When lenders, underwriters, or reviewing authorities assess income, the document you submit can significantly affect the outcome. Applicants often assume that an employment letter is enough, until they are asked for something more detailed, more reliable, and more accountable. This is where the debate around CPA Letter vs Employment Letter becomes important.

For salaried employees, an employment letter may work. For business owners, freelancers, and contractors, however, lenders increasingly rely on CPA-prepared documentation. In particular, a CPA Letter for Self-Employed applicants has become a preferred tool for explaining income clearly and responsibly.

Why Income Verification Is a Trust Issue

From a lender’s perspective, income verification is not about convenience, it’s about risk. Whether the goal is Mortgage & Loan Approval, immigration processing, or financial due diligence, the reviewer wants to answer three core questions:

- Is the income real?

- Is it recurring?

- Is it supported by verifiable records?

The level of trust depends on who prepares the document and what data it relies on.

What Is an Employment Letter?

Purpose of an Employment Letter

An employment letter is typically issued by an employer’s HR or payroll department. It confirms the existence of an employer-employee relationship and provides basic details such as job title and compensation.

What Employment Letters Are Based On

Employment letters are usually based on payroll & HR records, including:

- Salary or hourly wage

- Pay frequency

- Employment status (full-time or part-time)

They are simple, direct, and effective, for traditional employees.

Limitations of Employment Letters

Why Lenders Treat Them Carefully

While useful, employment letters have limitations:

- They do not verify tax reporting

- They do not explain deductions or expenses

- They do not reflect business income

For anyone outside standard payroll, an employment letter provides little insight.

What Is a CPA Letter?

Role of a Certified Public Accountant

A CPA letter is prepared by a Certified Public Accountant who is bound by professional and ethical standards. Unlike HR-issued letters, CPA letters rely on reviewed financial and tax documentation.

What CPA Letters Are Based On

CPA letters may rely on:

- Filed tax returns

- Profit & Loss Statements

- Bank Statements

- IRS-related records and filings

They explain income in context, rather than simply stating a number.

CPA Letter for Self-Employed Borrowers

Why Self-Employed Applicants Need CPA Letters

Self-employed individuals do not have payroll departments issuing letters. Income varies, expenses reduce taxable income, and cash flow does not always match reported net figures.

A CPA Letter for Self-Employed applicants helps lenders understand:

- How income is generated

- Why deductions exist

- Whether income is sustainable

This makes CPA letters especially valuable for freelancers, consultants, and business owners.

CPA Letter vs Employment Letter: Key Differences

Source of Authority

- Employment Letter: Issued by an employer; internal document

- CPA Letter: Issued by an independent professional with regulatory obligations

Type of Verification

- Employment letters confirm payroll details

- CPA letters explain income using tax and financial records

Scope and Accountability

CPAs operate under standards set by the American Institute of Certified Public Accountants (AICPA), which requires clear disclosures, defined scope, and ethical responsibility.

Why Lenders Often Trust CPA Letters More

Independence and Professional Judgment

A CPA is not the employer and not the borrower. This independence increases credibility, especially in cases involving self-employment verification or complex income.

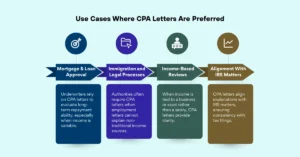

Alignment With IRS Matters

CPA letters align explanations with IRS matters, ensuring consistency with tax filings. This reduces discrepancies that could otherwise delay approval.

Use Cases Where CPA Letters Are Preferred

Mortgage & Loan Approval

Underwriters rely on CPA letters to evaluate long-term repayment ability, especially when income is variable.

Immigration and Legal Processes

Authorities often require CPA letters when employment letters cannot explain non-traditional income sources.

Asset and Income-Based Reviews

When income is tied to a business or asset rather than a salary, CPA letters provide clarity.

What CPA Letters Do Not Do

To remain ethical and compliant, CPA letters:

- Do not guarantee income

- Do not predict future earnings

- Do not make approval decisions

These limits are not weaknesses, they are safeguards that preserve trust.

EEAT Perspective: Why CPA Letters Carry Authority

From an EEAT standpoint, CPA letters demonstrate:

- Experience interpreting complex income

- Expertise in accounting and tax matters

- Authoritativeness through professional licensing

- Trustworthiness via transparency and disclaimers

Employment letters, while useful, lack this depth for non-traditional earners.

So, Which Document Do Lenders Actually Trust?

The answer depends on the borrower:

- For salaried employees, employment letters are usually sufficient

- For self-employed individuals, business owners, and contractors, CPA letters are often essential

In the CPA Letter vs Employment Letter comparison, CPA letters provide broader credibility, especially when income does not fit a standard payroll model.