For self-employed borrowers, mortgage underwriting is rarely just about income. Lenders also want confidence that the business generating that income is stable, sustainable, and resilient over time. This is where a CPA Letter for Self-Employed Business Stability becomes an important supporting document.

This article explains what a business-stability CPA letter is, how lenders use it, and how it differs from income-focused documentation, while remaining compliant, professional, and clearly non-attest in nature. It also shows how this letter fits into the broader framework of a CPA letter for self employed borrowers.

What Is a CPA Letter Explaining Business Stability?

A CPA Letter Explaining Business Stability is a non-attest, explanatory letter prepared at the request of a self-employed borrower. Its purpose is to describe whether a business appears operationally stable based on historical financial patterns and business characteristics.

The letter:

- Describes business continuity and operating history

- Explains revenue behavior and expense structure

- Provides professional context without prediction or assurance

It does not audit financial statements, verify results, or guarantee future performance.

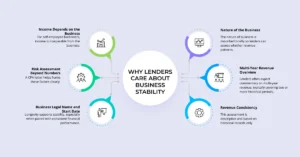

Why Lenders Care About Business Stability

Income Depends on the Business

For self-employed borrowers, income is inseparable from the business. Even strong historical earnings may be viewed as risky if the business lacks stability.

Risk Assessment Beyond Numbers

Underwriters look beyond totals to understand:

- How long the business has operated

- Whether revenue is repeatable

- Whether expenses are controlled

A CPA letter helps frame these factors clearly.

Business Identification and Background

Business Legal Name and Start Date

A compliant letter clearly identifies:

- Business legal name

- Business start date

Longevity supports stability, especially when paired with consistent financial performance.

Nature of the Business

The nature of business is described briefly so lenders can assess whether revenue patterns align with the industry and business model.

Revenue History and Continuity

Multi-Year Revenue Overview

Lenders often expect commentary on multi-year revenue, typically covering two or more historical periods.

Revenue Consistency

The letter may describe whether revenue appears:

- Stable

- Increasing

- Variable

This assessment is descriptive and based on historical records only.

Client Concentration and Diversification

Revenue Concentration Risk

High reliance on a single client can increase risk. The letter may address revenue concentration risk at a high level.

Client Diversification

Where applicable, the letter may note client diversification as a stabilizing factor.

Client Concentration Disclosure

Any material concentration is disclosed factually, without judgment or speculation.

Expense Behavior and Cost Structure

Expense Stability

Lenders want to see whether expenses are predictable. The letter may comment on expense stability over time.

Relationship Between Revenue and Expenses

Descriptive commentary may explain whether expenses scale reasonably with revenue.

Industry and Market Context

Industry Stability

The letter may reference industry stability to contextualize revenue patterns, especially for cyclical or seasonal businesses.

This is provided as background context, not a market forecast.

CPA Professional Commentary

CPA Professional Opinion (Limited)

Any CPA professional opinion is carefully framed as:

- Observational

- Based on historical information

- Non-predictive

Language avoids assurance, guarantees, or forward-looking conclusions.

Records Reviewed and Scope

Financial Information Considered

The letter typically references:

- Tax returns

- Financial statements

- Internal accounting records

These are reviewed at a high level.

Defined Scope

The scope is clearly stated to prevent reliance beyond the stated purpose.

Audit and Assurance Limitations

Audit Disclaimer

A clear audit disclaimer is included, stating that:

- No audit, review, or assurance was performed

- Information relies on records provided by the client

This protects both the CPA and the lender.

How Lenders Use Business Stability Letters

Context for Underwriting Decisions

Lenders use the letter to:

- Assess business continuity

- Understand concentration and expense risk

- Evaluate sustainability of income sources

Complement to Income Verification

A stability letter complements income-focused documents, but does not replace them.

What the Letter Covers, and What It Does Not

What It Covers

- Historical revenue patterns

- Client concentration and diversification

- Expense behavior and industry context

What It Does Not Do

- Predict future business success

- Verify financial accuracy

- Guarantee mortgage approval

Best Practices for Borrowers

Be Transparent

Disclosing concentration or variability upfront reduces lender concerns.

Keep Documentation Consistent

Ensure the CPA letter aligns with tax returns and loan disclosures.

Best Practices for CPAs

Use Neutral, Evidence-Based Language

Stick to what records show, avoid opinionated or promotional wording.

Define Limits Clearly

Clear scope and disclaimers prevent misinterpretation.