A CPA letter is a formal document prepared by a licensed CPA (Certified Public Accountant) to confirm specific financial details. This letter serves as a 3rd party verification of income, self-employment status, or other financial metrics. A CPA comfort letter may be requested by lenders, landlords, or other entities that need a reliable source to confirm a financial claim. So, what is a CPA letter exactly? It’s a financial reference that vouches for your income and creditworthiness, helping smooth out crucial processes like loans or rental applications.

This sample can serve as a guide to help self-employed individuals or business owners understand what to expect in a professionally written CPA letter. CPA Write the Customized letter to match specific lender requirements or unique financial situations.

Ready to request your CPA letter? Contact us to begin the process today!

A CPA letter is essential in various financial contexts, such as securing a CPA letter mortgage loan, verifying income, or rental applications. When you need proof of CPA letter details, lenders or landlords trust CPAs as financial experts, which is why these letters carry significant credibility. This verification method reassures recipients about the applicant’s financial stability and responsibility.

Different financial scenarios require different types of CPA letters. Here are some common examples:

Often requested by lenders, a CPA comfort letter provides an overview of an individual’s or business’s financial health. This letter ensures that the recipient (such as a lender) feels assured about the financial information provided.

This is one of the most common letters requested, used to confirm the income levels of an applicant, which is crucial for lenders’ letters and loan applications. It helps lenders assess whether the applicant can meet loan obligations.

Self-employed individuals often need this letter to confirm steady income. For instance, income verification documents for apartment leases often require a self-employed applicant to provide such a letter to ensure their income meets rent requirements.

A CPA letter for a mortgage loan provides specific income and tax details required by banks and mortgage lenders. It offers a clear view of income history and consistency, which is often essential for securing mortgage loans.

CPA letters are especially useful for:

CPA letters typically contain several essential elements to meet professional and legal standards.

The letter typically includes the recipient’s name, address, contact details, and the purpose of the verification. It also mentions the CPA’s role in confirming these details.

The CPA letter of explanation generally includes information about income, expenses, and creditworthiness. This financial reference letter provides an accurate picture of the applicant’s financial standing.

The letter should also contain the CPA’s license details, firm information, and contact info to allow the recipient to verify the CPA’s authority. This enhances the credibility of the letter as a 3rd party verification.

Getting a CPA letter is straightforward but requires attention to detail.

Not all CPAs are experienced in creating such letters, so ensure you find someone familiar with tax and accounting services relevant to your needs. Look for reputable CPA associates or firms with a good track record.

Be specific about your requirements when you ask for a CPA letter. Share any supporting documents like tax returns or financial statements to ensure the CPA has all the information they need. For example, sample proof of relationship letter or previous verified tax return documents may help confirm the financial details you want verified.

Here are some typical cases where a CPA letter is essential:

For renters, a CPA letter can act as a rent verification letter to confirm income, especially for self-employed renters or those with complex financial situations. This can reassure landlords about the renter’s ability to meet rent obligations.

Lenders often request CPA letters as part of their tax verification process to confirm income sources. This is especially common for self-employed individuals or those with income from multiple sources.

Many entities require 3rd party verification to ensure financial claims are legitimate, such as for rental property CPA letters or mortgage applications.

To ensure a smooth process, verify the accuracy of the letter. Confirm that the CPA is reputable, licensed, and that all financial details match what is expected. Discuss your requirements clearly with the CPA to avoid any misunderstandings.

Avoid these common pitfalls to keep your CPA letter effective:

Conceptscpa prepares CPA Letter services for the United States. Scope is clear. We verify income and facts from tax returns, bank statements, and financial statements. We align wording to lender and landlord checklists. For self-employed clients, most mortgage programs expect one to two years of federal tax returns. Fannie Mae and Freddie Mac outline these documentation rules.

We follow AICPA (American Institute of Certified Public Accountants) guidance for third-party verification and comfort letters. We state what was checked. We avoid assurances outside CPA standards.

This is used when a lender requests a CPA letter for mortgage underwriting. It supports a home loan file when standard documents do not answer a specific question.

What it verifies

Income verification, self-employment status, business ownership, or a specific item the lender lists in the request.

A proof of income letter is used when a third party needs a CPA income verification letter. This is common for loans, leases, and financial verification.

What it verifies

Income level or income range based on records provided.

It can also confirm the income source when supported by documentation.

This letter is requested when a lender asks about expense ratio. It is often used for self-employed individuals and business owners.

What it verifies

Expense ratio or an expense percentage based on financial reporting.

The numbers must match the financial statement or supporting records.

This is used when a landlord requests a CPA letter for apartment rental. It supports a rental agreement application when income is variable or self-employed.

What it verifies

Income verification, self-employment status, or business income confirmation for landlord screening.

Many recipients ask for a CPA letter for self employed applicants. This supports verification of self-employment and related income questions.

What it verifies

Self-employment status, business activity, and income support based on records.

It can also confirm length of self-employment when records support it.

This is requested when a lender wants clarity on the use of business funds. It is common in loan files and business loan reviews.

What it verifies

The source and use of funds as shown in records.

It can support a specific financial transaction or transfer trail when documented.

This is used when a third party needs a CPA letter confirming consulting income or consulting activity. It can support contractor and freelancer documentation.

What it verifies

Consulting income support, business activity, or engagement-related details that can be supported by records.

A comfort letter CPA request is usually driven by recipient language. Scope depends on what the third party asks for and what can be supported by records.

What it verifies

A defined set of confirmations based on available documentation.

We keep statements within professional standards and avoid unsupported assurance.

This service supports cpa third party verification letter requests for banks, lenders, landlords, and other financial institutions. It focuses on financial verification and clear communication.

What it verifies

The specific items listed by the third party.

Examples include income verification, self-employment verification, or business ownership verification when supported.

This letter supports an explanation requested by underwriting or leasing. It is used to clarify a defined point in an application.

What it verifies

It explains a specific item using documented facts.

It does not provide legal advice.

Some recipients request a notarized CPA letter. Notarization confirms signature procedures, not the content of the financial records.

What it verifies

A CPA Letter prepared for a defined purpose, with notarization when applicable.

The notary public step depends on the request and availability.

An income verification letter supports financial verification for third parties. This may be requested for renting, loans, insurance, or other applications.

What it verifies

Income information that can be supported by tax documents and financial records.

It may confirm income source when supported.

CPA letters are invaluable in financial and legal matters, providing third-party verified financial support. Choose a qualified CPA and provide clear, accurate information to facilitate the process. These letters not only support your credibility but also streamline approvals for loans, rentals, and other financial agreements.

Costs vary depending on complexity and location, but generally range from $100 to $500.

Typical documents include tax returns, proof of income, and financial statements.

Contact a CPA, request income verification for rent, and provide income documents.

Not necessarily; CPAs hold additional qualifications beyond those of tax preparers.

It indicates that a CPA has reviewed and confirmed the accuracy of financial records or tax returns.

When a lender, landlord, or financial institution asks for a CPA Letter, timing matters. So does compliance.

Concepts CPA prepares CPA Letters for third party verification that match the recipient’s request and stay within Certified Public Accountant professional boundaries.

You share the recipient’s wording.

We review your supporting documents.

We deliver a signed CPA Letter on letterhead for your rental, apartment rental, bank, or loan application.

If you are searching for a Chicago IL CPA Letter, Concepts CPA supports individuals and businesses across Chicago, Illinois.

We handle common request types like:

Most delays happen when the recipient’s checklist is unclear or documents are missing.

We start with the exact purpose and recipient requirements.

That keeps communication clean and reduces rework.

In many cases, once we have complete documents and the recipient’s wording, delivery can be as fast as 1–2 business days.

Your timeline depends on scope and verification needs.

Call Concepts CPA in Chicago, IL or request a CPA Letter quote today.

Concepts CPA is a Chicago, IL accounting firm that prepares CPA Letters for financial verification and third party verification.

We support requests from lenders, landlords, and financial institutions.

We keep the process direct.

We keep the wording clear.

We stay focused on compliance.

Your recipient usually wants specific statements.

They also want a letter that is consistent with documents.

That is where a licensed Certified Public Accountant helps.

An accountant reviews the purpose of the request first.

Then we confirm what can be verified from records like a tax return, income statement, and bank statement.

We use formal language.

We avoid extra claims.

This approach supports compliance.

It also helps reduce back-and-forth with the lender or landlord.

A Certified Public Accountant Letter is often used to support an application when standard documents do not answer the recipient’s question.

It may be requested for:

A CPA Letter does not replace underwriting.

It is a formal letter that addresses a defined verification request based on the records provided.

A CPA Letter is only useful when it matches the recipient’s request.

That is why our process starts with the lender, landlord, or financial institution requirements.

Then we verify what can be supported by your records.

We keep communication simple and compliant.

We begin by confirming who will receive the letter.

This can be a lender, landlord, bank, or other financial institution.

We also confirm the purpose.

Mortgage underwriting is different from apartment rental screening.

A third party verification letter may have its own checklist.

You can send a sample CPA letter request, email instructions, or a form from the recipient.

That helps us align the CPA Letter to what the recipient expects.

Next, we review the documents needed to support the requested verification.

The exact list depends on the purpose and wording.

Common documents include:

If the request involves tax filings, we may reference IRS (Internal Revenue Service) forms or filing years.

We do not guess.

We verify using what is provided.

Before drafting, we confirm what can be stated and what cannot.

This protects the client and supports regulatory compliance.

We follow professional standards and keep the scope clear.

We also consider AICPA (American Institute of Certified Public Accountants) guidance at a high level, especially for comfort letter style requests.

If a recipient asks for wording that implies assurance beyond the documents, we flag it early.

Then we suggest compliant wording options based on records.

We draft the CPA Letter in a formal format.

It includes the date, recipient details, purpose, and scope.

We keep statements specific.

We avoid extra claims.

After review, the letter is signed and issued on CPA letterhead as a formal document.

We deliver the CPA Letter in the format you need for your application timeline.

Common delivery options include:

If the recipient has a deadline, share it early.

That helps us plan the turnaround.

Start the process.

Concepts CPA supports CPA Letter requests across Chicago, IL.

Many applications move fast.

A lender or landlord may only allow a short review window.

We focus on clear wording and complete documentation to reduce delays.

Chicago applications often involve several parties.

A loan broker may coordinate with a lender.

A landlord may use a property manager.

A bank may have a third party verification process.

We write CPA Letters that fit how theseremember these groups review files.

We keep the purpose clear.

We keep the recipient information complete.

We reference the records provided.

If a rental agreement or loan checklist has special wording, we align the letter to that wording.

That helps your file move through review with fewer follow-ups.

Mortgage underwriting

Lenders often request a CPA letter when income is self-employed or variable.

They may ask for verification of self-employment, income confirmation, or an expense ratio letter.

Apartment leasing

Landlords may request a CPA letter for apartment rental as a proof of income letter.

This is common when pay stubs do not apply.

Line of credit and business loan requests

Banks and financial institutions may request a CPA third party verification letter.

They may also request a letter for use of business funds or a letter of explanation tied to a transaction.

A CPA Letter is only as credible as the professional standing behind it.

Concepts CPA focuses on licensed practice and careful documentation.

We also keep confidentiality and professional boundaries in every engagement.

A CPA license matters in third party verification.

Many recipients ask for confirmation that the letter comes from a licensed CPA (Certified Public Accountant).

We maintain professional standing and focus on ethics.

If a recipient asks for CPA license status or verification of good standing, we address that within the scope of the request and applicable rules.

CPA Letters require accuracy and precision.

We state what can be supported by records.

We avoid unsupported conclusions.

We also protect confidentiality.

Your documents are handled with care.

Information is shared only for the stated purpose and recipient.

This approach supports compliance and reduces the risk of misinterpretation during review.

A CPA Letter is often requested at the last step of an application.

Concepts CPA focuses on a simple process, clear communication, and compliance.

We start with the recipient’s request.

That can be a lender checklist, landlord email, or financial institution form.

This reduces back-and-forth.

It also helps avoid revisions that slow down mortgage underwriting or apartment leasing.

You know what we need.

The recipient gets what they asked for.

Clients often ask about CPA letter cost.

Pricing depends on the type of letter, complexity, and document volume.

Notarized CPA letter requests can add steps.

We provide pricing guidance early.

That helps you decide before we begin.

No vague ranges.

Some files have deadlines tied to a down payment, loan lock, lease start date, or creditor review timeline.

We schedule intake quickly when documents are ready.

Turnaround depends on scope.

Most standard CPA Letter requests are completed within 1–2 business days after complete documents are received.

A CPA Letter must be clear and careful.

We keep communication focused on verified facts.

We use simple wording.

We avoid statements that go beyond the records.

This supports compliance and helps the lender or landlord review the letter faster.

Some recipients request notarized letters.

If you need a notarized CPA letter, tell us early.

We can discuss notary public options and what the recipient requires.

Notarization may affect timing.

We keep that transparent from the start.

People usually reach out when a deadline is close.

They want a CPA Letter that fits the lender or landlord checklist.

They also want it written in a way a third party can review quickly.

Below are examples of feedback themes we see in conceptscpa CPA Letter reviews.

Use short quotes on the page.

Keep them outcome-focused.

Speed

Clients mention faster progress when documents are complete.

They value a clear intake and quick scheduling.

Document clarity

Clients mention that lenders and landlords respond better to short, direct verification statements.

Lender-ready format

Clients mention that a signed CPA Letter on letterhead, with a defined scope, reduces follow-up questions.

Verification work comes with responsibility.

Concepts CPA keeps scope clear and protects client information.

Professional liability insurance supports a standard of care in professional work.

Coverage can vary by engagement and situation.

If a third party requests confirmation related to insurance, we address it within appropriate limits.

CPA Letters often require sensitive data.

We treat documents as confidential records.

We do not share information beyond the stated purpose and recipient.

We follow a clear consent approach.

You approve what is provided and who it is provided to.

We keep a policy-based workflow for document handling and retention.

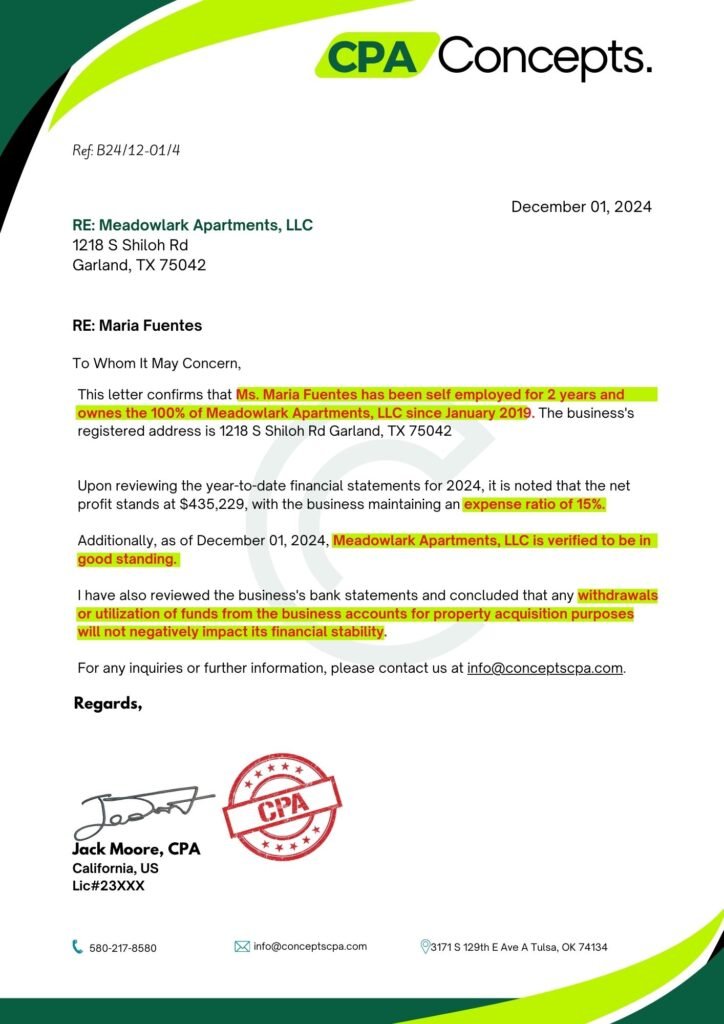

This section can show a sample CPA letter with private details removed.

It helps applicants understand what a lender or landlord usually expects.

Use short notes under the sample to explain what each section does.

A CPA letter template is a starting point, not a one-size format.

Recipient requirements vary.

Keep a template checklist on the page:

This helps reduce revisions and supports compliance.

Most CPA Letter problems are not about the letter format.

Below are common issues we see in Chicago, IL applications and how we handle them.

Self-employed applicants may not have pay stubs.

Income can be clearly supported through self-employment records instead.

We start by confirming what the recipient is trying to verify.

Then we review documents that support income, such as a tax return and income statement.

If the request is for a CPA letter for self employed income, we keep statements tied to records.

This helps the lender or landlord understand the income source without forcing pay stub comparisons.

Some lenders ask for an expense ratio letter.

This usually relates to expense levels as a percentage of revenue.

We confirm how the lender defines the ratio.

Then we review the financial reporting practices used in the records provided.

Numbers must match the financial statement and supporting documents.

We keep the ratio explanation short.

We state the period covered.

We avoid extra reminders or opinions.

Rental verification can still be completed when income changes month to month.

This is common for freelancers, contractors, and business owners.

We clarify what the landlord needs for the lease decision.

Then we use documentation like tax returns, bank statements, and income statements when relevant.

We keep the letter aligned to the rental agreement process.

We avoid predicting future income.

We verify what records support.

If you need a CPA Letter in Chicago, IL, the fastest way to start is to send the recipient request and your documents list.

That allows accurate pricing and a realistic turnaround range.

Send these items when you request a quote:

If anything is missing, we tell you early.

That reduces rework and protects your timeline.

Request a CPA Letter quote in Chicago, IL.

Call Concepts CPA or submit the form with the recipient wording and your documents list.

This section helps you understand what a CPA Letter does in a loan or rental file.

It also explains what lenders, landlords, and banks typically look for.

CPA letter meaning is simple.

It is a formal letter from a CPA (Certified Public Accountant).

It addresses a specific verification request.

A lender may request it for mortgage underwriting.

A landlord may request it for apartment rental screening.

A financial institution may request it for third party verification.

The letter should match the recipient’s wording.

It should stay within the scope of the documents reviewed.

A CPA income verification letter focuses on income support based on records.

A proof of income letter is a broader label.

Recipients use it in different ways.

Common records used for income support include:

The right choice depends on the recipient’s checklist.

Some lenders want tax-year income.

Some landlords want recent cash flow.

Recipients are trying to reduce credit risk.

They want to confirm solvency and financial stability.

Common checks include:

A CPA Letter helps when the file needs a short, formal explanation tied to records.

A CPA Letter must stay factual.

It should not imply assurance that goes beyond the records reviewed.

For comfort letter style requests, CPAs often consider AICPA (American Institute of Certified Public Accountants) guidance at a high level.

The main point is scope.

What is reviewed must be clear.

What is not reviewed must be clear.

If a recipient’s wording creates compliance issues, it should be addressed before drafting.

I can include 2–4 sourced, dated stats in the final copy.

Here are the exact stat “slots” to include, with the source types that typically support them:

If you paste links or screenshots of the sources you want, I will plug the stats into this section with the correct dates and wording.

Delays usually come from documentation gaps.

To reduce delays:

This supports diligence.

It also reduces follow-up questions from the lender or landlord.

A CPA income verification letter is a formal letter from a CPA (Certified Public Accountant).

It supports income verification for a third party such as a lender, landlord, or bank.

It is based on the documents you provide, such as a tax return, income statement, or bank statement.

People often need a CPA letter when income is not shown through standard pay stubs.

This includes self-employed individuals, contractors, freelancers, and small business owners.

A lender may also request a cpa lender letter to confirm a specific detail in the loan application.

For verification of self-employment, the most common documents are:

The exact list depends on what the lender or landlord is asking to verify.

Yes, a notarized CPA letter may be available when requested and applicable.

Notarization confirms signature procedures.

It does not change what can be verified from records.

If you need notarization, share the recipient requirement early because it can affect timing.

Most CPA Letter requests are completed in 1–2 business days after we receive:

CPA letter cost depends on:

We provide pricing guidance before starting work.

Sometimes, but often not.

Many lenders and landlords require recipient-specific wording and addressee details.

If you need multiple versions, we can plan that upfront.

Lenders usually provide the wording.

It often includes:

If you have a sample CPA letter request from the lender, send it.

That reduces revisions.

Yes, we can support CPA comfort letter requests when the scope is clear and supported by documentation.

Comfort letter language varies by recipient.

We also consider AICPA (American Institute of Certified Public Accountants) guidance at a high level and keep statements within professional boundaries.

A signed CPA letter on letterhead typically includes:

If the recipient has a required format, share it so the letter matches their checklist.

If you searched “CPA near me” or “CPA Letter near me,” you likely have a deadline.

Many lenders and landlords ask for a CPA Letter late in the application.

Local support helps when timelines are tight and documents need a fast review.

Concepts CPA provides CPA Letter services in Chicago, IL for mortgage, apartment rental, and third party verification requests.

We focus on clear scope and recipient-ready formatting.

Time-sensitive files usually involve a loan or lease deadline.

Examples include a mortgage underwriting condition, a lease start date, or a bank request tied to a credit decision.

Local CPA support helps when you need:

If you can share the recipient wording and documents in one packet, the process moves faster.

Financial institutions often require a CPA third party verification letter for a defined purpose.

The request can come from a bank, broker, or creditor.

The letter must match their checklist and avoid statements that go beyond records.

Concepts CPA supports financial verification requests in Chicago, IL with a scope-first process.

We confirm what the institution is asking.

Then we verify what can be supported by documents.

Third party requests vary by reviewer.

A bank may focus on income consistency.

A broker may focus on documentation completeness.

A creditor may focus on solvency signals tied to cash flow and liabilities.

To reduce delays, we typically ask for:

We keep the letter clear for review.

We keep communication compliant.

A CPA Letter for a loan application is usually a condition item.

It is requested to clarify income, self-employment, business ownership, or the use of funds.

It should read like a formal document tied to records.

Underwriting checklists are specific.

They often require:

If the lender provides a sample CPA letter, send it.

It helps avoid rework and speeds up approval review.

“Verifiable” has one meaning in these requests.

It means the income statement in the letter can be supported by documents.

Not assumptions.

Not projections.

A CPA letter verifying income should match the record type the recipient accepts.

Some recipients prefer tax returns.

Some prefer recent financial records.

Tax returns are commonly used because they show reported income for a defined year.

For self-employed individuals, business schedules and related forms matter.

Financial records can help when the recipient needs recent activity.

Examples include:

The key is consistency.

If documents conflict, the letter should not try to “smooth it over.”

It should stay factual and explain scope.

A CPA letter for verification of self-employment helps when a lender or landlord needs confirmation beyond pay stubs.

This is common for freelancers, contractors, and small business owners.

The verification must be tied to documentation.

It should identify the period covered and what records support the statement.

Sole proprietorship and freelancer documentation often includes:

If the recipient has a defined phrase they want included, share it early.

That keeps the CPA Letter aligned to their checklist and reduces follow-up questions.

Some recipients need more than income confirmation.

They may ask for a CPA Letter that supports business verification and ownership.

This is common for business loan files, lines of credit, and self-employment reviews.

A business verification letter must stay specific.

It should match the recipient’s checklist.

Business structure affects what can be verified and which records apply.

Common scenarios include:

Common documents used to support business verification include:

If the recipient asks for exact language, share it first.

That reduces revisions and keeps communication clean.

Some lenders ask for a CPA letter for use of business funds when a down payment involves business accounts.

They want to understand the source and movement of funds.

They may also want a clear trail that matches the bank statements.

This type of letter is usually driven by transaction records.

A clean audit trail is simple.

It shows what happened and when.

What we typically review:

We keep the letter factual.

We describe what records show.

We do not make assumptions about future funds or approvals.

Expense ratio letters are often requested in self-employment underwriting.

The lender wants a ratio that supports how they evaluate cash flow.

The ratio must match the recipient’s definition.

Different lenders calculate it differently.

Most expense ratio requests relate to:

Common supporting documents include:

We confirm the time period first.

Then we confirm the formula.

Then we state the ratio and the records used.

Underwriting teams sometimes ask for a CPA letter of explanation when a file has a specific question.

It may relate to income changes, business activity, or a one-time transaction.

A letter of explanation should not be long.

A compliant explanation focuses on:

We avoid opinions.

We avoid predictions.

We avoid statements that create compliance risk or misrepresentation risk.

If the recipient provides wording, we use that as the starting point.

Some lenders and landlords request notarization.

A notarized CPA letter may be used for a rental agreement file or a loan condition package.

Notarization confirms identity and signature procedure.

It does not change what the CPA letter can verify.

Notarization is most common when:

If you need a notary public step, share it early.

Notarization can affect scheduling and turnaround.

We will confirm the recipient requirement, discuss available options in Chicago, and plan delivery to match your deadline.

Verification work should start with clear scope.

That is why an engagement letter matters.

It outlines what Concepts CPA will do, what documents will be reviewed, and what the CPA Letter will cover.

It also helps set expectations on timing, revisions, and delivery.

An engagement letter protects the client and the CPA.

It confirms the purpose of the request and the intended recipient.

It also documents consent for using and sharing information for third party verification.

It helps prevent common issues such as:

Clear scope supports compliance and reduces rework.

A sample CPA letter can be useful as a reference.

It shows format and common sections.

But many recipients require custom wording.

What you can often reuse:

What must change in most cases:

If a lender or landlord provides required language, that language controls the draft.

Some applicants include a short cover letter when submitting a verification packet.

This helps the recipient understand what is included.

It also reduces follow-up questions.

A cover letter is not the same as a CPA Letter.

It is an applicant document that organizes the file.

A clean verification packet often includes:

Keep the cover letter short.

Use dates and file names.

Avoid extra explanations that are not supported by records.

Some CPA Letter requests are based on comfort letter language.

Others are general verification requests.

Either way, professional standards matter.

AICPA (American Institute of Certified Public Accountants) guidance is often considered at a high level for what can be stated, especially when a request implies assurance.

A CPA can state what is supported by documents reviewed.

Common practical limits include:

This protects the recipient from misunderstanding.

It also supports compliance.

Many recipients ask for details that relate to a financial statement.

This is common for self-employment verification, business loan review, and expense ratio letters.

The goal is to connect the CPA Letter statements to the records.

An income statement is often used to support revenue and expense totals for a period.

It can also support net income figures when prepared consistently.

Solvency and financial standing are broader terms.

Recipients may use them to describe basic financial stability.

A CPA Letter should define what records were reviewed and avoid broad conclusions unless the recipient request and documents support it.

If a lender or bank asks for specific wording around solvency, we review the request first.

Then we confirm what can be stated based on the financial records provided.

These two documents are often confused.

They serve different purposes.

A tax verification letter typically confirms tax filing information.

A CPA Letter is a third party verification letter that addresses a defined request using the records you provide.

IRS (Internal Revenue Service) documents are often part of the support package.

Examples include tax returns and related filing records.

In many rental files, the recipient wants tax-year income support.

That is when IRS-based records help.

They show reported income for a defined period.

A CPA Letter can reference the documents reviewed.

It should not claim more than the records show.

If the recipient needs a specific IRS transcript or form, that should be requested directly as part of the file requirements.

Some recipients care about who is issuing the letter.

They may ask if it comes from an accounting firm or an individual CPA.

What matters most is licensing, scope, and documentation.

A licensed CPA (Certified Public Accountant) is credentialed by the state.

Many lenders, landlords, and banks view a CPA license as a credibility marker for verification letters.

Credibility still depends on:

If a recipient asks for CPA license status, we handle that within the scope of the request and applicable rules.

A comfort letter CPA request usually comes with recipient language.

It is often used in situations where a third party wants limited confirmation, not a full audit.

The letter must not imply assurance that was not performed.

Accredited investor requests may include wording that sounds like assurance.

Clear scope language helps keep the letter compliant and reduces liability risk when terms suggest an audit, review, or guarantee.

We handle this by:

If the request cannot be supported, we flag it early.

CPA letter cost is not one fixed number.

Pricing depends on what needs to be verified and what records are involved.

We explain pricing before work begins.

Pricing commonly changes based on:

If you share the recipient wording and document list upfront, pricing can be quoted more accurately.

Most rejections happen for small issues.

Approvals are often faster when the details are complete.

Include the correct date and addressee.

Match the recipient’s checklist wording.

Use this checklist before you submit.

For faster approval, confirm the file includes:

If the recipient provided sample language, follow it.

If they did not, ask for their requirements before drafting.