When a borrower uses business funds to support a home purchase, mortgage underwriters apply a much higher level of scrutiny. Lenders must confirm that the funds are accessible, authorized, non-borrowed, and will not weaken the business after withdrawal. This is where a CPA Letter for Use of Business Funds Mortgage becomes essential, especially for entrepreneurs and owners already providing a CPA Letter for Self-Employed Mortgage Borrowers.

This article explains what lenders expect to see, how CPAs frame these letters compliantly, and why precise language and documentation matter for mortgage approval.

What Is a CPA Letter for Use of Business Funds in Mortgage Applications?

A CPA Letter for Use of Business Funds Mortgage is a non-attest, explanatory letter prepared at the borrower’s request for a specific lender and transaction. Its purpose is to explain:

- The source and nature of business funds

- The borrower’s authority to access and withdraw those funds

- Whether the withdrawal appears permitted and non-detrimental to business operations

The letter does not verify balances, audit accounts, or guarantee mortgage approval.

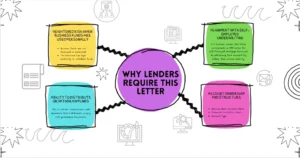

Why Lenders Require This Letter

Heightened Risk When Business Funds Are Used Personally

Mortgage lenders must ensure that:

- Business funds are not borrowed or restricted

- The borrower has legal authority to withdraw funds

- The business remains solvent after the withdrawal

Alignment With Self-Employed Underwriting

For business owners, this letter complements a CPA Letter for Self-Employed Mortgage Borrowers by addressing fund accessibility rather than income stability.

Business Bank Account Identification

Account Ownership and Structure

The letter typically identifies:

- Business Bank Account Name

- Financial Institution Name

- Account Type (Checking, Savings, Operating)

- Account Ownership (Business-owned)

This confirms that funds originate from legitimate business accounts—not personal or third-party sources.

Authorized Signers and Control

Lenders expect clarity on:

- Authorized Signers

- Borrower Authorization Level

- Borrower Ownership Percentage

These details establish legal access to funds.

Borrower Authority and Control Over Funds

Decision-Making Authority

The letter explains whether the borrower has:

- Control over distributions

- Authority to approve withdrawals

Ability to Distribute or Withdraw Funds

This is critical. Underwriters need assurance that withdrawals comply with governance documents.

Compliance With Operating Agreement

For LLCs and corporations, the letter may state that distributions are consistent with the operating agreement or bylaws, based on representations.

Availability and History of Business Funds

Cash Balance and Timing

The letter may describe:

- Available Cash Balance

- Average Business Account Balance

- Date Funds Became Available

Seasoned, stable balances are generally viewed more favorably.

Source of Accumulated Funds

Typical sources include:

- Retained earnings

- Operating profits

The letter avoids reclassifying income or validating balances.

Amount and Intended Use of Funds

Amount of Funds Intended for Use

Lenders expect a clear statement of:

- How much business cash is being applied to the mortgage

Type of Withdrawal

The letter identifies whether funds are taken as:

- Owner Draw

- Distribution

- Dividend

Tax Treatment (Descriptive Only)

The CPA may note general tax treatment (e.g., distribution vs draw) without giving tax advice.

Business Health After Withdrawal

Business Solvency After Withdrawal

Underwriters want comfort that the business remains viable after funds are withdrawn.

Adequacy of Working Capital Post-Withdrawal

The letter may state whether working capital appears sufficient based on historical records.

Impact on Ongoing Operations

This includes the business’s ability to:

- Meet payroll

- Pay vendors

- Service existing debt

Required Negative Confirmations

Mortgage lenders almost always expect explicit statements that the funds are not encumbered.

Confirmation Funds Are Not a Loan

The letter clarifies that funds are not loan proceeds.

Confirmation Funds Are Not Borrowed or Restricted

Common confirmations include:

- Funds are not borrowed

- Funds are not restricted

- Funds are not encumbered

No Pledge or Collateral Statement

The letter may state that funds are not pledged as collateral elsewhere.

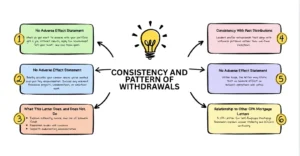

Consistency and Pattern of Withdrawals

Consistency With Past Distributions

Lenders prefer withdrawals that align with historical patterns rather than one-time exceptions.

No Adverse Effect Statement

Within scope, the letter may state that no adverse effect on business operations was noted.

Relationship to Other CPA Mortgage Letters

A CPA Letter for Self-Employed Mortgage Borrowers explains income stability and business continuity.

A CPA Letter for Use of Business Funds Mortgage explains cash accessibility and business impact.

Together, they form a complete underwriting narrative.

What This Letter Does, and Does Not, Do

What It Does

- Explains authority, source, and use of business funds

- Addresses lender risk concerns

- Supports underwriting documentation

What It Does Not

- Verify bank balances

- Guarantee mortgage approval

- Replace lender due diligence

Best Practices for Borrowers

Before Requesting the Letter

- Confirm lender-specific wording

- Avoid commingling funds

During Underwriting

- Keep transfers clean and well-documented

- Stay consistent with tax filings and governance documents

Best Practices for CPAs

Use Careful, Limited Language

Avoid assurance-style phrases and define reliance clearly.

Focus on Authority and Impact

Lenders care more about access and sustainability than accounting theory.