For self-employed borrowers, mortgage underwriting often raises questions that standard documents don’t fully answer. In response, lenders sometimes ask for a CPA Comfort Letter for Self-Employed borrowers. While commonly requested, comfort letters are also frequently misunderstood, by borrowers, lenders, and sometimes even practitioners.

This article explains what a CPA comfort letter is, what it can and cannot say, and why lenders treat it cautiously, especially when business funds are involved. It also clarifies how a comfort letter differs from more targeted documentation such as a CPA Letter for Use of Business Funds Self-Employed.

What Is a CPA Comfort Letter for Self-Employed Borrowers?

A CPA comfort letter is a non-attest, limited-scope letter issued at the borrower’s request. Its role is to provide general, negative-assurance–style comfort based on the CPA’s familiarity with the client and records previously prepared or reviewed.

The letter is not designed to:

- Verify income

- Validate bank balances

- Confirm business stability

- Approve mortgage qualification

Instead, it offers context, nothing more.

Why Lenders Request Comfort Letters

When Documentation Leaves Gaps

Lenders may request a comfort letter when:

- Income is non-traditional or variable

- Business structures are complex

- Fund movements require explanation

Professional Perspective Without Verification

A comfort letter allows lenders to receive professional commentary without placing verification or assurance responsibility on the CPA.

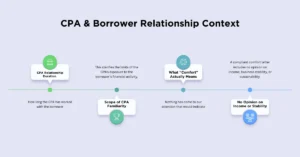

CPA & Borrower Relationship Context

CPA Relationship Duration with Borrower

Comfort letters often disclose:

- How long the CPA has worked with the borrower

This establishes familiarity, not assurance.

Scope of CPA Familiarity

The letter may describe whether the CPA’s role includes:

- Tax preparation

- Ongoing accounting services

This clarifies the limits of the CPA’s exposure to the borrower’s financial activity.

Level of Comfort Provided

What “Comfort” Actually Means

Comfort is typically expressed using language such as:

- “Based on the information provided…”

- “Nothing has come to our attention that would indicate…”

This is negative assurance, not confirmation.

No Opinion on Income or Stability

A compliant comfort letter includes no opinion on income, business stability, or sustainability.

Information Sources and Reliance

Information Source Reliance

The letter clearly states that all information referenced is:

- Provided by the borrower

- Derived from previously prepared records

No Verification or Validation Performed

A core element of the letter is an explicit statement that:

- No independent verification or validation was performed

This protects both the CPA and the lender.

Assurance and Attestation Limits

No Assurance or Attestation Provided

The letter explicitly states:

- No audit, review, or attestation was conducted

No Guarantee of Future Performance

Comfort letters never guarantee:

- Future income

- Ongoing business success

- Mortgage approval

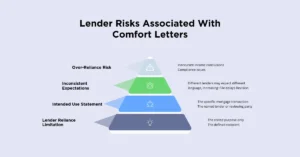

Intended Use and Lender Reliance

Intended Use Statement

A proper comfort letter includes a clear intended use statement, specifying:

- The specific mortgage transaction

- The named lender or reviewing party

Lender Reliance Limitation

The letter restricts reliance to:

- The stated purpose only

- The defined recipient

This prevents reuse or misinterpretation.

Comfort Letter vs. Use-of-Funds Letter

Key Differences

A CPA Comfort Letter for Self-Employed:

- Provides limited, general comfort

- Uses negative-assurance language

- Avoids transaction-specific conclusions

A CPA Letter for Use of Business Funds Self-Employed:

- Explains where business funds come from

- Describes how they are used

- Addresses liquidity and operational impact

Why Lenders Prefer Specific Letters

Lenders often prefer use-of-funds letters because they are:

- Narrower in scope

- More directly tied to underwriting questions

- Less risky from a reliance standpoint

Lender Risks Associated With Comfort Letters

Over-Reliance Risk

If a comfort letter is misinterpreted as verification, lenders risk:

- Inaccurate income conclusions

- Compliance issues

Inconsistent Expectations

Different lenders may expect different language, increasing:

- File delays

- Revision requests

What the Comfort Letter Covers, and What It Does Not

What It Covers

- CPA’s general familiarity with the borrower

- Information sources relied upon

- Defined scope and limitations

What It Does Not Do

- Verify income or assets

- Assess business viability

- Replace lender underwriting

Borrower Considerations

Request the Right Letter

Borrowers should understand that comfort letters are not substitutes for income or fund verification.

Expect Conservative Language

Overly strong language will be rejected by CPAs and lenders alike.

Professional Considerations for CPAs

Protect the Scope

Always define:

- Relationship duration

- Information sources

- Explicit exclusions

Avoid Underwriting Language

Never imply approval, sufficiency, or certainty.