FHA financing is one of the most accessible mortgage options for self-employed borrowers, but it also comes with specific documentation expectations. When income is derived from a business or independent work, lenders often request a CPA Letter for Self-Employed FHA Loan to help interpret income history, continuity, and reasonableness under FHA rules.

This guide explains what FHA lenders expect, how a CPA letter supports underwriting, and how it differs from a general CPA Letter for Self-Employed Mortgage, all while staying compliant with non-attest standards and EEAT best practices.

What Is a CPA Letter for Self-Employed FHA Loan?

A CPA Letter for Self-Employed FHA Loan is a non-attest, explanatory letter prepared at the borrower’s request. Its purpose is to provide professional context around self-employment income already reported in tax filings and accounting records so FHA underwriters can assess eligibility and risk.

The letter:

- Explains income structure and continuity

- Summarizes records reviewed and periods covered

- Does not verify income, audit records, or guarantee approval

Final qualifying income and approval decisions always remain with the FHA-approved lender.

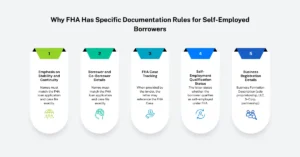

Why FHA Has Specific Documentation Rules for Self-Employed Borrowers

FHA loans are insured by the Federal Housing Administration, which requires lenders to apply consistent, risk-focused underwriting standards.

Emphasis on Stability and Continuity

For self-employed borrowers, FHA underwriting focuses on:

- Length of self-employment

- Consistency of income

- Reasonableness relative to the borrower’s profession

A CPA letter helps lenders understand these factors without shifting responsibility away from underwriting.

FHA Applicant Identification

Borrower and Co-Borrower Details

A compliant letter identifies:

- FHA Applicant Legal Name

- Additional FHA Applicant Identifier (if applicable)

Names must match the FHA loan application and case file exactly.

FHA Case Tracking

When provided by the lender, the letter may reference the FHA Case Tracking Reference to tie the letter to the correct file.

Self-Employment Qualification and Business Legitimacy

Self-Employment Qualification Status

The letter states whether the borrower qualifies as self-employed under FHA definitions.

Business Registration Details

Where applicable, the letter references:

- Registered Enterprise Name

- Commercial License Identifier

- Business Formation Description (sole proprietorship, LLC, S-Corp, partnership)

Operational Start Confirmation

- Operational Start Confirmation and business longevity support income continuity analysis.

Business Location and Operations

Primary Operating Address

Identifying the Primary Operating Address helps establish legitimacy and ongoing operations.

FHA Income Evaluation Framework

Qualifying Income Determination Method

The letter describes, at a high level, how income is derived from historical records, without calculating qualifying income.

Historical Income Acceptance Period

FHA lenders typically review:

- Two years of self-employment income, when available

Average Monthly Income Measure

If referenced, averages are descriptive only and based on historical filings.

Income Continuity and Stability

Income Continuity Confirmation

The letter may state whether income appears continuous based on records reviewed.

Anticipated Income Stability Statement

Any stability language is informational, grounded in historical patterns, not a forecast or guarantee.

Occupancy and FHA Eligibility Statements

Owner-Occupancy Attestation

FHA loans require owner occupancy. The letter may acknowledge this requirement based on borrower representations.

Principal Residence Certification

This reinforces FHA eligibility context but does not replace lender verification.

FHA Guideline Reference Indicator

The letter may reference FHA guidelines at a high level to frame context, without interpreting or enforcing them.

CPA Identification and Professional Standing

Reviewing CPA Information

A lender-acceptable letter includes:

- Reviewing CPA Full Name

- Professional Certification Status

- State Board of Accountancy

- CPA Registration Number

Client Relationship Context

- Duration of Client Representation may be disclosed to show familiarity with records.

Scope of Review and Records Considered

Scope of Financial Examination

The letter clearly defines scope as a review of client-provided records, not an audit or verification.

Tax Filing Years Considered

Commonly includes:

- Most recent tax filing years

Interim Coverage

If applicable, the letter may reference an Interim Financial Coverage Period (e.g., year-to-date).

Income Reasonableness and Documentation

Income Reasonableness Opinion

The CPA may describe whether income appears reasonable for the borrower’s role and industry, descriptively only.

Records Evaluated Description

Typical records referenced include:

- Tax returns

- Financial statements

- Internal accounting summaries

No independent verification is implied.

Accounting Firm Identification

Practice and Contact Details

A compliant letter includes:

- Accounting Practice Legal Name

- Office Physical Address

- Contact Telephone Identifier

- Professional Email Address

These allow lenders to verify credentials or request clarification.

FHA-Specific Disclaimers and Reliance Limits

FHA-Specific Reliance Limitation

The letter states it is prepared solely for FHA mortgage underwriting for the identified transaction.

No Assurance Disclosure Statement

Clear language confirms:

- No audit or assurance was performed

- Information relies on records provided

- The letter does not guarantee approval

How This Differs From a General CPA Letter for Self-Employed Mortgage

A CPA Letter for Self-Employed Mortgage may apply broadly to different loan programs.

A CPA Letter for Self-Employed FHA Loan is tailored to FHA’s emphasis on continuity, owner occupancy, and insured-loan risk controls.

What the Letter Does, and Does Not, Do

What It Does

- Provides FHA-specific income context

- Explains self-employment continuity

- Supports lender underwriting review

What It Does Not

- Verify income accuracy

- Predict future earnings

- Replace FHA lender underwriting

Best Practices for Borrowers

Align All Documents

Ensure the CPA letter matches tax returns, FHA application data, and business records.

Avoid Overreaching Requests

FHA lenders will reject letters that imply guarantees or approvals.

Best Practices for CPAs

Use FHA-Appropriate Language

Stick to historical facts, defined periods, and descriptive observations.

Define Scope Clearly

Clear scope and disclaimers reduce follow-up and protect all parties.