Conventional mortgages follow a different rulebook than FHA or Non-QM loans, especially when the borrower is self-employed. Income must meet agency standards, trends must be explainable, and documentation must align cleanly with underwriting models. That’s why lenders often request a CPA Letter for Self-Employed Conventional Loan when tax returns alone don’t tell the full story.

This article explains how CPA letters are used in conventional underwriting, what Fannie Mae and Freddie Mac expect, and how these letters differ from a CPA Letter for Self-Employed FHA Loan, all while staying within non-attest, EEAT-compliant boundaries.

What Is a CPA Letter for Self-Employed Conventional Loans?

A CPA Letter for Self-Employed Conventional Loan is a non-attest explanatory letter prepared at the borrower’s request to help lenders interpret self-employment income under agency guidelines.

The letter:

- Provides context around income history and trends

- Summarizes records reviewed and periods covered

- Does not verify income, audit records, or guarantee approval

Final income qualification and approval decisions remain solely with the lender and its automated or manual underwriting process.

Why Conventional Lenders Request CPA Letters

Agency Rules Emphasize Consistency

Conventional underwriting focuses heavily on:

- Two-year income history

- Direction and stability of earnings

- Alignment with tax returns and schedules

A CPA letter helps explain why income looks the way it does.

When Tax Returns Raise Questions

Declining income, recent business changes, or complex structures often trigger requests for additional professional explanation.

Borrower and Loan Identification

Applicant Details

A compliant letter identifies:

- Conventional Loan Applicant Name

- Secondary Applicant Reference (if applicable)

Names must match the loan file exactly.

Loan Reference

If provided, the letter may include a Loan Tracking Identifier to tie it to the correct underwriting file.

Conventional Transaction Context

Purpose of the Loan

The letter references the Conventional Transaction Purpose, such as:

- Home purchase

- Rate-term refinance

- Cash-out refinance

This provides underwriting context only.

Self-Employment and Business Legitimacy

Self-Employed Status Confirmation

The letter states that income is derived from self-employment based on records reviewed.

Business Registration and Structure

Where applicable, it references:

- Enterprise Registration Title

- State Filing Identifier

- Organizational Classification (sole proprietor, LLC, S-Corp, partnership)

Operational History

- Commencement of Operations Date

- Commercial Activity Location

Longevity supports income reliability under agency rules.

Qualifying Income Framework (Descriptive Only)

Conventional Qualifying Income Basis

The CPA does not calculate qualifying income but may describe how income is derived from historical records.

Two-Year Income History Indicator

Agency underwriting typically relies on:

- At least two prior years of self-employment income

Average Earnings Calculation

If mentioned, averages are historical summaries, not underwriting determinations.

Income Trends and Direction

Income Trend Direction Statement

The letter may describe whether income appears:

- Stable

- Increasing

- Declining

This is descriptive and based on tax periods reviewed.

Ongoing Income Expectancy Opinion

Any commentary is informational, grounded in past performance, not a prediction or assurance.

Agency Standards and Compliance Context

Agency Underwriting Standard

The letter may reference alignment with FNMA / FHLMC standards at a high level.

Self-Employment Eligibility Confirmation

The CPA may state that income meets basic self-employment definition requirements, without interpreting agency rules.

Guideline Compliance Representation

This is framed as contextual, not authoritative.

CPA Identification and Professional Standing

Evaluating CPA Information

A lender-acceptable letter includes:

- Evaluating CPA Name

- Active License Verification

- Credential Issuance Authority

- CPA Identification Code

Client Relationship

- Length of Client Engagement may be disclosed to show familiarity with records.

Scope of Review and Records Considered

Review Method Description

The letter clearly states that the CPA performed a review of client-provided information, not an audit or verification.

Tax Return Periods Reviewed

Typically includes:

- Two most recent tax years

Interim Financial Data

If applicable, the letter may reference year-to-date data.

Supporting Schedules Examined

Examples include:

- Schedule C

- K-1s

- Business returns

Referenced descriptively only.

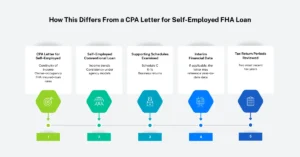

How This Differs From a CPA Letter for Self-Employed FHA Loan

A CPA Letter for Self-Employed FHA Loan emphasizes:

- Continuity of income

- Owner-occupancy

- FHA insured-loan rules

A CPA Letter for Self-Employed Conventional Loan focuses more on:

- Income trends

- Consistency under agency models

- Alignment with FNMA/FHLMC standards

Both are non-attest, but the underwriting lens differs.

What the Letter Does, and Does Not, Do

What It Does

- Explains income history and trends

- Provides professional context for agency underwriting

- Reduces lender follow-up questions

What It Does Not

- Verify income accuracy

- Predict future earnings

- Guarantee mortgage approval

Best Practices for Borrowers

Consistency Is Critical

Ensure CPA letter details align with:

- Tax returns

- Loan application

- Underwriting disclosures

Avoid Overreaching Requests

Agency lenders will reject letters implying guarantees or income approval.

Best Practices for CPAs

Define Scope Precisely

Clearly state:

- Period reviewed

- Records referenced

- Reliance limitations

Use Agency-Appropriate Language

Stick to neutral, factual descriptions aligned with conventional underwriting expectations.