Non-QM lending exists for borrowers whose income doesn’t fit inside agency boxes. Entrepreneurs, investors, and professionals with variable cash flow often qualify through bank statements, asset depletion, or DSCR, not traditional W-2s. In these cases, lenders may request a CPA Letter for Mortgage Non-QM to help interpret alternative income documentation.

This article explains what lenders expect, how CPAs frame these letters compliantly, and how a Non-QM letter differs from a CPA Letter for Mortgage Conventional Loan, while staying firmly within non-attest boundaries.

What Is a CPA Letter for Mortgage Non-QM?

A CPA Letter for Mortgage Non-QM is a non-attest, explanatory letter prepared at the borrower’s request to provide professional context around alternative income qualification methods. The letter summarizes how income is derived and reviewed, based on historical records supplied by the borrower.

It does not:

- Audit or verify income

- Set qualifying income

- Guarantee approval

Final underwriting decisions remain with the Non-QM lender.

Why Non-QM Lenders Request CPA Letters

Flexibility Requires Context

Non-QM programs allow flexibility, but lenders still need confidence. A CPA letter helps translate deposits, cash flow patterns, and business realities into an underwriting-ready narrative.

Complement to Alternative Documentation

The letter complements bank statements, asset schedules, or DSCR analyses by explaining how numbers were derived and what period they represent.

Applicant and File Identification

Applicant Legal Identity

The letter identifies the Applicant Legal Identity to match the loan file precisely.

Alternate Applicant Identifier

If applicable, a Secondary or Alternate Applicant Identifier may be referenced for co-borrowers or guarantors.

File Tracking Reference

Including a File Tracking Reference (when provided by the lender) ties the letter to the specific transaction.

Self-Employment and Business Context

Self-Employment Status Indicator

Non-QM borrowers are frequently self-employed; the letter states whether the borrower operates as such.

Business Affiliation and Ownership

Common references include:

- Business Affiliation Name

- Ownership Interest Percentage

Operating Tenure Length

Lenders look for how long the borrower has operated the business to assess stability.

Mortgage Classification and Loan Intent

Mortgage Classification

The letter identifies the Mortgage Classification (Non-QM) to frame expectations appropriately.

Loan Intent Description

It may state whether the loan is for purchase, refinance, or investment, without influencing underwriting.

Property Classification

Property use (primary, second home, investment) may be noted as context.

Qualification Methodology Explained

Alternative Qualification Paths

The letter identifies the Qualification Methodology, such as:

- Bank Statement

- Asset Depletion

- DSCR

- Other lender-approved methods

Why Methodology Matters

Different methods require different interpretations of cash flow and sustainability.

CPA Identification and Professional Standing

Certifying Accountant Details

A lender-acceptable letter includes:

- Certifying Accountant Name

- Accounting Credential Type

- Licensing Region

- Credential Authorization Code

Professional Relationship Start Date

Some lenders request how long the CPA has worked with the borrower to gauge familiarity.

Financial Review Basis and Period

Financial Review Basis

The letter states the basis of review (e.g., client-provided records) without assurance.

Documentation Interval Reviewed

Typical intervals include 12 or 24 months, depending on the program.

Cash Flow and Income Interpretation

Cash Flow Reliability Statement

The CPA may describe whether cash flow appears reliable based on historical deposits, descriptively, not predictively.

Average Monthly Deposits

For bank-statement loans, the letter may reference Average Monthly Deposits as observed.

Adjusted Qualifying Income

If applicable, the letter explains how figures were adjusted per lender methodology, without setting the final number.

Expense Normalization and Variance

Expense Normalization Method

The letter may describe how expenses were normalized or considered for income analysis.

Variance Consideration Explanation

Material fluctuations may be explained (seasonality, one-time events) to prevent misinterpretation.

Accounting Firm Identification

Accounting Entity Details

Common inclusions:

- Accounting Entity Name

- Business Location Address

- Office Telephone Identifier

- Secure Email Contact

These details allow lender verification and follow-up.

How This Differs From Conventional Mortgage CPA Letters

Non-QM vs. Conventional

A CPA Letter for Mortgage Conventional Loan aligns with agency standards and automated underwriting.

A CPA Letter for Mortgage Non-QM aligns with lender-specific methodologies and alternative documentation.

What Stays the Same

Both remain non-attest, descriptive, and scoped to a specific purpose.

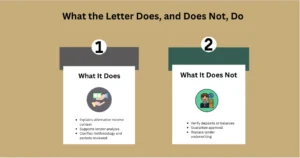

What the Letter Does, and Does Not, Do

What It Does

- Explains alternative income context

- Supports lender analysis

- Clarifies methodology and periods reviewed

What It Does Not

- Verify deposits or balances

- Guarantee approval

- Replace lender underwriting

Best Practices for Borrowers

Consistency Is Critical

Ensure the CPA letter aligns with bank statements and loan disclosures.

Avoid Overreach

Requests for guarantees or predictions can stall underwriting.

Best Practices for CPAs

Define Scope Precisely

State the purpose, period, and reliance clearly.

Use Neutral, Lender-Friendly Language

Explain facts and methods without judgment or assurance.