Mortgage underwriting treats self-employed borrowers differently, and for good reason. Income may be variable, business-driven, or reported across multiple records. To bridge the gap between tax documents and underwriting decisions, lenders often request a CPA letter. This guide explains lender guidelines for self-employed borrowers, what underwriters expect to see, and how a CPA Letter for Self-Employed Income Verification supports the process without crossing professional boundaries.

What Is a CPA Letter for Self-Employed Mortgage Borrowers?

A CPA letter for self-employed mortgage borrowers is a non-attest, explanatory letter prepared at the borrower’s request. Its purpose is to provide clear context around income sources, business structure, and historical performance so lenders can evaluate risk appropriately.

The letter:

- Explains income characteristics and continuity

- Summarizes records reviewed and periods covered

- Does not verify income, audit records, or guarantee approval

Final income qualification always remains with the lender.

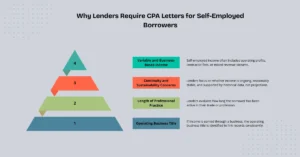

Why Lenders Require CPA Letters for Self-Employed Borrowers

Variable and Business-Based Income

Self-employed income often includes operating profits, contractor fees, or mixed revenue streams. Underwriters need context to interpret these figures accurately.

Continuity and Sustainability Concerns

Lenders focus on whether income is ongoing, reasonably stable, and supported by historical data, not projections.

Borrower Identification and Classification

Applicant Details

A compliant letter identifies:

- Self-Employed Applicant Full Name

- Personal Tax Identification Reference (not typically disclosed in full)

Work Classification

The letter clarifies:

- Independent Contractor Classification

- Primary Vocational Activity

This helps underwriters classify income correctly.

Professional History and Practice Duration

Length of Professional Practice

Lenders evaluate how long the borrower has been active in their trade or profession.

Operating Business Title

If income is earned through a business, the operating business title is identified to link records consistently.

Business Registration and Legal Configuration

Registration and Structure

Where applicable, the letter references:

- Commercial Registration Identifier

- Legal Business Configuration (sole proprietorship, LLC, S-Corp, partnership)

Commencement and Location

- Business Commencement Timestamp

- Principal Place of Business

These details support legitimacy and operating continuity.

Income Measures and Behavior

Gross Receipts Indicator

Gross receipts provide a high-level view of revenue generation before expenses.

Normalized Income Estimate

The letter may describe normalized income derived from historical records, without determining qualifying income.

Earnings Volatility Assessment

If income fluctuates, the letter explains patterns (seasonality, market conditions) descriptively.

Income Continuity and Permanence

Continuing Income Expectation

Any commentary is historical and descriptive, grounded in prior performance.

Income Source Permanence Statement

The letter may state whether income sources appear ongoing based on records reviewed, without forecasting.

Records Reviewed and Periods Evaluated

Records Assessment Category

Common categories include:

- Tax filings

- Financial statements

- Internal accounting summaries

Financial Period Evaluated

The letter specifies the exact period reviewed.

Comparative Year Analysis Marker

Where applicable, the letter notes year-over-year comparisons to contextualize trends.

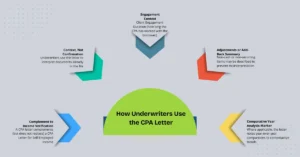

Adjustments and Add-Backs (Descriptive Only)

Adjustments or Add-Back Summary

Non-cash or non-recurring items may be described to prevent misinterpretation, without recalculating income.

CPA Identification and Professional Standing

Attesting CPA Details

A lender-acceptable letter includes:

- Attesting CPA Name

- Professional License Status

- Issuing Licensing Board

- Registration Serial Code

Engagement Context

- Client Engagement Duration (how long the CPA has worked with the borrower)

Firm Identification and Contact Information

Practice Details

- Accounting Firm Designation

- Business Mailing Location

- Office Communication Number

- Professional Email Contact

These allow lender verification and follow-up.

Attestation Limits and Disclaimers

Attestation Limitation Statement

The letter clearly states:

- No audit or assurance was performed

- Information relies on client-provided records

- The letter is intended solely for the specified mortgage review

These limits are essential for compliance and risk management.

How Underwriters Use the CPA Letter

Context, Not Confirmation

Underwriters use the letter to interpret documents already in the file, tax returns, bank statements, and disclosures.

Complement to Income Verification

A CPA letter complements (but does not replace) a CPA Letter for Self-Employed Income Verification by adding business and continuity context.

What the Letter Does, and Does Not, Do

What It Does

- Clarifies income structure and history

- Explains volatility and continuity

- Supports lender risk assessment

What It Does Not

- Verify income accuracy

- Predict future earnings

- Guarantee mortgage approval

Recommended Steps for Mortgage Borrowers

Keep Documentation Consistent

Ensure the CPA letter aligns with tax filings and loan disclosures.

Avoid Overreach

Requests for guarantees or predictions can delay underwriting.

Professional Standards for CPAs Issuing Mortgage Letters

Define Scope Precisely

State purpose, period, and reliance clearly.

Use Neutral, Evidence-Based Language

Describe facts shown by records, no more, no less.