For many self-employed borrowers, qualifying for a traditional mortgage can be challenging. Tax strategies, fluctuating revenue, or business write-offs often reduce taxable income on paper, even when real cash flow is strong. This is where Non-QM (Non-Qualified Mortgage) programs come in, and why lenders frequently request a CPA Letter for Self-Employed Non-QM borrowers.

This article explains how CPA letters are used in bank statements and alternative income programs, what lenders evaluate, and how these letters differ in purpose from a CPA Letter for Self-Employed Conventional Loan, all while remaining compliant with professional and EEAT standards.

What Is a CPA Letter for Self-Employed Non-QM Mortgages?

A CPA Letter for Self-Employed Non-QM is a non-attest, explanatory letter prepared at the borrower’s request. Its role is to help lenders understand how self-employed income is derived and reviewed when traditional agency guidelines do not apply.

The letter:

- Explains income calculation methodology

- Describes cash flow behavior and income variability

- References records reviewed without verifying or auditing them

It does not certify income, confirm qualifying amounts, or guarantee loan approval.

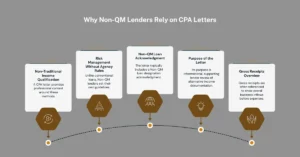

Why Non-QM Lenders Rely on CPA Letters

Non-Traditional Income Qualification

Non-QM programs allow lenders to qualify borrowers using methods such as:

- Bank statement analysis

- Profit and loss (P&L) statements

- Alternative income calculations

A CPA letter provides professional context around these methods.

Risk Management Without Agency Rules

Unlike conventional loans, Non-QM lenders set their own guidelines. CPA letters help document how income was evaluated, without shifting underwriting responsibility to the CPA.

Non-QM Loan Designation and Context

Non-QM Loan Acknowledgment

The letter typically includes a Non-QM loan designation acknowledgment, clarifying that the loan is outside agency (FNMA/FHLMC) standards.

Purpose of the Letter

Its purpose is informational, supporting lender review of alternative income documentation.

Income Calculation Methods Explained

Income Calculation Method

The CPA letter describes the method used to evaluate income, such as:

- Average monthly deposits from bank statements

- Gross income reflected in a P&L

Gross Receipts Overview

Gross receipts are often referenced to show overall business inflows before expenses.

Average Monthly Income

The letter may explain how average monthly income was derived from historical records, without declaring it as qualifying income.

Profit and Loss (P&L) Context

P&L Period Covered

The CPA letter clearly states the P&L period covered, such as year-to-date or trailing twelve months.

Gross Income per P&L

Gross income figures may be referenced to support consistency between internal records and bank statements.

Statement Business Is Economically Active

The letter may include a statement that the business is economically active based on records reviewed, without implying future viability.

Bank Statement Analysis

Bank Statement Review

For bank statement programs, the CPA letter explains how deposits were reviewed and interpreted.

Bank Statement Analysis Context

This may include commentary on:

- Deposit consistency

- Client payment cycles

- Seasonality or project-based income

All explanations are historical and descriptive.

Income Fluctuations and Variability

Income Fluctuation Explanation

Self-employed income often varies. The letter may explain fluctuations due to:

- Seasonality

- Market conditions

- Client concentration

Sustainability Commentary

Any sustainability language is limited to historical observation, not prediction or assurance.

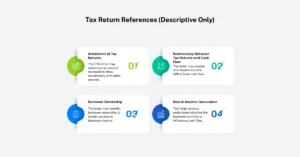

Tax Return References (Descriptive Only)

Statement of Tax Returns

The CPA letter may reference tax returns reviewed to show consistency with other records.

Relationship Between Tax Returns and Cash Flow

The letter may explain why taxable income differs from cash flow, without recharacterizing tax positions.

Borrower Ownership and Business Control

Borrower Ownership

The letter may identify borrower ownership to explain access to business income.

Role in Income Generation

This helps lenders understand whether the borrower controls or influences cash flow.

CPA Identification and Professional Context

CPA Professional Role

The letter identifies the CPA and clarifies that:

- No audit or assurance was performed

- Information is based on client-provided records

Non-QM CPA Letters

Non-QM CPA letters are specifically tailored to alternative documentation programs and should not mirror agency-style letters.

Non-QM vs Conventional CPA Letters

Key Differences

A CPA Letter for Self-Employed Conventional Loan focuses on:

- Two-year tax history

- Income trend direction

- Agency underwriting consistency

A CPA Letter for Self-Employed Non-QM focuses on:

- Cash flow reality

- Deposit behavior

- Alternative income documentation

Both are non-attest, but they serve different underwriting philosophies.

What the Letter Covers, and What It Does Not

What It Covers

- Explanation of income calculation methods

- Context around bank statements and P&L data

- Historical explanation of income variability

What It Does Not Do

- Verify bank balances

- Determine qualifying income

- Guarantee mortgage approval

Best Practices for Borrowers

Maintain Clean Records

Consistent bank activity and clear P&L records reduce lender questions.

Align All Documents

Ensure CPA letter explanations match bank statements and loan disclosures.

Best Practices for CPAs

Define Scope Clearly

State the period reviewed, records referenced, and reliance limitations.

Avoid Underwriting Language

Do not use terms implying approval, verification, or assurance.