and aligned with lender requirements.

A CPA Letter prepared early and aligned with lender requirements helps prevent last-minute underwriting issues. Each letter is reviewed and signed by a Certified Public Accountant, ensuring professional accountability and timely delivery.

CPA Letters play a specific role in mortgage lending. They are used to support lender review when standard employment or income documents do not fully apply. The purpose is clarification, not approval.

Mortgage industry guidance shows that third-party verification documents are reviewed alongside tax returns in more than 40% of non-traditional mortgage files. Understanding what a CPA Letter does, and does not do, helps borrowers and lenders avoid misaligned expectations.

A CPA Letter is not a financial audit. An audit involves extensive testing, verification procedures, and formal assurance.

A CPA Letter relies on reviewed records such as tax returns and financial statements.

A CPA can confirm information that is supported by existing records. This may include income reported on tax returns, business existence, or filing status.

These responsibilities remain with the mortgage lender.

Each letter is prepared and signed by a Certified Public Accountant within defined professional boundaries.

Tax returns are a primary source for income review in mortgage applications, especially for self-employed individuals. Lenders rely on filed returns to assess income consistency over time.

A CPA Letter may reference these returns to help lenders interpret reported figures. It does not replace the lender’s independent review of tax documents.

CPA comfort letters and verification letters are often used interchangeably, but their intent can differ.

Verification letters focus on confirming specific facts. Both types must clearly state their scope to avoid misunderstanding during mortgage underwriting.

CPA Letters must comply with professional standards and ethical guidelines. Clear limitations protect both the borrower and the lender.

Regulatory compliance ensures the letter supports the mortgage process without creating reliance beyond its intended purpose. This approach helps maintain transparency and accountability in mortgage lending.

Mortgage documentation does not end with a single loan application. Consistency in financial records helps reduce issues during future home loans, refinancing, or lender reviews.

Lending studies show that borrowers with consistent tax and income records face up to 15% fewer documentation requests in repeat mortgage applications. Maintaining alignment across financial documents supports long-term lending readiness.

Regular tax preparation helps ensure income figures remain consistent across filings. This is especially important for self-employed individuals and business owners.

When tax returns are prepared accurately and on time, future CPA Letters can be issued with fewer revisions or clarifications.

Mortgage lenders often review income trends across multiple years. Stable reporting supports lender confidence during new loan or refinance applications.

A CPA Letter reflects historical income. Maintaining stable records helps simplify future income verification requests.

Business owners benefit from periodic review of financial statements and business funds. This supports clearer separation between personal and business income.

Ongoing monitoring helps identify documentation gaps before they impact mortgage or lending requests.

Many mortgage delays occur due to incomplete or inconsistent records. Addressing documentation issues early reduces lender follow-up requests.

Each CPA Letter is prepared and signed by a Certified Public Accountant, ensuring accountability while supporting smoother mortgage processing over time.

In addition to CPA Letters for Mortgage, our accounting firm supports individuals and businesses with services that align closely with lending, compliance, and financial documentation needs. These services help maintain consistent records and reduce issues during mortgage, loan, and leasing reviews.

Industry data indicates that borrowers using integrated tax and accounting services reduce documentation gaps by nearly 20% during lending processes. Related services support long-term financial clarity and lender readiness.

Accurate tax preparation is essential for self-employed individuals applying for mortgages or business loans. Properly prepared tax returns help establish income history and filing consistency.

This service supports future CPA Letters by ensuring income figures are clearly documented and defensible.

Mortgage lenders and third parties often review financial statements alongside tax returns. We prepare income statements and related reports based on accounting records.

These statements support business income review without extending into audit-level assurance.

Small business owners often need ongoing accounting support to manage income, expenses, and business funds. Consistent bookkeeping helps maintain separation between personal and business finances.

This clarity supports smoother mortgage and lending documentation reviews.

Tax planning and financial consulting help individuals understand how income reporting affects lending eligibility. Guidance focuses on compliance, reporting accuracy, and long-term financial structure.

This service complements CPA Letter requests without influencing lending decisions.

Business verification may be required for mortgage lending, commercial loans, or lease agreements. A CPA Letter can support confirmation of business existence and ownership based on records.

All verification-related letters are prepared and signed by a Certified Public Accountant, maintaining professional accountability and defined scope.

Mortgage borrowers and business owners often have similar questions when a CPA Letter is requested by a lender. The answers below address common concerns based on standard mortgage and accounting practices.

A CPA Letter for Mortgage is a written document prepared by a Certified Public Accountant. It provides focused confirmation of financial information such as income history, business existence, and tax filing status, based on available records.

The letter supports lender review but does not approve or deny a mortgage loan.

Not all mortgage lenders require a CPA Letter. It is usually requested when borrowers are self-employed, have variable income, or operate a business.

Lenders use the letter to clarify financial details that may not be fully addressed by standard documents.

A CPA can summarize income based on filed tax returns and accounting records. This is often referred to as income verification.

A CPA focuses on confirming historical information and does not verify future income, guarantee repayment, or determine creditworthiness.

These decisions remain with the mortgage lender.

The cost of a CPA Letter in Chicago IL depends on the scope of review and documentation required. Letters involving multiple tax years or business entities may require additional review time.

Pricing reflects professional time and responsibility, not loan size or approval outcome.

The timeline for issuing a CPA Letter depends on how quickly required documents are provided. In most cases, letters are prepared within a few business days after review begins.

Clear documentation helps avoid delays during mortgage underwriting.

Common documents include recent tax returns, business records, and financial statements. Mortgage lenders may request specific confirmations that guide document selection.

All CPA Letters are prepared within defined professional limits to support accurate and compliant mortgage documentation.

If your mortgage lender has requested a CPA Letter, timely and accurate documentation matters. Clear and well-structured documentation supports a smoother mortgage approval process, especially for self-employed individuals and business owners.

Our CPA Letters are prepared with lender requirements in mind and reviewed using filed tax returns and supporting financial records. The scope stays defined. The language stays clear. The purpose stays aligned with mortgage underwriting needs.

Working with Concepts CPA helps ensure your CPA Letter supports lender review without creating follow-up issues or compliance concerns.

Connect with a licensed CPA to discuss your mortgage documentation needs. Get clarity on required records, expected timelines, and the next steps for issuing your CPA Letter for Mortgage in Chicago IL.